ENERGY TRANSFER (ET) - Dos noticias una buena y una mala… Primero la mala.

La buena… trae además un par de sugerencias interesantes…

M*

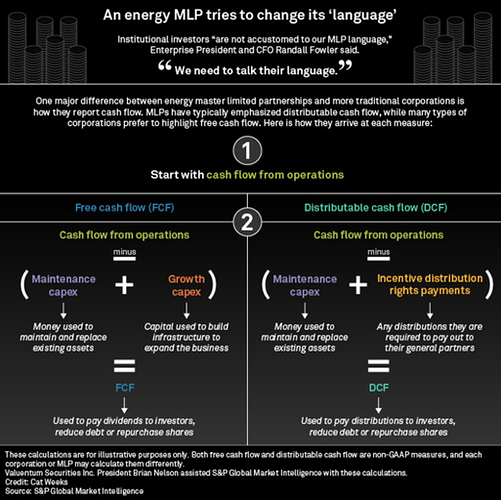

On the other end of the spectrum are the energy infrastructure positions. This group has delivered solid financial results, but the market has significantly moderated the value it’s willing to pay for these cash flows. Enbridge ENB, Magellan Midstream Partners MMP, Enterprise Products Partners EPD, and Plains GP Holdings PAGP all posted solid earnings results, much as they have all year. Their average distributable cash flow growth was 9%. With three quarters in the bag, we have a decent view of 2019 now, and current estimates put average full-year growth at 10%. Average distribution growth in 2019 in this group is tracking earnings, and per share payouts are expected to end the year up 9%.

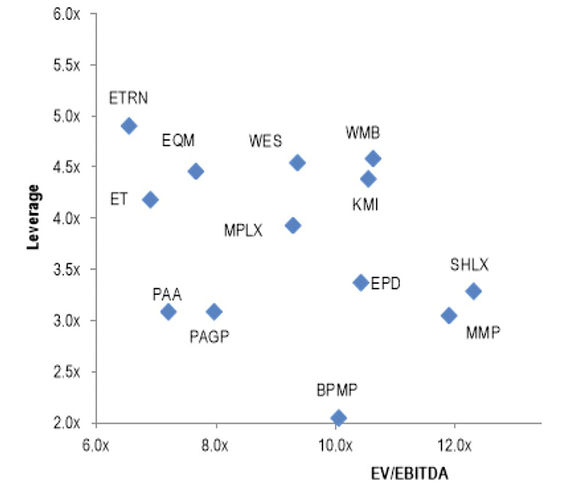

Clearly, the market is having a decidedly different reaction to energy infrastructure than to P&G. The market is ascribing lower valuations and thus higher yields. The average yield of these four companies is now approaching 7%, well above recent averages. Lower valuations are rational, based on an expectation that growth will slow in 2020–21. However, in my view, moderate growth will continue, merely at a slower pace. The only reason to push yields much higher from here would be to price in the imminent risk of a distribution cut. That is an outcome I do not see as likely.

In fact, today’s midstream energy sector has healthier balance sheets, better-covered distributions, less commodity sensitivity, and a better alignment of incentives with management than it has had in many years.

Finding 7% yields that are growing from companies with stable and low-volatility businesses would be extremely difficult to find elsewhere. In the meantime, holders of these securities will have to persevere through a rough patch in investor sentiment. I continue to focus on the businesses’ actual performance while Mr. Market goes through one of his depressive episodes.

Lo que viene siendo en el peor de los casos (según el buen hombre que ha escrito eso) quedarte cobrando un rendimiento cercano o superior al 7%, y si continúa la tónica, crecimientos de un dígito alto. Y eso durante el periodo en el que persista el sentimiento negativo hacia el sector. Bueno, descarta la probabilidad de recortes en el dividendo y apuesta por crecimiento moderado a pesar del sentimiento negativo del mercado hacia ellas … sin renunciar a nada mejor, y según las están tratando, no son tan malas previsiones.

Un saludo.

M*

Investors are increasingly paying attention to environmental, social, and governance, or ESG, factors, and for midstream companies, environmental concerns are paramount.

Pipeline companies are “enablers” that encourage downstream consumption of fossil fuels, making them partially accountable for the greenhouse gas emissions that follow. Most midstream firms also emit waste gasses directly, and the regular occurrence of pipeline spills creates a negative buzz around the industry, inviting further ESG scrutiny. The direct financial burden associated with these issues is generally modest, as pipeline spill costs account for only a sliver of industry spending. If increased regulatory pressure eventually leads to a carbon tax, we would not expect major valuation changes as firms would pass most of these costs to end consumers. However, the resulting reputational damage threatens relationships with stakeholders on pipeline projects, including local communities, indigenous populations, and government regulators. This often leads to lengthy project delays and increased construction costs, and these can be meaningful.

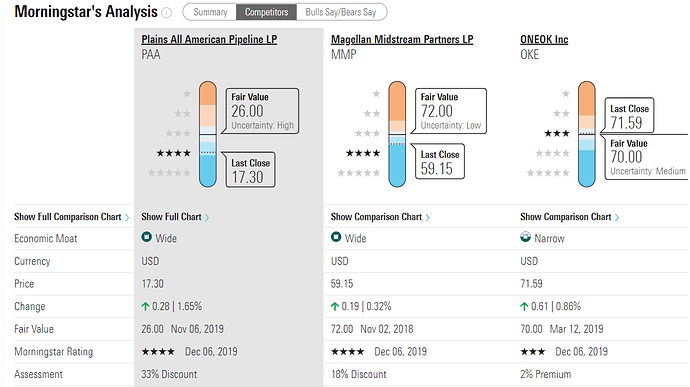

Our top picks are Cheniere and Plains All American Pipeline, which rank favorably on ESG issues and are attractively priced. Enbridge also looks undervalued and should see concerns start to recede because of the emergence of lower-emission solvent-assisted technologies in the oil sands. Energy Transfer is one of the cheapest midstream firms we cover, but that could be related to its relatively high exposure to ESG-related factors.

Es una MLP?

Esta a PER 4, desconozco si el BPA esta inflado por algún motivo, o si realmente esta tan barata.

Un poco de info desde Value Line:

Nov 22, 2019 Commentary

Units of Plains All American have struggled of late. Over the past three months, the price of the master limited partnership’s (MLP) stock has declined over 23%. By comparison, the industry benchmark, the Alerian Index, has lost less than 15% of its value, and the S&P 500 Index has increased nearly 7%.On the operations front, the situation remains good. Last quarter, the partnership saw volume in the Transportation segment climb meaningfully due to higher activity in the Permian Basin. The recent start-up of the Cactus II pipeline and the completion of the Sunrise II project late last year were also major contributors. The Supply and Logistics business did well too, thanks to favorable oil differentials in the Permian. Some of these positives were offset by lower NGL margins, however. The earnings picture is more encouraging than at first glance, as well. In the third quarter, unit earnings were 10% higher than we had expected. Furthermore, it looks like the bottom-line momentum should continue through to the fourth quarter. To reflect this, we have raised our unit-earnings estimate for Plains by $0.15 this year, to $2.65. Also, comparisons in 2020 will be more positive than they appear as profits in both 2018 and 2019 were aided, to some degree, by unusual gains. Finances are strong. Unlike most of its peers, the MLP’s long-term debt-to-total capital ratio is well below 50%. In addition, because the MLP spent heavily investing in new projects from 2012 to 2015, its current capital budget has moderated, which should leave more funds available to improve the balance sheet by retiring debt, or for raising the distribution. In any case, the bulk of the new investment will most likely continue to be in the Permian Basin, which is proving to be the country’s most-lucrative shale play. Investors might find this a good entry point to start a position in Plains. Following the stock’s recent subpar price performance, these units are now ranked to outpace the market in the year ahead. Also, we think PAA offers appealing total-return potential over the next 3-to 5-year period thanks to the MLP’s 9.1% yield and good distribution growth prospects. James A. Flood November 29, 2019

Creo que me sigue gustando más EPD. Tiene mejor ratios de seguridad y “Financial Strenght” y también está algo barata, aunque menos que esta.

Luego está el 42% de Retencion Perdida de Dividendo, ¿no?

Hare una pequeña entrada, a ver como se comporta a futuro.

No llevo nada de este sector en USA.

Aun así, a estos niveles creo que se queda en un yield de mas del 5%, tampoco esta tan mal.

The tax reform bill also lowered the highest individual tax rate from 39.6% to 37%, which provides an additional benefit to MLP investors

Escribí por aquí y abri un hilo sobre Hess Midstream. Poca deuda y negocio creciente con inversiones ya hechas, solo queda que se contruyan para aumentar ingresos a un ritmo de doble digito los dos próximos años. Lo que más me echa para atrás es que sea una MLP.

Aun no he entrado por falta de liquidez, tengo líquidez para hacer una compra pero se viene la extra en unos días y creo que voy a aguantar para hacer toda la conversión de divisa y entrar a HESM además de ampliar geo group que está a buen precio.

Por otra parte, que empresas de midstream recomendais que operen en Canadá y su carga impositiva sea menor?

Supongo que has echado ya un vistazo a Embridge …

Creo que tb anda por ahí Inter Pipeline (IPL)

Y creo que es un 1099 con lo que no estarían aplicando el 37% de los K1 …

http://www.interpipeline.com/investor/shareholderinformation/historical-tax-info.cfm

Un saludo.

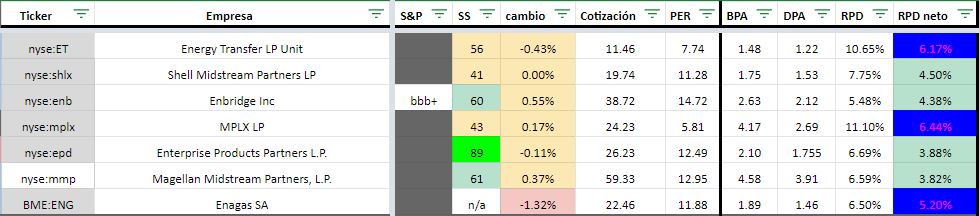

¿Como obtienes los RPD netos?

Llevo Enbridge y me ha parecido poca diferencia entre el RPD y el RPD neto y he hecho varias cuentas para probar pero ninguna me cuadra.

Enbridge 20% (15% ORIGEN+ 5% GIPUZKOA). Los demás estan a 37+5 y enagas al 20.