BTC never sleeps

Nos congelan el dividendo (1.6 HKD)

El principio del fin!!

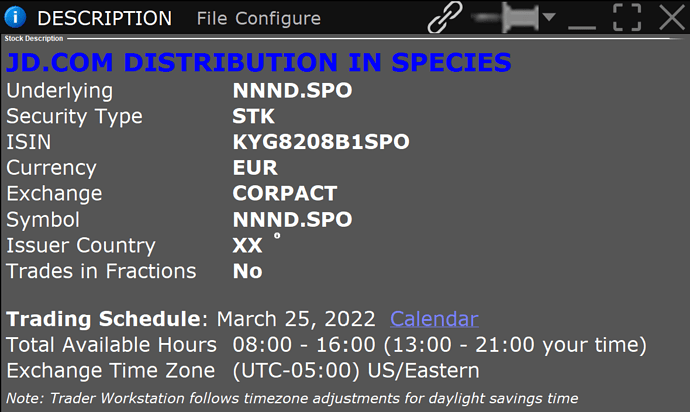

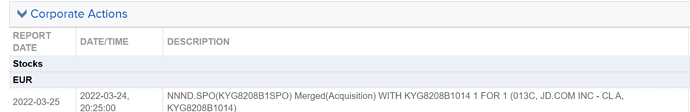

Depende. ¿El “regalo” de las JD.com lo consideramos un dividendo especial?

Yo lo considero un spin off como las Organones de Merck

On 23 December 2021, the Board resolved to declare a special interim dividend in the form of a distribution in specie of approximately 457 million Class A ordinary shares of JD.com indirectly held by the Company, on the basis of 1 Class A ordinary share of JD.com for every 21 Shares held by the Qualifying Shareholders.

Aquí los enlaces a resultados 2021Q4:

- El dividendo comentado: https://static.www.tencent.com/uploads/2022/03/23/f3fc61ef35fabee44d893af180ba225b.pdf

- gráfico con datos: https://mp.weixin.qq.com/s/l_YU9UHzEjZBwZUfLG2eow

- Announcement (of the annual results): https://static.www.tencent.com/uploads/2022/03/23/08030c33af5d5ae19d4978a0c4cb2c25.PDF

- la press release (de los resultados anuales): https://static.www.tencent.com/uploads/2022/03/23/d5231df5649ef4a97990d3ac1c20bb69.pdf

- este el enlace a la presentación en directo (no sé si funcionará después): https://edge.media-server.com/mmc/p/5gzs4hmg

Una pregunta para los que tenéis carteras más desarrolladas: ¿qué % de la cartera os supone Tencent a importe de compra?

Saludos!

¿Cómo se calcula? ¿Importe Compra Tencent dividido por el Valor Actual Cartera?

pensaba más en (importe total compras Tencent / importe total compra cartera), con o sin comisiones, da igual, es por tener una idea de cómo la tenéis ponderada, pero si tienes más a mano el dato a cotización actual también me vale.

Mi ponderación a precios de compra es del 0,44% y supongo que estaré cómodo con un 1-2% de la cartera.

Los resultados le han sentado mal

Gracias!

Tencent un 2.09% y Alibaba un 2.80%.

@luindog

Así me va. Tencent (-20%) y Alibaba (-41%). De KWEB ni hablo porque ya la vendí

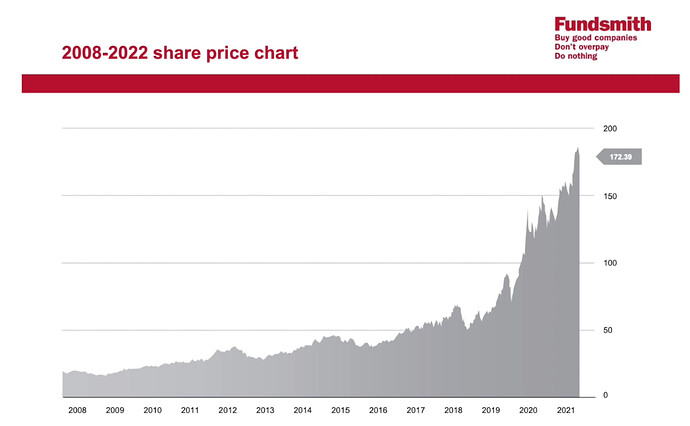

Me consuelo pensando en el ejemplo que presentó ayer Mr. Smith

Mas del que deberia

Analyst Note 03/24/2022

Wide-moat Tencent delivered an underwhelming fourth quarter, but our opinion of the company is unchanged. Regulations on advertisers resulted in a decline in Tencent’s advertising revenue, and measures intended to protect minors affected spending on games. Overall revenue deceleration, in the absence of cost control, drove adjusted net profit down 25% year over year. While we see earnings continuing to decline for a few more quarters, the end of the earnings trough is in clear sight. We anticipate upcoming expansionary policies, coupled with a shift in advertiser mix, will bring growth back to the advertising business later this year. We also expect a resumption of game license approvals, which will accelerate gaming revenue growth in early 2023.

We maintain our fair value estimate of HKD 837 per share and view shares as very undervalued. The greatest risks to our valuation come from more unanticipated regulatory actions and prolonged macroeconomic slowdown, but we think these risks are largely price-in.

The fourth-quarter result was terrible, but we believe most investors saw it coming. Total revenue grew just 8% year over year, coming below both our and Pitchbook’s consensus expectations. The weakness was most pronounced in the advertising business, where revenue dropped by 13%. This was mainly the result of regulations imposed on advertisers in several verticals–games, education, and insurance. Revenue from valued-added services grew 7%, payment and enterprise software’s revenue were up 25%–showing decelerating growth on all fronts. Management was unfazed by the short-term setbacks, and did not pull back most of its costs or investments despite slowing growth. While this led to margin compressions (adjusted operating margin down by 550 basis points), we believe continued investing is the right strategy when headwinds are temporary. Therefore, we think investors should look past a few quarters of earnings decline and focus on the long-term picture for Tencent.

¿Vas a comprar mas?

No. La ponderación de China en mi cartera ya es mayor de lo recomendable.

Acabo de recibir un ingreso en degiro con el concepto coste de accion. ¿Alguien sabe a que se refiere?