Esta mañana he leído que Sanofi y Johnson&Johnson están pujando por una biotech Actelion y que Johnson&Johnson se ha retirado. Actelion es una farmacéutica especializada en enfermedades raras.

Hola paxon,como en toda compra interesa saber como esta la empresa comprada, nivel de deuda, en el caso de farmaceuticas negocio actual y pipeline de productos en Investigacion en fases I, II y III y, lo mas importante, el precio a pagar.Como en casos q hemos visto puede ser una buena compra o un castañazo.

Saludos

Resultados del cuarto trimesre de Sanofi:

OCU la ve correctamente valorada pero algo arriesgada y recomienda mantener. A pesar del ligero aumento de ventas, dice en su análisis que cuenta con pocos productos prometedores, salvo el Dupixent (eccema) y el Kevzara (artritis reumatoide), aunque compensa este hecho parcilamente con la aportación de los medicamentos sin receta de Boehringer Ingelheim.

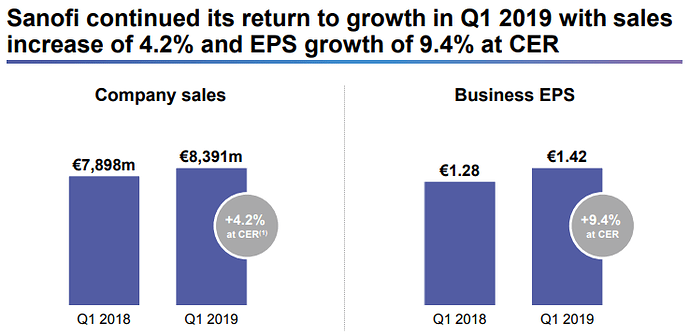

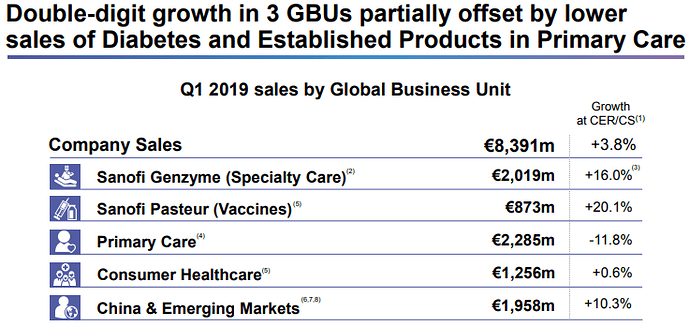

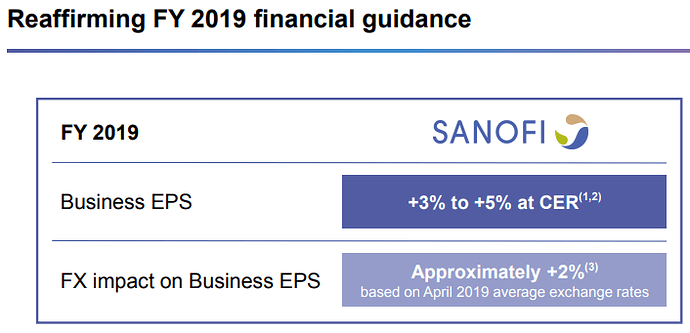

Nota de prensa de resultados del 1er Q de 2019:

Sanofi delivered solid growth in Q2 2019 (29/07/2019)

Second-quarter 2019 sales growth(3) driven by Sanofi Genzyme, Sanofi Pasteur and Emerging Markets

- Net sales were €8,628 million, up 5.5% on a reported basis, up 3.9%(3) at CER and up 5.8% at CER/CS(4).

- Sanofi Genzyme sales up 21.8% due to strong launch performance of Dupixent®.

- Vaccines sales increased 24.7% mainly reflecting the recovery and growth of Pentaxim® in China and low basis for comparison.

- CHC sales up 1.1%, as U.S. growth more than offset lower sales in Europe impacted by non-strategic brand divestments.

- Primary Care GBU sales declined 10.4% at CER/CS mainly as a result of lower Diabetes sales.

- Emerging Markets sales(5) grew double-digits (up 10.0%) supported by higher Vaccines and Rare Disease sales.

2019 business EPS guidance revised upward

- Q2 2019 business net income increased 5.3% to €1,641 million and 4.9% at CER.

- Q2 2019 business EPS(1) up 4.8% at CER to €1.31.

- Q2 2019 IFRS EPS was -€0.07 (-115.5%) reflecting a €1.8 billion impairment charge mainly related to Eloctate®.

- Business EPS(1) in 2019 is now expected to grow approximately 5% at CER(6) barring unforeseen major adverse events. Applying the average July 2019 exchange rates, the currency impact on 2019 business EPS is estimated to be between 1% and 2%.

Third-quarter 2019 (31/10/2019)

- Net sales were €9,499 million, up 1.1% on a reported basis, down 1.1%(3) at CER and up 0.5% at CER/CS.

- Sanofi Genzyme sales increased 19.5% driven by continued strong uptake of Dupixent®.

- Vaccines sales decreased 9.8% reflecting anticipated weighting of U.S. flu vaccines supply towards fourth quarter.

- CHC sales up 0.4%, impacted by Zantac® voluntary recall, non-core divestments and increased regulatory requirements.

- Primary Care sales declined 12.7% at CER/CS due to lower sales in Diabetes and Established Products.

- Emerging Markets sales grew 9.7% due to strong performance in most regions.

Full-year business EPS guidance confirmed

- Q3 2019 business net income increased 4.3% to €2,399 million and 0.2% at CER.

- Q3 2019 business EPS was stable at CER at €1.92.

- Q3 2019 IFRS EPS was €1.49, down 18.6% reflecting the capital gain on the European generics divestment in Q3 2018.

- Sanofi expects 2019 business EPS to grow approximately 5% at CER barring unforeseen major adverse events. Applying the average October 2019 exchange rates, the currency impact on 2019 business EPS is estimated to be around +3%.

¿Oportunidad de compra?

Tentadora cuando menos. Justo cotiza a mi precio de coste.

¿alguien sabe donde se pueden comprar nominativas?

Hola:

Las puedes comprar a través de BNP Paribas. Escribeles para pedirles la documentación, luego la tienes que enviar rellenada y con suerte en unas semanas podrás operar con las claves que te enviaran por correo físico.

Puedes contactar directamente a Sanofi que te indicarán el proceso

relations-actionnaires@sanofi.com

o bien a BNP

paris.bp2s.cts.relations.actionnaires@corp.bnpparibas.com

y la dirección:

BNP Paribas Securities Services

Grands Moulins de Pantin – Corporate Trust Services

Relations Actionnaires SANOFI

9, rue du Débarcadère

93761 Pantin CEDEX

Me quedo con esto:

Sanofi, que está trabajando en dos candidatos de vacuna para el coronavirus, anunció el pasado diciembre que sus planes para poner en el mercado la que está experimentando junto al británico GSK (LON:GSK) no se podrá materializar a comienzos del segundo semestre como esperaban, sino que se retrasará al menos hasta el cuarto trimestre.

El consejero delegado, Paul Hudson, afirmó en el comunicado publicado hoy que siguen trabajando en esos proyectos, con nuevos ensayos clínicos que empezarán “en las próximas semanas”.

En paralelo, recordó que han llegado a un acuerdo con Pfizer (NYSE:PFE) y BioNTech para fabricar la vacuna que ya comercializan estos competidores en las propias plantas de Sanofi.

En cuanto a sus perspectivas financieras para 2021, la compañía francesa anticipa un aumento del beneficio neto por acción de sus actividades de cerca del 10 %, a menos que se produzcan acontecimientos desfavorables imprevistos importantes.

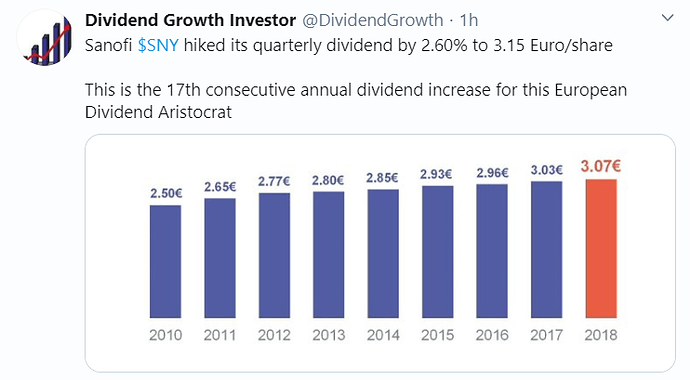

Pues ya va siendo hora de incrementar el dividendo como Dios manda. El 2 y pico por ciento ya aburre.

Lo suyo sería multiplicarlo por 3,4.

No entiendo lo de esta acción… Salen noticias constantes de que va asociarse con toda farmaceutica que se precie para hacer vacunas, buenos resultados, trabajando en una vacuna de las de toda la vida, etc… y no hace más que gotear poco a poco a la baja.

En teoría eso es bueno, ¿no?