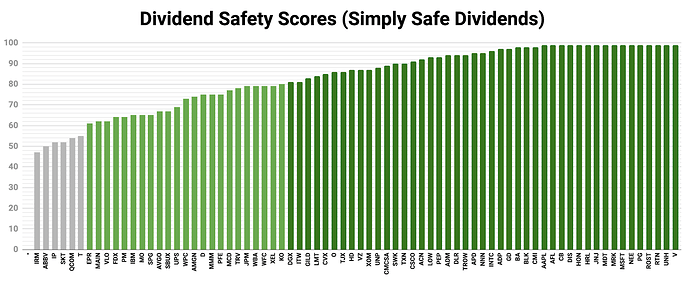

Empresas con un Dividend Safety Score >= 90. Entre 81 y 100 se considera “Very Safe”: Cut is extremely unlikely

Ticker Dividend Safety

6 Me gusta

18 companies with yield over 3% and SSD 90 and over

(I find 16 companies if we ignore companies with less than 5 years of dividend growth, that would remove FII and PSA).

The 18 companies are: ADM, AVB, BEN, BMO, DLR, ETN, EV, FII, MAA, NNN, OMC, PEG, PEP, PNW, PSA, SJM, TD, TROW

4 Me gusta

luisg

8 Marzo, 2019 21:28

3

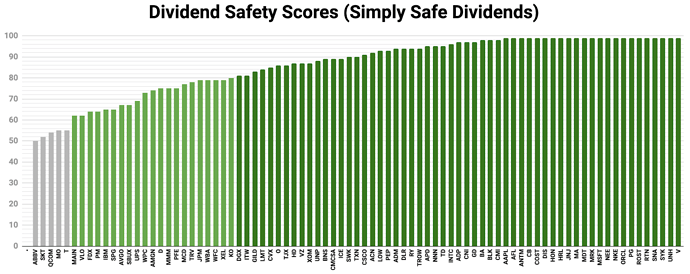

Del hilo de younger folks de Chowder. Pone el CAGR y la puntación SSD.

"I sorted by CAGR to make it easier to spot the safety targets at higher CAGR values. The CAGR’s listed are for a 20 year period.

Stock*** CAGRSafety

5 Me gusta

La verdad es que con la mitad de estos valores se puede montar una cartera muy buena.

1 me gusta

Nos han pillado la matrícula y ya no permite registros de prueba con emails inventados, ni siquiera con emails temporales generados en distintas webs hechas para estos menesteres.