Pues fíjate que yo la empiezo a ver a un precio atractivo. La llevo a precios más bajos, pero no descarto ampliar en breve

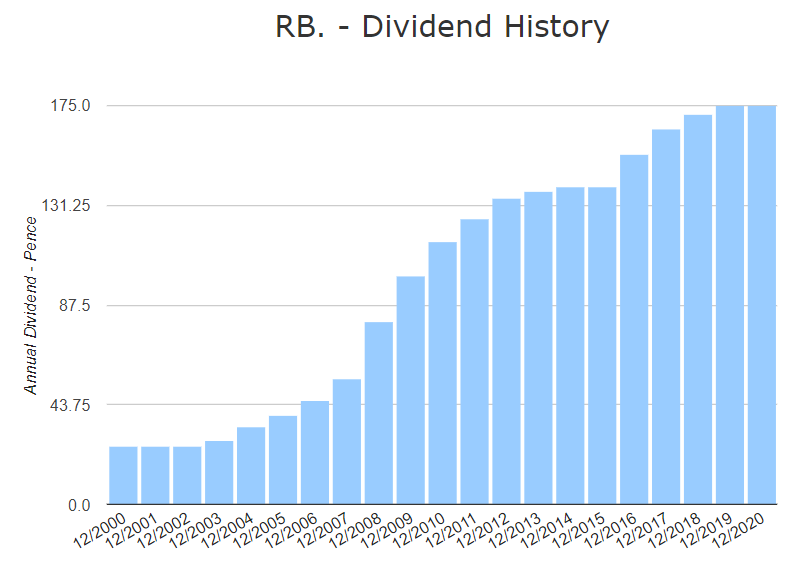

Congelan el dividendo

Reckitt Benckiser Ends Good Year With Strong Q4

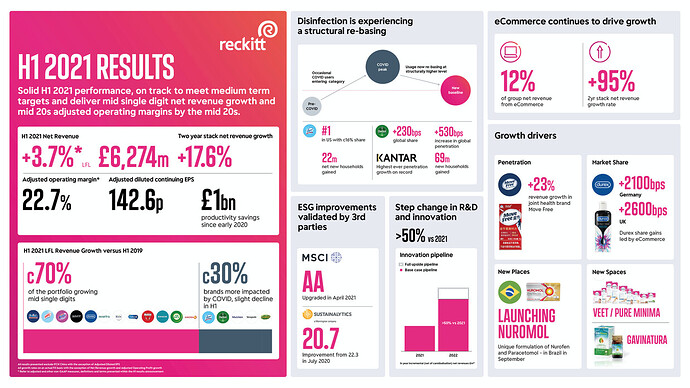

Reckitt Benckiser wrapped up a good performance in 2020 with a strong fourth quarter. We expected sales in the hygiene segment to be strong as consumers have been hygiene-conscious through the pandemic, but the 26% underlying divisional growth was a surprise. It seems likely that elevated demand for the hygiene portfolio will be sustained well into 2021. Under these circumstances, we think the 25% pullback in the stock from the peak of 2020 is overdone, and there is now double-digit upside to our fair value estimate of GBX 6,800. Even if hygiene demand eventually fades as consumer behaviour normalises, RB is positioned in strong categories across the portfolios, and we expect price/mix in the nutrition and consumer health divisions to drive above-average growth in the medium term.

Fourth-quarter like-for-like sales growth in the hygiene division of 26%, driven by remarkable 22% volume growth, was the source of modest upside to our estimate and led to EPS being above our forecast. The hygiene sales growth was a sequential improvement from the third quarter and shows that demand for detergents remains very strong and was facilitated by increased capacity for products such as Lysol. Whether demand remains high when consumer behaviour normalises, and whether that incremental capacity is still required, remains to be seen and is a key variable in forecasting RB’s future cash flows. We continue to expect that demand will remain higher than it was before the pandemic, though likely not as high as it was last year.

Beyond the impact of COVID-19, our investment thesis is centered on the price/mix inherent in the business. We think consumer health is likely to have higher pricing power than most other fast-moving consumer goods categories, and this was borne out in RB’s 2020 results. The health business achieved over 6% price/mix in the fourth quarter and 4% in the full year, above even our bullish forecasts for the medium term.

Efectivamente, un buen año para RB, aunque…

Reckitt revisará su división china de fórmulas para bebés, que representa alrededor del 6 por ciento de las ventas y ha sido una carga para la compañía con una caída en los ingresos desde que fue adquirida a Mead Johnson hace cuatro años. También acordó vender el cuidado de los pies Scholl y comprar la marca de alivio del dolor Biofreeze.

Al menos en Google Finance parece que el ticker ha pasado a ser RKT. A ver si engañan a algún RobinHooder con que es el próximo Rocket

Consumer goods giant Reckitt Benckiser Group PLC said Wednesday it is rebranding as “Reckitt” in an effort to make its name “clearer, simpler and more memorable”.

Reckitt noted its listed company name will remain the same but will be changing its ticker (LON:RKT)

@jefedelforo, ya tienes faena esta semana santa

Cambiado.

En ING está actualizado a medias, las que tengo en cartera siguen como RB y los botones de compra/venta están desactivados, mientras que en el buscador ya sale como RKT.

Entiendo que lo actualizarán, tarde, como suele ser costumbre en ING.

Reckitt Reports In Line First Quarter

Reckitt made a decent start to the year, with organic revenue growth that was bang in line with our forecasts. We are reiterating our wide moat rating and GBX 6,800 fair value estimate. Reckitt’s stock has been volatile in recent quarters, and after a pullback since mid-2020, we now believe the shares are modestly undervalued.

First-quarter revenue fell by 1.1% year over year, but after adjusting for the impact of the strength of sterling, like-for-like growth was 4.1%. This is in line with our estimate for the medium term for Reckitt, but there are wide dispersions in the performance of the various divisions, most of which we expect to normalise. In particular, we regard consumer health and infant nutrition as being categories possessing reasonable pricing power that should deliver above-average growth in the medium term. Both categories are currently underperforming, however, with like-for-like sales in the quarter down by 13% and 7%, respectively. In the case of the health division, Reckitt was cycling pantry stocking of Dettol as COVID-19 spread last year and suffered a weak cold season, which affected several OTC brands. In the case of nutrition, a lower birth rate during the pandemic season is weighing on sales. All these trends appear to be transitory, however, and we see no reason why these divisions can’t achieve 3% to 4% like-for-like sales growth in the medium term.

Conversely, the hygiene division is still performing very well, reporting constant-currency sales growth of 28%. This number includes the entry into some new markets for Lysol, which is another trend that is likely to fade over the next few quarters. Nevertheless, underlying sales remain strong, and we think it is likely that elevated demand is sustained throughout this year and beyond, due to increased awareness of personal and home hygiene as a result of the pandemic.

Por eso, a veces te planteas, poner tu dinero en Fundsmith y aunque tengas unos costes mayores que en tu cartera DGI, la sabiduria de ese señor la aseguras y puede ser que cuando tu vas, él ya ha vuelto.

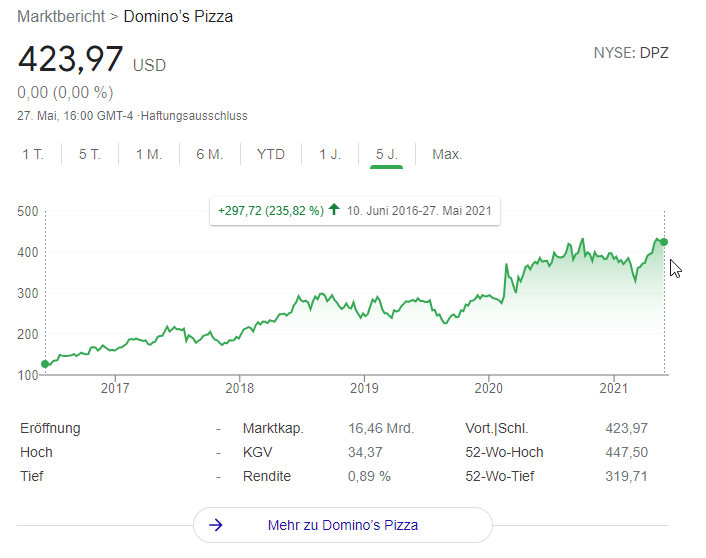

Realmente no siempre es así. También vendió Dominos Pizza a principios de 2016 y ha hecho casi un x4 en ese tiempo:

El bueno de Terry también se equivoca como todo inversor.

Efectivamente, como decia, creo, Buffett, el secreto no es no equivocarse, que es imposible, hasta el lo hace, sino equivocarse menos veces de las que aciertas

Y nisiquiera, con que las veces que aciertes compenses con creces las que fallas vale.

Reckitt venderá el negocio de fórmulas para bebés en China por 2.200 millones de dólares

Venta por 2,2B$ y un impairment de 3,5B$. Tantas veces hemos visto cómo acaban este tipo de adquisiciones…

Alguien sabe a que se debe el bajon de hoy? Porque se ha quedado a un precio muy interesante…

Hoy lleva una leche muy considerable