Ver esa tabla me recuerda algo. Leía el otro día una frase de la Dama de los Dividendos que me pareció muy interesante. Decía algo así como que en el mercado no hay que agobiarse pensando que se nos escapa el tren, después pasará otro.

Y ciertamente tenemos memoria de corto plazo como inversores porque vemos una acción a precio y muchos nos podemos hasta agobiar por no aprovechar el tren . No pasa nada si no podemos disparar, ya pasará otro tren. Y es cierto que qué más da JNJ o LEG, si ambos cazan ratones tomaremos el que nos venga bien cuando acudamos al mercado.

Yo creo que lo que hay que hacer es tener una cartera diversificada con muchos sectores, de forma que nunca será la que mejor se comporte, ni tampoco la peor.

Porque ir rotando en base a las previsiones macro, etc es casi seguro que no va a funcionar a la mayoría de inversores. Primero porque las previsiones no se cumplen, o bien que aunque se cumplan, sus efectos no tienen por qué ser los que creamos.

Entonces si tenemos la suficiente diversificación, en todo momento tendremos lo que vaya bien y lo que vaya mal. Menos cuando llega un mercado bajista de verdad, que ahí prácticamente no hay nada donde refugiarse. Y eso también debe de saberse, para estar preparado cuando suceda.

Está claro, que cuando hay un mercado bajista casi todo cae, pero hay sectores que se comportan mejor, vease farmas, consumo defensivo, utilities.

El consumo discrecional se comporta mal, sin embargo, MCD suele hacerlo bien, por su modelo de negocio.

Al final, la diversificación te lleva a manejar mejor los mercados bajistas que puedan darse.

Precisamente LEG es una de las que mi excel me avisa con señal de compra. Otras son ITX, RMG, HEN y VID.

Compras YTD de fondos Quality Growth y Growth 5★ Morningstar

| Security Name | Weighting |

|---|---|

| Orsted A/S | 11.4 |

| United Parcel Service Inc Class B | 9.33 |

| NetEase Inc Ordinary Shares | 7.51 |

| AbbVie Inc | 6.97 |

| Intercontinental Exchange Inc | 6.39 |

| Advanced Micro Devices Inc | 6.24 |

| Blackstone Inc | 6.19 |

| Coca-Cola Co | 5.8 |

| L’Oreal SA | 5.06 |

| T&D Holdings Inc | 5.03 |

| Costco Wholesale Corp | 4.1 |

| CVS Health Corp | 3.63 |

| Eli Lilly and Co | 3.14 |

| Baidu Inc ADR | 3.01 |

| Allegion PLC | 3.01 |

| Roblox Corp Ordinary Shares - Class A | 2.57 |

| Autodesk Inc | 2.51 |

| Zebra Technologies Corp Class A | 2.44 |

| Bilibili Inc Class Z | 2.01 |

| Shopify Inc Registered Shs -A- Subord Vtg | 1.23 |

| JD.com Inc Ordinary Shares - Class A | 1.04 |

| Manhattan Associates Inc | 0.69 |

| Sika AG | 0.69 |

Top50 Holdings de fondos Quality Growth y Growth 5★ Morningstar

| Security Name | Weighting |

|---|---|

| Microsoft Corp | 8.41 |

| Amazon.com Inc | 5.1 |

| ASML Holding NV | 4.82 |

| Visa Inc Class A | 4.27 |

| Novo Nordisk A/S Class B | 3.28 |

| Alphabet Inc Class A | 3.27 |

| Adobe Inc | 3.17 |

| Nike Inc Class B | 3.1 |

| Mastercard Inc Class A | 3.08 |

| LVMH Moet Hennessy Louis Vuitton SE | 3.05 |

| Intuit Inc | 2.89 |

| Alphabet Inc Class C | 2.88 |

| Meta Platforms Inc Class A | 2.41 |

| Lonza Group Ltd | 2.16 |

| NVIDIA Corp | 2.13 |

| Accenture PLC Class A | 2.01 |

| Thermo Fisher Scientific Inc | 1.9 |

| PayPal Holdings Inc | 1.86 |

| The Estee Lauder Companies Inc Class A | 1.77 |

| Essilorluxottica | 1.76 |

| Apple Inc | 1.69 |

| Nestle SA | 1.69 |

| L’Oreal SA | 1.61 |

| Shopify Inc Registered Shs -A- Subord Vtg | 1.58 |

| Adyen NV | 1.53 |

| Charles Schwab Corp | 1.52 |

| Edwards Lifesciences Corp | 1.49 |

| Sika AG | 1.45 |

| Tencent Holdings Ltd | 1.4 |

| Tesla Inc | 1.38 |

| AIA Group Ltd | 1.34 |

| Danaher Corp | 1.32 |

| Netflix Inc | 1.26 |

| SAP SE | 1.2 |

| Zoetis Inc Class A | 1.18 |

| IDEXX Laboratories Inc | 1.14 |

| Dassault Systemes SE | 1.1 |

| Roche Holding AG | 1.04 |

| S&P Global Inc | 1.04 |

| DSV AS | 1.03 |

| The Walt Disney Co | 1.02 |

| Diageo PLC | 1.02 |

| adidas AG | 1.02 |

| Philip Morris International Inc | 0.98 |

| Intuitive Surgical Inc | 0.97 |

| Linde PLC | 0.97 |

| Taiwan Semiconductor Manufacturing Co Ltd ADR | 0.97 |

| Chocoladefabriken Lindt & Spruengli AG | 0.94 |

| Schneider Electric SE | 0.9 |

| Booking Holdings Inc | 0.89 |

Posiblemente a muchas empresas growth les quede por delante un duro tramo de bajada de sus cotizaciones.

IIPR cayó un 7,5% ayer, el yield a este precio supera el 4%.

Algo de info sobre la caída:

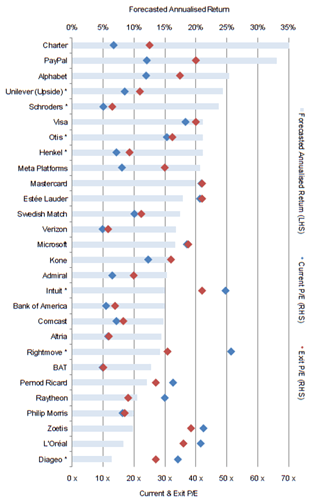

No sé si he entendido bien todo tu mensaje por cuando dices “de Microsoft para arriba”, la tabla está ordenada por predicción de retorno anualizado.

Charter, Henkel, y Unilever tienen PER entre 12 y 17 (rombo azul).

Llevas mas razon que un santo y he metido la pata, lo he leido completamente al reves y pensaba que la grafica en vez de annualized return expresaba el PER. mejor quitar el comentario…gracias por hacermelo ver. Error total

jejeje, el comentario deberia ser al contrario, de microsoft para arriba quitando OTIS y VISA y añadiendo Bank of America y Comcast con esos PER y projection de annualized return tienen buena pinta, siguiendo mi argumento. Todo al reves por no leer el grafico correctamente. Gracias por la correccion.

Entiendo entonces que el rombo rojo es el PER actual y el azul el esperado, aunque no me cuadran bien las cifras porque en el grafico el PER actual de Unilever dice ser de aprox el 12 o 13% y el esperado por debajo del 10% pero el PER actual de Unilever esta en el 17,5% por lo que he visto.

Y en Charter actualmente esta en 22 o 23.

Me he perdido

Nono, rombo azul PER actual, rojo creo que es el PER que se marcan como de salida (solo he visto la gráfica, lo pone en la leyenda). Los porcentajes de arriba solo aplican al forecasted expected return, son los de abajo los que corresponden al PER.

Star Rating: ★★★★★

Moat: Narrow | Wide

FV: Fair Value (M*)

FV Q: Fair Value Quantitative (M*)

PT: Price Target (Consenso)

| Exchange | Ticker | Title | Sector | P/FV | P/PT | P/FV Q | Moat | Star Rating | Uncertainty | Stewardship | Forward PE | Price/Forward Earnings 5-Yr | PEG Ratio |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NASDAQ | GRUB | Just Eat Takeaway.com NV ADR | Consumer Cyclical | 0.2 | - | 0.33 | Narrow | ★★★★★ | High | Exemplary | -7.92 | - | - |

| XAMS | TKWY | Just Eat Takeaway.com NV | Consumer Cyclical | 0.22 | 0.41 | 0.33 | Narrow | ★★★★★ | High | Exemplary | -8.05 | 189.71 | - |

| XETR | DHER | Delivery Hero SE | Consumer Cyclical | 0.31 | 0.42 | 0.37 | Narrow | ★★★★★ | High | Standard | -7.46 | - | - |

| NYSE | TWLO | Twilio Inc Class A | Communication Services | 0.36 | 0.42 | 0.44 | Narrow | ★★★★★ | Very High | Exemplary | -344.83 | 1451.12 | - |

| NYSE | PINS | Pinterest Inc | Communication Services | 0.37 | 0.57 | 0.51 | Narrow | ★★★★★ | Very High | Standard | 19.96 | - | 0.57 |

| XPAR | WLN | Worldline SA | Technology | 0.39 | 0.53 | 0.47 | Narrow | ★★★★★ | Medium | Standard | 13.74 | 32.75 | 0.69 |

| NYSE | RNG | RingCentral Inc Class A | Technology | 0.39 | 0.46 | 0.51 | Narrow | ★★★★★ | High | Exemplary | 61.73 | 182.48 | 1.48 |

| NYSE | PLTR | Palantir Technologies Inc Ordinary Shares - Class A | Technology | 0.4 | 0.8 | 0.52 | Narrow | ★★★★★ | High | Exemplary | 65.36 | - | 1.7 |

| NYSE | ATUS | Altice USA Inc Class A | Communication Services | 0.42 | 0.59 | 0.52 | Narrow | ★★★★★ | High | Poor | 7.94 | 31.23 | 1.42 |

| NYSE | RBLX | Roblox Corp Ordinary Shares - Class A | Communication Services | 0.42 | 0.6 | 0.54 | Narrow | ★★★★★ | High | Exemplary | 98.04 | - | 2.31 |

| OTCPK | TCEHY | Tencent Holdings Ltd ADR | Communication Services | 0.43 | - | 0.57 | Wide | ★★★★★ | High | Exemplary | 22.83 | 31.82 | 1.35 |

| HKSE | 700 | Tencent Holdings Ltd | Communication Services | 0.45 | - | 0.57 | Wide | ★★★★★ | High | Exemplary | 23.26 | 31.92 | 1.37 |

| NYSE | UBER | Uber Technologies Inc | Technology | 0.45 | 0.55 | 0.61 | Narrow | ★★★★★ | Very High | Standard | -102.04 | - | - |

| XETR | CON | Continental AG | Consumer Cyclical | 0.45 | 0.69 | 0.57 | Narrow | ★★★★★ | High | Standard | 9.81 | 13.12 | 0.26 |

| TPE | 2454 | MediaTek Inc | Technology | 0.46 | 0.63 | 0.64 | Narrow | ★★★★★ | High | Standard | 10.38 | 20.43 | 0.89 |

| NYSE | YUMC | Yum China Holdings Inc | Consumer Cyclical | 0.49 | 0.72 | 0.64 | Wide | ★★★★★ | Medium | Standard | 24.21 | 32.25 | 1.16 |

| NYSE | SAM | Boston Beer Co Inc Class A | Consumer Defensive | 0.49 | 0.7 | 0.52 | Narrow | ★★★★★ | Medium | Exemplary | 23.36 | 36.53 | 1.03 |

| XPAR | UBI | Ubisoft Entertainment | Communication Services | 0.5 | 0.62 | 0.65 | Narrow | ★★★★★ | High | Exemplary | 16.03 | 37.32 | 1.41 |

| MIL | NEXI | Nexi SpA | Technology | 0.51 | 0.53 | 0.62 | Narrow | ★★★★★ | Medium | Standard | 16.29 | - | - |

| NYSE | BWA | BorgWarner Inc | Consumer Cyclical | 0.51 | 0.73 | 0.68 | Narrow | ★★★★★ | High | Standard | 8.95 | 10.86 | 0.64 |

| NASDAQ | OKTA | Okta Inc A | Technology | 0.51 | 0.65 | 0.65 | Narrow | ★★★★★ | High | Exemplary | -114.94 | 4500.0 | - |

| NASDAQ | ETSY | Etsy Inc | Consumer Cyclical | 0.52 | 0.57 | 0.61 | Wide | ★★★★★ | High | Standard | 30.21 | 67.5 | 1.13 |

| NASDAQ | FB | Facebook Inc Class A | Communication Services | 0.53 | - | 0.6 | Wide | ★★★★★ | High | Exemplary | 16.18 | 24.69 | 1.14 |

| NYSE | BABA | Alibaba Group Holding Ltd ADR | Consumer Cyclical | 0.53 | 0.09 | 0.59 | Wide | ★★★★★ | High | Exemplary | 11.12 | 25.11 | - |

| OTCPK | BMWYY | Bayerische Motoren Werke AG ADR | Consumer Cyclical | 0.54 | - | 0.64 | Narrow | ★★★★★ | High | Standard | 5.12 | 7.78 | 0.25 |

| OTCPK | IMBBY | Imperial Brands PLC ADR | Consumer Defensive | 0.54 | 1.1 | 0.77 | Wide | ★★★★★ | Medium | Poor | 6.83 | 8.25 | 2.13 |

| NASDAQ | JD | JD.com Inc ADR | Consumer Cyclical | 0.54 | 0.1 | 0.64 | Wide | ★★★★★ | High | Exemplary | 28.25 | 58.79 | 1.04 |

| NYSE | HBI | Hanesbrands Inc | Consumer Cyclical | 0.54 | 0.69 | 0.69 | Narrow | ★★★★★ | Medium | Standard | 7.75 | 10.22 | 1.23 |

| XETR | BMW | Bayerische Motoren Werke AG | Consumer Cyclical | 0.55 | - | 0.64 | Narrow | ★★★★★ | High | Standard | 5.15 | 7.77 | 0.25 |

| HKSE | 9988 | Alibaba Group Holding Ltd Ordinary Shares | Consumer Cyclical | 0.55 | - | 0.59 | Wide | ★★★★★ | High | Exemplary | 11.36 | - | - |

| XPAR | ALO | Alstom SA | Industrials | 0.56 | 0.58 | 0.56 | Narrow | ★★★★★ | Medium | Standard | 11.17 | 19.05 | 0.75 |

| NASDAQ | SWKS | Skyworks Solutions Inc | Technology | 0.56 | 0.66 | 0.66 | Narrow | ★★★★★ | High | Exemplary | 10.19 | 14.89 | 0.83 |

| TPE | 2330 | Taiwan Semiconductor Manufacturing Co Ltd | Technology | 0.57 | 0.69 | 0.76 | Wide | ★★★★★ | Medium | Exemplary | 18.59 | 20.13 | 1.11 |

| NYSE | TME | Tencent Music Entertainment Group ADR | Communication Services | 0.57 | 0.12 | 0.52 | Narrow | ★★★★★ | High | Standard | 13.46 | - | 1.14 |

| LSE | IMB | Imperial Brands PLC | Consumer Defensive | 0.57 | 0.82 | 0.77 | Wide | ★★★★★ | Medium | Poor | 6.68 | 8.17 | 2.09 |

| NASDAQ | PEGA | Pegasystems Inc | Technology | 0.57 | 0.58 | 0.68 | Narrow | ★★★★★ | High | Standard | 107.53 | 231.13 | 1.26 |

| XETR | KGX | KION GROUP AG | Industrials | 0.57 | 0.6 | 0.6 | Narrow | ★★★★★ | Medium | Standard | 11.34 | 15.29 | 0.54 |

| NYSE | TSM | Taiwan Semiconductor Manufacturing Co Ltd ADR | Technology | 0.58 | - | 0.76 | Wide | ★★★★★ | Medium | Exemplary | 18.8 | 21.35 | 1.13 |

| NYSE | PII | Polaris Inc | Consumer Cyclical | 0.58 | 0.74 | 0.81 | Wide | ★★★★★ | High | Exemplary | 10.35 | 15.41 | 0.9 |

| HKSE | 2382 | Sunny Optical Technology (Group) Co Ltd | Technology | 0.58 | - | 0.63 | Narrow | ★★★★★ | High | Standard | 19.8 | 27.08 | 0.64 |

| TSE | 4452 | Kao Corp | Consumer Defensive | 0.59 | 0.8 | 0.72 | Wide | ★★★★★ | Medium | Standard | 19.92 | 24.9 | 1.89 |

| NYSE | VNT | Vontier Corp Ordinary Shares | Technology | 0.59 | 0.69 | 0.68 | Narrow | ★★★★★ | Medium | Standard | 8.03 | - | 1.03 |

| NYSE | CRM | Salesforce.com Inc | Technology | 0.59 | 0.64 | 0.69 | Wide | ★★★★★ | Medium | Standard | 40.49 | 61.77 | 2.02 |

| HKSE | 1099 | Sinopharm Group Co Ltd H | Healthcare | 0.6 | 0.88 | 0.61 | Narrow | ★★★★★ | Medium | Standard | 7.65 | 10.59 | - |

| HKSE | 2313 | Shenzhou International Group Holdings Ltd | Consumer Cyclical | 0.6 | - | 0.68 | Narrow | ★★★★★ | Medium | Exemplary | 23.04 | 25.84 | 0.71 |

| NYSE | BBWI | Bath & Body Works Inc | Consumer Cyclical | 0.61 | - | 0.7 | Narrow | ★★★★★ | Medium | Standard | 10.99 | 12.74 | 1.13 |

| XETR | HEN | Henkel AG & Co KGaA | Consumer Defensive | 0.61 | 0.79 | 0.71 | Narrow | ★★★★★ | Low | Standard | 13.79 | 15.73 | 0.84 |

| XETR | HEN3 | Henkel AG & Co KGaA Pfd Shs - Non-voting | Consumer Defensive | 0.61 | 0.79 | 0.71 | Narrow | ★★★★★ | Low | Standard | 13.81 | 17.33 | 0.84 |

| HKSE | 941 | China Mobile Ltd | Communication Services | 0.61 | - | 0.87 | Narrow | ★★★★★ | Medium | Poor | 7.55 | 10.05 | 2.27 |

| NASDAQ | BIIB | Biogen Inc | Healthcare | 0.62 | 0.85 | 0.64 | Wide | ★★★★★ | High | Standard | 13.74 | 11.74 | 7.94 |

| NASDAQ | GRFS | Grifols SA ADR | Healthcare | 0.63 | - | 0.68 | Narrow | ★★★★★ | Medium | Standard | 8.72 | 14.89 | 1.48 |

| OTCPK | BASFY | Basf SE ADR | Basic Materials | 0.63 | 0.21 | 0.77 | Narrow | ★★★★★ | Medium | Standard | 9.03 | 13.82 | 0.63 |

| NYSE | EFX | Equifax Inc | Industrials | 0.64 | 0.75 | 0.86 | Wide | ★★★★★ | Medium | Exemplary | 25.13 | 24.33 | 1.86 |

| XMAD | ITX | Industria De Diseno Textil SA | Consumer Cyclical | 0.64 | - | 0.72 | Narrow | ★★★★★ | Medium | Exemplary | 17.86 | 24.79 | 0.49 |

| HKSE | 1972 | Swire Properties Ltd | Real Estate | 0.65 | - | 0.72 | Narrow | ★★★★★ | Low | Standard | 14.6 | 17.52 | 1.53 |

| NYSE | BUD | Anheuser-Busch InBev SA/NV ADR | Consumer Defensive | 0.65 | - | 0.82 | Wide | ★★★★★ | Medium | Exemplary | 18.18 | 19.81 | 1.19 |

| XMAD | GRF.P | Grifols SA B | Healthcare | 0.65 | 0.45 | 0.68 | Narrow | ★★★★★ | Medium | Standard | 8.83 | 14.9 | 1.49 |

| TSE | 2269 | Meiji Holdings Co Ltd | Consumer Defensive | 0.65 | 0.87 | 0.83 | Narrow | ★★★★★ | Medium | Standard | 14.37 | 17.16 | 4.71 |

| NYSE | WSM | Williams-Sonoma Inc | Consumer Cyclical | 0.66 | 0.82 | 0.72 | Narrow | ★★★★★ | Medium | Standard | 10.28 | 14.69 | 1.23 |

| NYSE | FTV | Fortive Corp | Technology | 0.66 | 0.71 | 0.8 | Narrow | ★★★★★ | Medium | Exemplary | 18.76 | 22.82 | 1.64 |

| NYSE | PHG | Koninklijke Philips NV ADR | Healthcare | 0.66 | - | 0.75 | Narrow | ★★★★★ | Medium | Standard | 16.53 | 20.25 | 3.02 |

| XBRU | ABI | Anheuser-Busch InBev SA/NV | Consumer Defensive | 0.68 | 0.77 | 0.82 | Wide | ★★★★★ | Medium | Exemplary | 18.42 | 19.8 | 1.2 |

| XPAR | SW | Sodexo | Industrials | 0.7 | 0.79 | 0.85 | Narrow | ★★★★★ | Medium | Standard | 15.7 | 20.0 | 0.32 |

Star Rating: ★★★★

Moat: Wide

Stewardship: Standard | Exemplary

Forward PE > 0

Uncertainty: Low | Medium | High

FV: Fair Value (M*)

FV Q: Fair Value Quantitative (M*)

PT: Price Target (Consenso)

| Exchange | Ticker | Title | Sector | P/FV | P/PT | P/FV Q | Moat | Star Rating | Uncertainty | Stewardship | Forward PE | Price/Forward Earnings 5-Yr | PEG Ratio |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NASDAQ | TER | Teradyne Inc | Technology | 0.62 | 0.75 | 0.73 | Wide | ★★★★ | High | Standard | 22.12 | 21.3 | 2.05 |

| NASDAQ | LRCX | Lam Research Corp | Technology | 0.63 | 0.65 | 0.71 | Wide | ★★★★ | High | Exemplary | 11.72 | 15.21 | 0.86 |

| OTCPK | FANUY | Fanuc Corp ADR | Industrials | 0.64 | 0.0 | 0.79 | Wide | ★★★★ | High | Exemplary | 21.98 | 39.3 | 1.1 |

| NASDAQ | MELI | MercadoLibre Inc | Consumer Cyclical | 0.67 | 0.66 | 0.75 | Wide | ★★★★ | High | Exemplary | 147.06 | 524.77 | 1.71 |

| NYSE | MAS | Masco Corp | Industrials | 0.68 | 224.5 | 0.85 | Wide | ★★★★ | Medium | Standard | 11.95 | 16.52 | 1.34 |

| NASDAQ | ADBE | Adobe Inc | Technology | 0.68 | 0.75 | 0.82 | Wide | ★★★★ | Medium | Exemplary | 30.58 | 37.07 | 1.82 |

| XPAR | SAF | Safran SA | Industrials | 0.69 | 0.8 | 0.88 | Wide | ★★★★ | Medium | Standard | 28.17 | 25.64 | 0.99 |

| NYSE | VEEV | Veeva Systems Inc Class A | Healthcare | 0.7 | 0.75 | 0.8 | Wide | ★★★★ | Medium | Standard | 47.62 | 71.44 | 2.73 |

| NASDAQ | INTC | Intel Corp | Technology | 0.7 | 0.85 | 0.8 | Wide | ★★★★ | High | Standard | 13.24 | 12.3 | 2.65 |

| NASDAQ | GOOGL | Alphabet Inc Class A | Communication Services | 0.7 | 0.73 | 0.87 | Wide | ★★★★ | High | Exemplary | 21.83 | 26.57 | 0.88 |

| NASDAQ | GOOG | Alphabet Inc Class C | Communication Services | 0.71 | 0.73 | 0.87 | Wide | ★★★★ | High | Exemplary | 21.93 | 26.51 | 0.88 |

| NASDAQ | BIDU | Baidu Inc ADR | Communication Services | 0.71 | 0.09 | 0.75 | Wide | ★★★★ | High | Standard | 16.64 | 20.29 | 0.89 |

| XSWX | BAER | Julius Baer Gruppe AG | Financial Services | 0.71 | 0.73 | 0.71 | Wide | ★★★★ | High | Exemplary | 9.38 | 12.02 | 3.35 |

| NASDAQ | TROW | T. Rowe Price Group Inc | Financial Services | 0.71 | 0.9 | 0.71 | Wide | ★★★★ | Medium | Exemplary | 10.8 | 14.89 | 2.83 |

| NYSE | ZBH | Zimmer Biomet Holdings Inc | Healthcare | 0.72 | 0.95 | 0.83 | Wide | ★★★★ | Medium | Exemplary | 19.23 | 17.56 | 2.75 |

| NYSE | GWRE | Guidewire Software Inc | Technology | 0.72 | 0.83 | 0.83 | Wide | ★★★★ | Medium | Standard | 909.09 | 151.98 | 28.56 |

| NYSE | NOW | ServiceNow Inc | Technology | 0.72 | 0.74 | 0.86 | Wide | ★★★★ | Medium | Exemplary | 68.97 | 83.11 | 2.26 |

| OTCPK | JBAXY | Julius Baer Gruppe AG ADR | Financial Services | 0.73 | 0.16 | 0.71 | Wide | ★★★★ | High | Exemplary | 9.84 | 11.96 | 3.51 |

| OTCPK | EADSY | Airbus SE ADR | Industrials | 0.74 | 0.19 | 1.02 | Wide | ★★★★ | High | Standard | 20.08 | 24.36 | 1.34 |

| NASDAQ | MKTX | MarketAxess Holdings Inc | Financial Services | 0.74 | 0.75 | 0.82 | Wide | ★★★★ | High | Exemplary | 35.84 | 54.0 | 2.61 |

| NYSE | BLK | BlackRock Inc | Financial Services | 0.74 | 0.79 | 0.82 | Wide | ★★★★ | Medium | Exemplary | 17.06 | 18.4 | 2.27 |

| NASDAQ | AMZN | Amazon.com Inc | Consumer Cyclical | 0.74 | 0.74 | 1.06 | Wide | ★★★★ | High | Exemplary | 53.48 | 81.76 | 2.77 |

| TSE | 6954 | Fanuc Corp | Industrials | 0.75 | 0.77 | 0.79 | Wide | ★★★★ | High | Exemplary | 22.37 | 39.34 | 1.12 |

| NASDAQ | ASML | ASML Holding NV ADR | Technology | 0.75 | 0.81 | 0.87 | Wide | ★★★★ | Medium | Exemplary | 32.57 | 33.54 | 2.4 |

| NYSE | WFC | Wells Fargo & Co | Financial Services | 0.75 | 0.76 | 0.87 | Wide | ★★★★ | Medium | Standard | 12.45 | 13.76 | 4.79 |

| NASDAQ | SBUX | Starbucks Corp | Consumer Cyclical | 0.75 | 0.73 | 0.84 | Wide | ★★★★ | Medium | Exemplary | 23.7 | 28.46 | 2.08 |

| NASDAQ | GILD | Gilead Sciences Inc | Healthcare | 0.76 | 0.87 | 0.91 | Wide | ★★★★ | Medium | Standard | 9.41 | 10.07 | 0.52 |

| NYSE | TYL | Tyler Technologies Inc | Technology | 0.76 | 0.77 | 0.93 | Wide | ★★★★ | Medium | Standard | 54.05 | 53.07 | 3.43 |

| TSE | 6645 | OMRON Corp | Technology | 0.76 | 0.75 | 0.73 | Wide | ★★★★ | High | Exemplary | 19.19 | 1.3 | |

| NYSE | BTI | British American Tobacco PLC ADR | Consumer Defensive | 0.77 | 1.12 | 0.89 | Wide | ★★★★ | Medium | Standard | 9.26 | 10.56 | |

| NYSE | DIS | The Walt Disney Co | Communication Services | 0.77 | 0.7 | 0.81 | Wide | ★★★★ | High | Standard | 30.49 | 37.18 | 1.02 |

| NYSE | MMM | 3M Co | Industrials | 0.77 | 0.88 | 0.87 | Wide | ★★★★ | Medium | Standard | 14.16 | 19.05 | 2.03 |

| NYSE | K | Kellogg Co | Consumer Defensive | 0.78 | 1.0 | 0.95 | Wide | ★★★★ | Medium | Standard | 16.72 | 15.66 | 2.74 |

| NASDAQ | MCHP | Microchip Technology Inc | Technology | 0.79 | 0.69 | 0.9 | Wide | ★★★★ | Medium | Exemplary | 12.48 | 16.01 | 0.86 |

| XPAR | AIR | Airbus SE | Industrials | 0.79 | 0.72 | 1.02 | Wide | ★★★★ | High | Standard | 20.58 | 24.4 | 1.38 |

| ASX | BXB | Brambles Ltd | Industrials | 0.79 | 1.21 | 0.94 | Wide | ★★★★ | Medium | Exemplary | 17.83 | 19.82 | |

| NASDAQ | CMCSA | Comcast Corp Class A | Communication Services | 0.79 | 0.78 | 0.84 | Wide | ★★★★ | Medium | Standard | 13.37 | 15.62 | 0.98 |

| NASDAQ | MSFT | Microsoft Corp | Technology | 0.79 | 0.75 | 0.87 | Wide | ★★★★ | Medium | Exemplary | 25.77 | 27.82 | 1.91 |

| TSE | 6383 | Daifuku Co Ltd | Industrials | 0.8 | 0.77 | 0.83 | Wide | ★★★★ | High | Exemplary | 23.92 | 1.77 | |

| LSE | ULVR | Unilever PLC | Consumer Defensive | 0.8 | 0.72 | 0.94 | Wide | ★★★★ | Low | Standard | 16.0 | 20.31 | 2.65 |

| NYSE | UL | Unilever PLC ADR | Consumer Defensive | 0.8 | 0.94 | 0.94 | Wide | ★★★★ | Low | Standard | 16.0 | 20.36 | 2.65 |

| NASDAQ | AMAT | Applied Materials Inc | Technology | 0.8 | 0.68 | 0.79 | Wide | ★★★★ | High | Exemplary | 13.97 | 14.7 | 1.7 |

| XAMS | ASML | ASML Holding NV | Technology | 0.8 | 0.75 | 0.87 | Wide | ★★★★ | Medium | Exemplary | 32.89 | 33.54 | 2.43 |

| NYSE | ABB | ABB Ltd ADR | Industrials | 0.81 | 0.84 | 0.96 | Wide | ★★★★ | Medium | Standard | 19.88 | 20.07 | 0.28 |

| NASDAQ | KLAC | KLA Corp | Technology | 0.81 | 0.72 | 0.87 | Wide | ★★★★ | High | Exemplary | 13.76 | 15.81 | 1.29 |

| NYSE | TRU | TransUnion | Industrials | 0.81 | 0.78 | 0.91 | Wide | ★★★★ | Medium | Exemplary | 23.47 | 27.61 | 1.77 |

| TSE | 6506 | YASKAWA Electric Corp | Industrials | 0.82 | 0.82 | 0.87 | Wide | ★★★★ | High | Standard | 23.87 | 33.14 | 1.63 |

| OTCPK | EXPGY | Experian PLC ADR | Industrials | 0.82 | 0.76 | 0.98 | Wide | ★★★★ | Medium | Standard | 24.15 | 27.66 | 1.54 |

| NYSE | ECL | Ecolab Inc | Basic Materials | 0.82 | 0.87 | 0.94 | Wide | ★★★★ | Medium | Exemplary | 33.67 | 32.42 | 3.06 |

| NYSE | EMR | Emerson Electric Co | Industrials | 0.82 | 0.83 | 0.96 | Wide | ★★★★ | Medium | Standard | 18.52 | 20.31 | 1.72 |

| NYSE | WU | The Western Union Co | Financial Services | 0.82 | 0.93 | 0.81 | Wide | ★★★★ | High | Standard | 9.68 | 10.76 | 2.57 |

| NYSE | JPM | JPMorgan Chase & Co | Financial Services | 0.83 | 0.8 | 0.85 | Wide | ★★★★ | Medium | Exemplary | 11.26 | 12.58 | |

| OHEL | KNEBV | KONE Oyj Class B | Industrials | 0.83 | 0.83 | 0.86 | Wide | ★★★★ | Low | Exemplary | 24.45 | 26.97 | 3.71 |

| ASX | WBC | Westpac Banking Corp | Financial Services | 0.83 | 0.97 | 0.82 | Wide | ★★★★ | High | Standard | 15.85 | 13.24 | |

| LSE | LSEG | London Stock Exchange Group PLC | Financial Services | 0.83 | 0.89 | Wide | ★★★★ | Medium | Exemplary | 26.53 | 28.24 | 3.35 | |

| NYSE | IFF | International Flavors & Fragrances Inc | Basic Materials | 0.84 | 0.8 | 0.88 | Wide | ★★★★ | Medium | Standard | 22.32 | 21.85 | 4.49 |

| LSE | BATS | British American Tobacco PLC | Consumer Defensive | 0.84 | 0.85 | 0.89 | Wide | ★★★★ | Medium | Standard | 9.17 | 10.53 | |

| XSWX | ABBN | ABB Ltd | Industrials | 0.84 | 0.8 | 0.96 | Wide | ★★★★ | Medium | Standard | 20.33 | 20.07 | 0.29 |

| OSTO | ASSA B | Assa Abloy AB Class B | Industrials | 0.84 | 0.88 | 0.98 | Wide | ★★★★ | Medium | Standard | 22.03 | 22.68 | 1.6 |

| NYSE | MDT | Medtronic PLC | Healthcare | 0.85 | 0.87 | 0.93 | Wide | ★★★★ | Medium | Standard | 18.87 | 19.27 | 2.48 |

| LSE | EXPN | Experian PLC | Industrials | 0.85 | 0.59 | 0.98 | Wide | ★★★★ | Medium | Standard | 24.1 | 27.57 | 1.53 |

| NASDAQ | HON | Honeywell International Inc | Industrials | 0.85 | 0.89 | 0.96 | Wide | ★★★★ | Medium | Exemplary | 22.83 | 21.25 | 2.03 |

| NYSE | ALLE | Allegion PLC | Industrials | 0.85 | 0.78 | 0.95 | Wide | ★★★★ | Medium | Standard | 19.08 | 21.23 | 1.76 |

| XSWX | SCHN | Schindler Holding AG | Industrials | 0.85 | 0.87 | 0.88 | Wide | ★★★★ | Low | Standard | 23.81 | 26.54 | |

| NASDAQ | ADSK | Autodesk Inc | Technology | 0.86 | 0.69 | 0.88 | Wide | ★★★★ | Medium | Exemplary | 29.07 | 67.19 | 1.72 |

| NYSE | GGG | Graco Inc | Industrials | 0.86 | 0.81 | 0.96 | Wide | ★★★★ | Medium | Standard | 24.27 | 27.64 | 2.62 |

| NYSE | BK | Bank of New York Mellon Corp | Financial Services | 0.86 | 0.79 | 0.81 | Wide | ★★★★ | Medium | Standard | 10.27 | 11.88 | 1.15 |

| OTCPK | RHHBY | Roche Holding AG ADR | Healthcare | 0.86 | 0.13 | 1.19 | Wide | ★★★★ | Low | Exemplary | 18.45 | 15.14 | 3.03 |

| TSE | 2914 | Japan Tobacco Inc | Consumer Defensive | 0.86 | 0.93 | 0.88 | Wide | ★★★★ | Medium | Standard | 13.28 | 12.16 | 49.18 |

| NYSE | USB | U.S. Bancorp | Financial Services | 0.86 | 0.87 | 0.91 | Wide | ★★★★ | Medium | Exemplary | 12.03 | 13.15 | |

| XETR | G1A | GEA Group AG | Industrials | 0.87 | 0.86 | 0.87 | Wide | ★★★★ | Medium | Standard | 18.94 | 20.23 | 0.79 |

| TSE | 7309 | Shimano Inc | Consumer Cyclical | 0.87 | 0.8 | 0.89 | Wide | ★★★★ | Medium | Standard | 19.08 | 4.31 | |

| NYSE | GSK | GlaxoSmithKline PLC ADR | Healthcare | 0.87 | 2.57 | 1.02 | Wide | ★★★★ | Medium | Standard | 14.79 | 13.73 | 2.15 |

| NYSE | MCO | Moody’s Corporation | Financial Services | 0.88 | 0.87 | 0.98 | Wide | ★★★★ | Medium | Exemplary | 27.4 | 25.67 | 2.74 |

| TSE | 6465 | Hoshizaki Corp | Industrials | 0.88 | 0.92 | 0.87 | Wide | ★★★★ | Medium | Standard | 28.9 | 30.4 | 2.44 |

| XSWX | ROG | Roche Holding AG | Healthcare | 0.88 | 0.96 | 1.19 | Wide | ★★★★ | Low | Exemplary | 18.73 | 15.14 | 3.07 |

| NYSE | BF.B | Brown-Forman Corp Class B | Consumer Defensive | 0.89 | 0.97 | 1.12 | Wide | ★★★★ | Medium | Exemplary | 34.97 | 34.08 | 3.67 |

| NYSE | CLX | Clorox Co | Consumer Defensive | 0.9 | 1.04 | 0.93 | Wide | ★★★★ | Low | Exemplary | 26.11 | 25.33 | 6.42 |

| NYSE | CPB | Campbell Soup Co | Consumer Defensive | 0.91 | 1.02 | 0.98 | Wide | ★★★★ | Medium | Standard | 16.18 | 16.0 | 4.77 |

| LSE | GSK | GlaxoSmithKline PLC | Healthcare | 0.91 | 0.98 | 1.02 | Wide | ★★★★ | Medium | Standard | 14.73 | 13.62 | 2.14 |

| OTCPK | RBGLY | Reckitt Benckiser Group PLC ADR | Consumer Defensive | 0.95 | 0.24 | 1.08 | Wide | ★★★★ | Low | Standard | 20.37 | 20.06 | 2.91 |

| LSE | RKT | Reckitt Benckiser Group PLC | Consumer Defensive | 0.98 | 0.89 | 1.08 | Wide | ★★★★ | Low | Standard | 19.92 | 19.8 | 2.85 |

| LSE | KYGA | Kerry Group PLC Class A | Consumer Defensive | 0.88 | 0.81 | 0.95 | Wide | ★★★★ | Low | Exemplary | 24.39 | 26.17 | 3.13 |

Que te apuestas a que acierto a comprar la que menos sube/mas baja de toda esa lista ![]()

Todo es ponerse, yo me veo con fuerzas también

Es lo que se llama compounders inversas ![]()

![]()

Es otra manera de nombrar al Concurso cazadividendos 2022 ![]()