Parece que hace poco le tocó reunión de antiguos alumnos😂

¿La vecina del quinto lleva botas UGG? ![]()

The three leading causes of bankruptcy are:

(1) Divorce.

(2) Job loss.

(3) Health problems.

If you want to be financially miserable, those are three great ways to get you there.

The defeatist personality would think something like this—I can’t control what kind of spouse my significant other becomes, my employer could fire me at any moment, and I could wake up with cancer tomorrow. Each of those statements are true, but they ignore an important part of the thought process—every decision that we make puts us on a path with a certain series of probabilistic outcomes, and it is our job to act in a way that tilts those probabilities into a direction that we find favorable.

If I find myself falling for a girl that spends her days browsing Pinterest for $200 Ugg boots and $5,000 wedding dresses, well, I might want to back off before things get serious so I don’t become one of those yuppie snobs that live paycheck to paycheck.

Yeah, I can’t control what an employer does, but if I become damn good at mastering the law, there will likely be a place in any economy for the services I can provide.

Yeah, I can’t control what my future health situation will look like, but I can make a deliberate effort to avoid the one vice that seems to destroy many otherwise promising young men: alcohol.

That’s the kind of stuff I can control. When you look at your own life, you can probably make a good list of what it would take to put you on a path towards divorce, job loss, and health problems, and once you identify that path, you have a whole lot of power that can reduce the probabilities of you experiencing any of those three things.

¿No eran Liquor, Ladies and Leverage?

Divorce = Ladies

Job Loss = Not “Leveraging” your skills in the workplace

Health problems: Liquor

We can make individual decisions that either increase or decrease the probabilities of realizing an outcome that we desire. I’m really thankful that Mr. Munger taught me that it is dumb to give up on the things we cannot fully control, because we can almost surely influence them more than we might initially think.

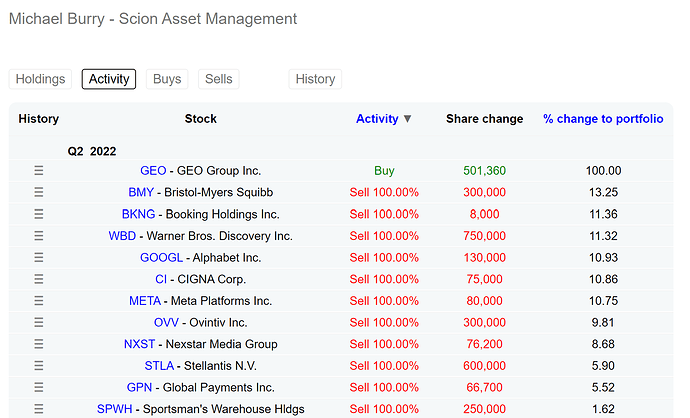

Esto tweet me gusta más, porque no se basa en el sesgo de supervivencia de una “super empresa” si no en una regla sencilla y que muchos de nosotros sigue en mayor o menor medida como es un número alto de años de aumento de dividendo.

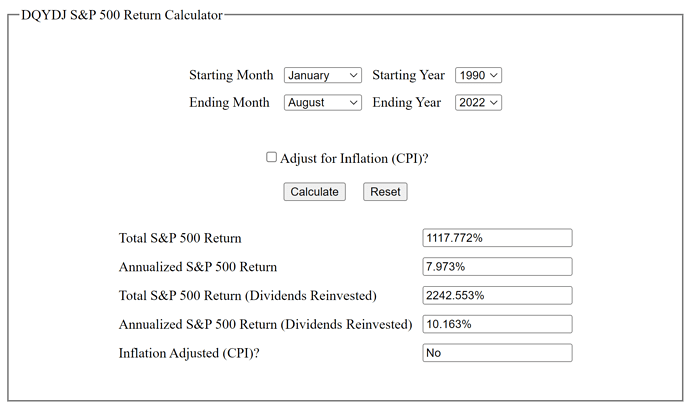

Por poner en contexto, el S&P 500 desde 1990 hasta ahora ha tenido una rentabilidad de algo más de un 8%.

Cuando se podia batir al mercado siendo DGI ![]()

Parezco nuevo, mire el índice y olvidé que no incluía dividendos.

La diferencia ya es menor pero aún así muy favorable a las acciones DGI

Yo el problema que veo es el de siempre:

Si las acciones DGI lo han hecho bien, la gente empieza a comprar acciones DGI, se encarecen, y dejan de superar al mercado.

Si las acciones Quality lo han hecho bien, la gente empieza a comprar acciones Quality, se encarecen, y dejan de superar al mercado.

Si las acciones Growth lo han hecho bien, la gente empieza a comprar acciones Growth, se encarecen, y dejan de superar al mercado.

…

Y así todo.

¿Hay algún criterio de selección de acciones que sea inmune al mercado? Yo creo que no. Por eso los factores también tienen sus rachas.

Yo creo que era algo tipo, compra barato y vende caro😉

Annual Return (con reinversión bruta de dividendos) de las trece empresas con mas puntuación en la CQSS USA_DGI desde enero de 1990 hasta el momento presente.

Absolutamente todas superan al S&P 500 y al MSCI World. ¿La calidad se pone o se pasa de moda? ![]()

PG 11,67%

PEP 11,65%

JNJ 12,60%

ACN 17,09% (desde el 20/07/2001)

MSFT 22,58%

HON 12,80%

KO 10,80%

CL 12,14%

LLY 12,51%

TXN 16,08%

NKE 17,67%

TROW 16,46%

JKHY 28,34%

S&P500 10,16%

MSCI World 8,23%

El problema en mi humilde opinión es que no empeñamos en comprar mortadela en vez de jabugo y encima nos hacemos veganos algunas temporadas.

Lo bonito es saber cuáles serán las empresas con mayor puntuación en la CQSS en el 2050 e invertir ahora en ellas

Ni idea. Solo sé que en 1998 cuando vivía en Estados Unidos todas las empresas que he puesto arriba ya eran archiconocidas y sus productos eran utilizados por una gran mayoría de la población. Por si sirve de pista.