Siemens gana el primer proyecto eólico off shore en Bélgica:

Gran empresa que creo que se nos ha escapado porque está, sino recuerdo mal, en máximos históricos o cerca de ellos. Uno de mis objetivos frustrados. En fin, ya llegara el momento.

Siemens ha aumentado en un 25% el beneficio del último trimestre de 2016, el que ganó 1.938 millones de euros.

https//www.efeempresas.com/noticia/siemens-beneficio-primer-trimestre-ano-fiscal/

Alianza de Siemens con Gamesa para formar un gigante de la energía eólica:

Siemens y Bombardier están negociando una posible colaboración en su negocio de construcción de trenes

Siemens se plantea fusionar su negocio sanitario con otra empresa para sacarlo a bolsa:

Siemens Gamesa gana un contrato en Turquía para instalar 36 aerogeneradores en Turquía:

https://www.efeempresas.com/noticia/siemens-gamesa-suministrara-118-mw-turquia/

Resultados de los nueve primeros meses del año fiscal:

- Beneficio: 4.886 millones (+11%).

- Cartera de pedidos: 62.006 millones (-6%).

- Cifra de negocio: 60.750 millones (+5%).

Siemens AG gana un 11% más en el ejercicio fiscal 2017, que concluyó el pasado 30 de septiembre.

Siemens despedirá a 6.900 empleados para adaptarse a los cambios en el sector energético con la presión que las renovables están ejerciendo sobre el resto.

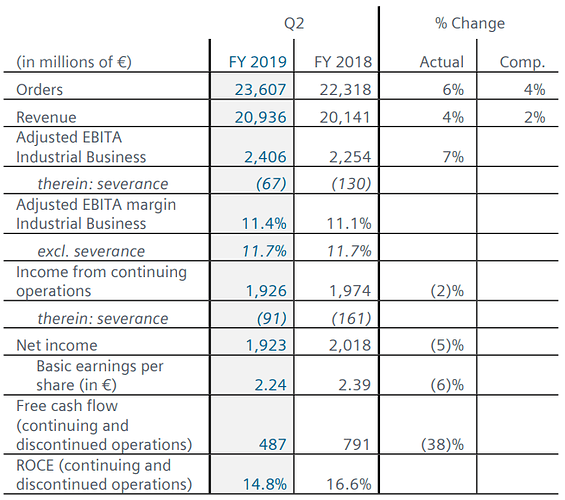

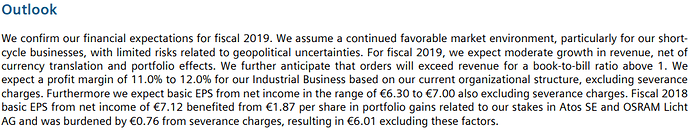

Resultados del 2Q del año fiscal 2019:

https://www.siemens.com/press/pool/de/events/2019/corporate/2019-q2/2019-q2-earnings-release-e.pdf

Las empresas alemanas estan en un momentum bajito.

BASF, Bayer, Siemens, Freseinus, Deustsch Post, Daimler, BMW…

Creo que están a un precio adecuado para largo plazo. Hoy he entrado en BASF a 59€ y tengo además orden en:

SIemens a 91,5€

Daimler a 45€

BMW a 62€

Para una primera entrada es buen precio

Un saludo

Tengo Siemens en el punto de mira. En estos momentos en mi cartera le pierdo casi un 10%. Me gusta que lleguen al -20% pero esta empresa en los últimos tiempos da pocas oportunidades. Veremos…

Third Quarter Results FY 2019 (01/08/2019)

- Orders grew 8%, to €24.5 billion, and revenue rose 4%, to €21.3 billion, for a strong book-to-bill ratio of 1.15 and record high order backlog of €144 billion

- On a comparable basis, excluding currency translation and portfolio effects, orders increased 6% and revenue was up 2% compared to Q3 FY 2018

- Adjusted EBITA Industrial Businesses declined to €1.9 billion, due mainly to decreases in Digital Industries and Gas and Power; Industrial Businesses Adjusted EBITA margin was 9.6%, held back by severance charges which took 0.3 percentage points

- Net income of €1.1 billion included substantially better results outside Industrial Businesses compared to Q3 FY 2018; basic earnings per share (EPS) of €1.28 was burdened by severance charges amounting to €0.09

Earnings Release Q4 FY 2019 (07/11/2019)

Fiscal 2019

- Orders increased 7% to €98.0 billion and revenue rose 5% to €86.8 billion.

- Adjusted EBITA Industrial Businesses increased slightly to €9.0 billion, including a clear increase for * Siemens Healthineers; most other industrial businesses close to prior-year levels

- Adjusted EBITA margin Industrial Businesses was 10.9%; excluding severance charges of €0.5 billion, Adjusted EBITA margin was 11.5%, well within the guidance range of 11% to 12%

- Net income of €5.6 billion.

- Basic earnings per share (EPS) at €6.41

- Basic EPS excluding severance charges were €6.93, at the top end of the guidance range of €6.30 to €7.00

- Free cash flow was €5.8 billion, level with the prior year

- Siemens proposes to raise the dividend €0.10 per share, to €3.90 per share

Q4 Fiscal 2019

- Siemens delivered a powerful growth performance in its fourth quarter despite deteriorating industrial investment sentiment, reporting revenue of €24.5 billion, an 8% increase year-over-year, and orders of €24.7 billion, up 4% from the high level a year earlier, for a book-to-bill ratio of 1.01

- Revenue and order growth were 6% and 2%, respectively, on a comparable basis

- Adjusted EBITA Industrial Businesses surged to €2.6 billion; Adjusted EBITA margin Industrial Businesses of 11.3%; Adjusted EBITA margin excluding severance charges was 12.5%

- Net income climbed to €1.5 billion and basic EPS rose to €1.63; excluding severance charges, basic EPS of €1.90

Outlook

- We expect global macroeconomic development to remain subdued in fiscal 2020, with risks particularly related to geopolitical and geoeconomic uncertainties. We assume a moderate decline in market volume for our short-cycle businesses.

- Given the foregoing, we expect the Siemens Group to again achieve moderate growth in comparable revenue, net of currency translation and portfolio effects, and a book-to-bill ratio above 1.

- Digital Industries expects fiscal 2020 comparable revenue to remain level compared to the prior-year, outperforming the broader market, despite continued weakness in its most important short-cycle markets, particularly the automotive and machine tool industries. Adjusted EBITA margin is expected at 17% to 18%.

- Smart Infrastructure expects to achieve moderate comparable revenue growth in fiscal 2020, driven by its longer-cycle solutions and service business, even as its short-cycle industrial products business faces headwinds from a market slowdown. Adjusted EBITA margin is expected at 10% to 11%.

- Economic cycles have limited impact on the markets for Mobility, which anticipates mid-single-digit comparable revenue growth in fiscal 2020 driven by its rolling stock business, which ramped up several large rail projects toward the end of fiscal 2019. Adjusted EBITA margin is expected at 10% to 11%.

- While energy markets are assumed to remain challenging with some signs of stabilization, Gas and Power expects a moderate comparable revenue growth particularly including execution on its large order backlog. Adjusted EBITA margin is expected at 2% to 5%.

- As previously announced, we plan to carve out Gas and Power and to contribute our 59% stake in Siemens Gamesa Renewable Energy (SGRE) to create a new entity, Siemens Energy. For this entity, we plan a spin-off and public listing before the end of fiscal 2020, with Siemens Energy becoming part of discontinued operations prior to the spin-off. We expect this to result in substantial positive effects within discontinued operations, including a substantial gain at spin-off, which cannot yet be reliably quantified.

First Quarter Results FY 2020 (05/02/2020)

- Orders at €24.8 billion, down 2% from the strong prior-year level as sharply lower volume from large orders in Mobility more than offset increases in the majority of industrial businesses, particularly in Siemens Gamesa Renewable Energy (SGRE); revenue rose 1%, to €20.3 billion

- On a comparable basis, excluding currency translation and portfolio effects, orders declined 4% and revenue was down 1%; the book-to-bill ratio was a strong 1.22 and the order backlog reached a new high at €149 billion

- Adjusted EBITA Industrial Businesses declined to €1.4 billion, due mainly to a loss in SGRE and market weakness for short-cycle businesses; Adjusted EBITA margin Industrial Businesses was 7.3%, held back by €0.2 billion in severance charges, which reduced Adjusted EBITA margin Industrial Businesses by 1.0 percentage points

- Net income declined 3% to €1.1 billion and included substantially better results outside Industrial Businesses compared to Q1 FY 2019; basic earnings per share (EPS) rose 6% to €1.33

Con la noticia de que Siemens Healthineers va a comprar Varian estaba revisando … cuando Siemens hizo el spin off de esta division no repartio acciones entre sus accionistas sino que la saco a bolsa via OPV y aunque fueses antiguo accionista de Siemens si querias las acciones de la nueva Healthineers tenias que comprarlas ¿Algun accionistas de Siemens lo puede confirmar?

Es decir, al estilo de Telefonica Moviles, Iberdrola Renovables, etc. En Europa no se lleva lo de hacer un spin off repartiendo las acciones entre sus legitimos dueños sino que las matrices sacan a bolsa trozos y se embolsan la pasta. Hasta en esto somos diferentes de los americanos.

Hola Vash,

A mi me gustan mucho las operaciones en situaciones especiales (especialmente spinoffs y security mergers). Ahora la verdad que no tengo mucho tiempo de mirar casos potenciales, pero me suena que te dan una acción de Siemens Energy por 2 de Siemens.

Ya digo que sólo lo miré por encima, pero las dos empresas (madre y spinoff) van a ser lo suficientemente grandes como para que no haya ventas indiscriminadas por parte de los gestores de fondos. Además me suena de que era todo bastante transparente y no había demasiadas cosas raras como para sacar tajada.

Desde que salió el libro de Greenblatt cada vez hay menos oportunidades en USA en situaciones especiales. Pero en Europa, como bien apuntas, las cosas son más oscuras (yo diría peores) y si se investiga bien es posible que haya algunas buenas oportunidades.

Si en el futuro hago de las mías con alguna spinoff o merger ya lo posteare en el foro

Soy accionista de Siemens desde 2012 Y a mi nunca me dieron acciones de ese “spin off”. Si tengo unas osram que dieron en 2013