RB creo que anda sobre el 56% de payout, tomando el eps diluido en total operations.

Un saludo.

RB creo que anda sobre el 56% de payout, tomando el eps diluido en total operations.

Un saludo.

Tenéis razón.

Miré el ADR en S.A. porque no estaba la acción inglesa.

Gracias por la corrección.

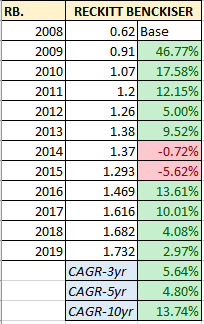

@ruindog ¿dónde has sacado ese cuadro?. Por tener la página.

Por comportamiento histórico de su yield es posible, pero ¿no se te hace que aun así seguiría dando aun unas cifras de crecimiento escasas?

Un saludo.

Ciertamente … pero yo soy mas conformadico que @anbax

Con ese 3.5% de yield se estaría yendo a casi los 10 años para doblar.

Un saludo.

Sabéis a que se debe la castaña de hoy? Solo he encontrado que Credit Swiss le ha dado un underperform

Ha recortado previsiones tras resultados.

Un saludo.

Ahora mismo tiene un Yield del 3.1% que es el pico de los ultimos 6 años, yo estaba dando vueltas a RB, ULVR y DGE para hacer una ultima compra este mes y cubrir los gastos de IB. Quiza le inque un poco el diente a RB

Bueno, hoy ha perforado para abajo el canal que le dibujo (no se ve en el gráfico, porque es de ayer). Eso no es buen augurio a corto plazo. A lo mejor se pega un batacacillo y entonces le pegaré otro tiro.

(y si sube tambien  )

)

RB missed our forecasts yet again in the third quarter and lowered guidance for the rest of this year. New CEO Laxman Narasimhan set the scene for a new strategic direction, to be unveiled with year-end results, by painting RB as a company with much work to do to improve execution. We agree that RB’s issues are executional rather than structural, and we are retaining our wide moat rating. The company operates in solid categories with above-average pricing power. However, improving operational execution is likely to come at a price. We no longer have conviction in RB’s ability to grow its margins, and we have lowered our medium-term margin forecasts accordingly, and we are lowering our fair value estimate to GBP 6,900 from GBX 7,100. The stock looks undervalued to us, and although the next few months may prove to be rock for RB, we believe RB’s wide moat makes it more likely than not that management’s turnaround attempt will prove fruitful.

Third-quarter like-for-like revenue growth was 1.6%, a sequential improvement from the flat second quarter, but nevertheless disappointing considering the easy comparison over last year’s third quarter. The problem area was Health in the U.S. and China. In the U.S., retailers’ demand for Mucinex was weak ahead of the flu season. In the event of a strong flu season, limited channel inventory should deliver upside to fourth-quarter guidance, but we think it its prudent to lower our growth forecast anyway. China is a little more concerning, however, as adjusted revenue in the IFCN segment declined. When the long tail of small local infant formula manufacturers was cut by tightened regulation, we expected multinationals to be the biggest beneficiary, but it now seems that larger local players have taken share. Infant formula is a category with pricing power, however, and with value-added innovation, we think RB can reignite growth, even if it means repositioning the brand at more premium price points.

https://www.rb.com/media/6020/q1-ims-final.pdf

Parece que al mercado le gustan los resultados del Q1, con crecimientos de ventas de doble dígito. Mucho dettol y aprovisionamiento de profilácticos, me parece a mí. Veremos en el Q2.

Dejémoslo solo en el Dettol.

En mi opinión, que solo es una intuición, creo que esta subida de RB se explica por un fly-to-quality más que por fundamentales. La gente, ahora mismo, solo está mínimamente tranquila con lo mejor de lo mejor en cartera (PG y JNJ serían otros ejemplos). Con todo sorprende lo bien que se ha comportado en todo momento durante lo que llevamos de pandemia.

Para cuando todo esto pase será interesante ver las empresas que menos cayeron y más rápido recuperaron, quizá podamos sacar alguna conclusión.

La compañía británica Reckitt Benckiser registró una facturación de 3.513 millones de libras (3.852 millones de euros) en el tercer trimestre de 2020, lo que supone un incremento del 6,9% en comparación con la cifra contabilizada en el mismo periodo del año pasado, según ha informado este martes la empresa.

En términos comparables, el grupo ha destacado que el incremento de los ingresos del trimestre fue del 13,3%.

Entre enero y septiembre, la facturación de la firma británica alcanzó los 10.424 millones de libras (11.435 millones de euros), un 9,4% más en comparación con las cifras del mismo periodo del año pasado. En términos comparables, el incremento fue del 12,4%.

Reckitt Benckiser has upgraded its full-year sales forecast, cementing its position as a winner from the pandemic thanks to consumers stuck at home buying more cleaning products.

The maker of Dettol and Lysol disinfectants, Nurofen painkillers and Durex condoms said third-quarter like-for-like net revenue growth, a key metric for the sector, was 13.3 per cent — above the 9.5 per cent that analysts had expected.

Reckitt said on Tuesday that it expected “low double-digit” growth for the full year, up from high single digits previously forecast.

Parece que está volviendo por niveles razonables (~6,300 GBX hoy)

20-Oct-2020

Reckitt Benckiser provided a third-quarter sales update that shows the company appears to be on track to at least meet our full-year sales growth estimate. The coronavirus pandemic is looking like a net positive for RB, with strong growth in the hygiene and health divisions more than offsetting weakness elsewhere in the portfolio. As a result of this, we think the stock is now modestly overvalued, although we are raising our fair value estimate to GBX 6,800 from GBX 6,700, primarily due to slightly higher near-term growth assumptions. There could be upside to our estimates next year if the uptick in demand during the pandemic proves to be stickier than we currently expect.Third-quarter revenue grew over 13% on a like-for-like basis, a modest acceleration from the 12% in the first half of the year. Reported year-to-date revenue growth of 9% remains marginally above our full-year estimate of 8%, and management has nudged full-year guidance of like-for-like sales growth slightly higher to low-double-digit growth. Hygiene brands such as Dettol and Lysol are clearly performing very well in the current environment. On the other hand, we think growth could slow in the fourth quarter, as social distancing is likely to limit demand for over-the-counter flu products.

The bullish narrative to the RB story appears to be that demand will be structurally higher after the pandemic has passed, as more cautious behaviour around personal and home hygiene becomes engrained. We were already accounting for this and have raised our revenue estimates slightly in 2021 for the hygiene and health divisions to account for further stickiness in demand. We now expect a like-for-like sales decrease of less than 2% next year, which implies two-year stacked organic revenue growth of over 8%. This is above recent trends, implying a boost to sales of around 2 percentage points over the pre-COVID-19 rate. Our medium-term growth rate estimate of 4% is unchanged.

Esta a una RPD de 2,60%, para mi le falta un poco para que me lo empiece a pensar