Fiscalmente, qué implicaría recibir las nuevas acciones?

Unos numeros rapidos me dan que AT&T “vende” los activos de Warner por ~4x ebitda del 2020.

Sacrifica 9bln de ebitda y baja su deuda de los 152bln (esperado en 2021) a 109bln.

Supongo que al mercdo lo gusta la bajada de deuda y apuesta por una revalorizacion de la acción, mas que por el dividendo en sí.

Yo he vendido. Tenía muy claro que el papel de T en mi cartera era el de vaca lechera, y el movimiento anunciado no va en esa dirección, independientemente de que vaya bien o mal. Pequeñas plusvalías + dividendos cobrados y liquidez para futuras compras, que falta me hacía. Ojalá vaya bien a los que mantengan.

Por cierto, la compra de WB se hizo por 85bln, y se le venderá a esa nueva corporación por 43bln. No se si van a hacer una depreciacion del goodwill de 42bln pero de alguna manera tendrán que cuadrar los números; esto último sería una barbaridad

Explícitamente no se dice es cierto pero:

1.- Si fuera lo contrario se anunciaría a bombo y platillo.

2.- Si una parte de tu empresa se fusiona con otra que no paga dividendos y en la parte que permanece constante pretendes bajar el payout, o has timado a la otra parte en la asignación de deuda de las empresas o creo que es imposible subir el dividendo.

Por cierto, como es el mercado, ha empezado la sesión AT&T subiendo un 5% y ahora baja casi un 1%, pero Disca ha empezado subiendo un 10% y ahora baja casi un 7%. Ha pasado de ser la típica operación “chachi” win-win a ser la menos “molona” operación lose-lose.

En este caso creo que me voy a hacer un @Bass.

Otro que se apunta a la inacción.

Yo había puesto de coña que había vendido, pero como nadie ha picado lo he quitado

M*

Analyst Note | by Michael Hodel Updated May 17, 2021

CEO John Stankey has wasted no time putting his mark on AT&T and we like the direction he’s headed. AT&T announced plans to spin off WarnerMedia and immediately merge the firm with Discovery to create a new media company. AT&T shareholders will own 71% of the new entity, which will assume $43 billion of AT&T’s debt load. The deal essentially completes the unwinding of former CEO Randall Stephenson’s strategic vision, which we’ve long considered ill-conceived, as reflected in our Poor capital allocation rating.

While we like this move, we don’t expect to change our $36 fair value estimate. Combining WarnerMedia with Discovery should enhance the value of the new firm, though not to an extent that we expect will have a huge impact on AT&T’s worth overall. The transaction does highlight the value of WarnerMedia, which we suspect would be trading well in excess of the roughly $100 billion AT&T paid for it, net of divestitures, if it were a stand-alone firm today. We also wouldn’t rule out the possibility that another firm makes a play for WarnerMedia–we still believe it would pair well with Comcast’s NBC Universal–but we wouldn’t count on it, either. We view AT&T shares as fairly valued.

AT&T used this announcement as cover to cut its dividend substantially. The firm will target a payout of around $8 billion-$9 billion annually, down from nearly $15 billion in 2020. While this shift will likely disappoint shareholders, we think it makes sense, especially considering the market hasn’t given the firm much credit for the payout, holding the stock’s yield around 7% in recent years. The firm will set the dividend at around 40% of free cash flow, down from more than 60% in 2020, leaving substantial excess cash to reduce leverage or take advantage of opportunities, including share repurchases. That free cash flow figure also contemplates a sizable increase in network investment, notably in fiber infrastructure, which we believe is important to AT&T’s long-term health.

No hay duda.

SSD.

"AT&T on Monday announced plans to combine its WarnerMedia business (around 20% of cash flow) with rival Discovery to form a new publicly traded company.

AT&T will maintain its current dividend until the transaction closes, which is expected in mid-2022.

Then, management will reduce the dividend to account for the distribution of WarnerMedia to AT&T shareholders, who will own 71% of the new media company.

Following the separation, management expects AT&T to have an annual dividend payout ratio of 40% to 43% on anticipated free cash flow of at least $20 billion.

This implies an annual dividend of $8 billion to $9 billion versus about $15 billion today. We estimate AT&T’s rebased dividend could be around $1.20 per share, a roughly 40% reduction compared to the current payout of $2.08 per share.

Reflecting the expected dividend reduction in 2022, we are downgrading AT&T’s Dividend Safety Score from Borderline Safe to Unsafe. However, that’s not necessarily reason to sell.

Shares of AT&T rallied as much as 4% in early trading as investors cheered the firm’s reversal of its prior strategy to create the largest vertically integrated content and distribution company.

Acquiring pay-TV provider DirecTV in 2015 and media powerhouse Time Warner in 2018 was intended to strengthen AT&T’s offerings. Bundling more services together and launching new streaming services offered potential to reduce churn and monetize a larger customer base.

But AT&T’s sprawling operations became increasingly difficult to manage as the world changed. The rise of over-the-top streaming services caused DirecTV to lose millions of subscribers, and the heated streaming race has demanded more investment in content to keep pace with global rivals such as Disney and Netflix.

AT&T could have continued down its current path of managing its content and distribution businesses under one roof. However, John Stankey, who became AT&T’s CEO last year, has concluded that these different operations would benefit from having more focused oversight.

Mr. Stankey has worked quickly to refocus AT&T on its core wireless and fiber businesses by unwinding his predecessor’s transformative deals. Besides today’s announcement to separate the firm’s media assets, AT&T earlier this year sold 30% of its DirecTV business to a private equity firm.

After the media transaction closes next year, we estimate AT&T will generate around 80% of its operating income from its wireless services business, with business wireline (15%) and broadband (5%) generating the remainder.

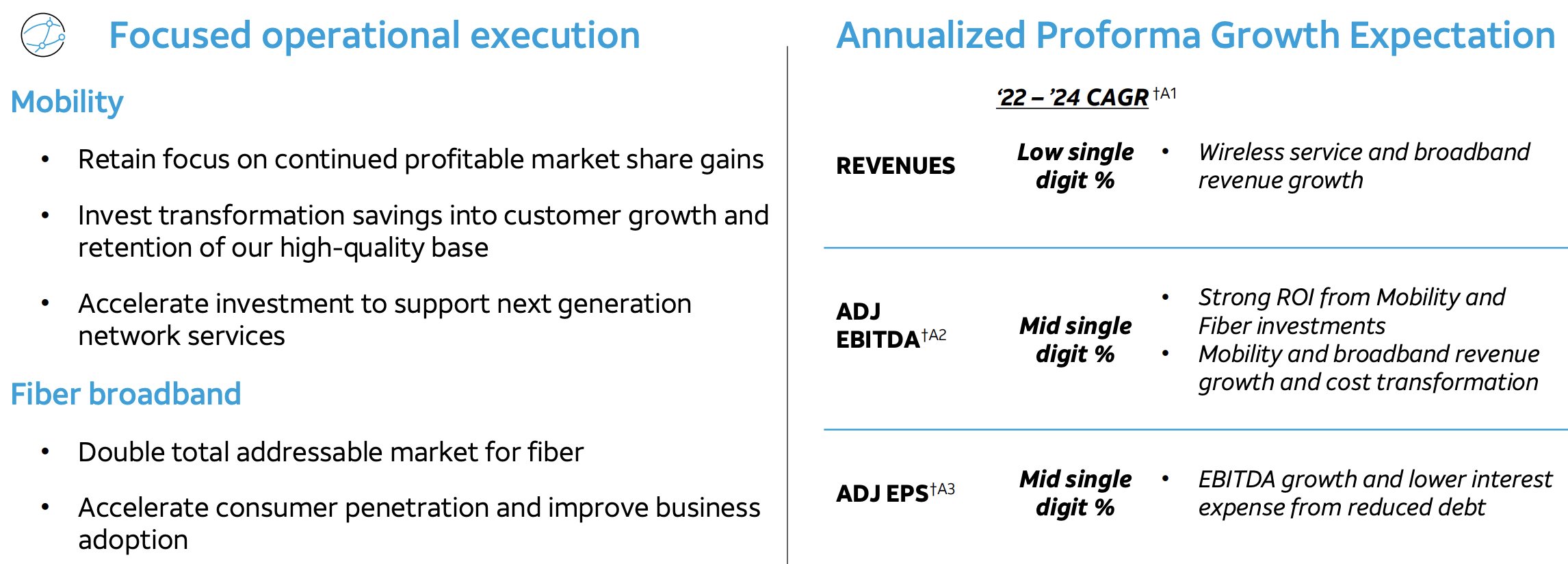

This predictable business will be a cash cow and targets low single-digit revenue growth as management continues investing in AT&T’s 5G network and fiber internet footprint.

Source: AT&T Investor Presentation

AT&T’s balance sheet will also improve since the firm will effectively shove nearly 30% of its net debt onto the new media company being created.

This will lower AT&T’s net debt to adjusted EBITDA leverage ratio from an expected level of 3.0x in 2021 to about 2.6x after the transaction closes. AT&T’s BBB investment-grade credit rating should have more support thanks to this action.

Coupled with AT&T’s reasonable payout ratio near 40%, the firm should have flexibility to continue reducing debt, repurchase shares, or grow the rebased dividend.

Based on the firm’s projections, we expect to upgrade AT&T’s Dividend Safety Score to Safe once the new dividend is in place next year. The firm’s remaining operations and financial profile should appeal to value-oriented income investors.

The new media business will appeal to a different investor base. AT&T shareholders will receive shares in this company when the tax-free transaction takes closes in mid-2022. They will have to decide whether to retain their shares or reinvest elsewhere.

WarnerMedia and Discovery are focused on winning the global streaming race. Rather than pay a dividend, they will invest aggressively in content as they seek to capitalize on their greater scale.

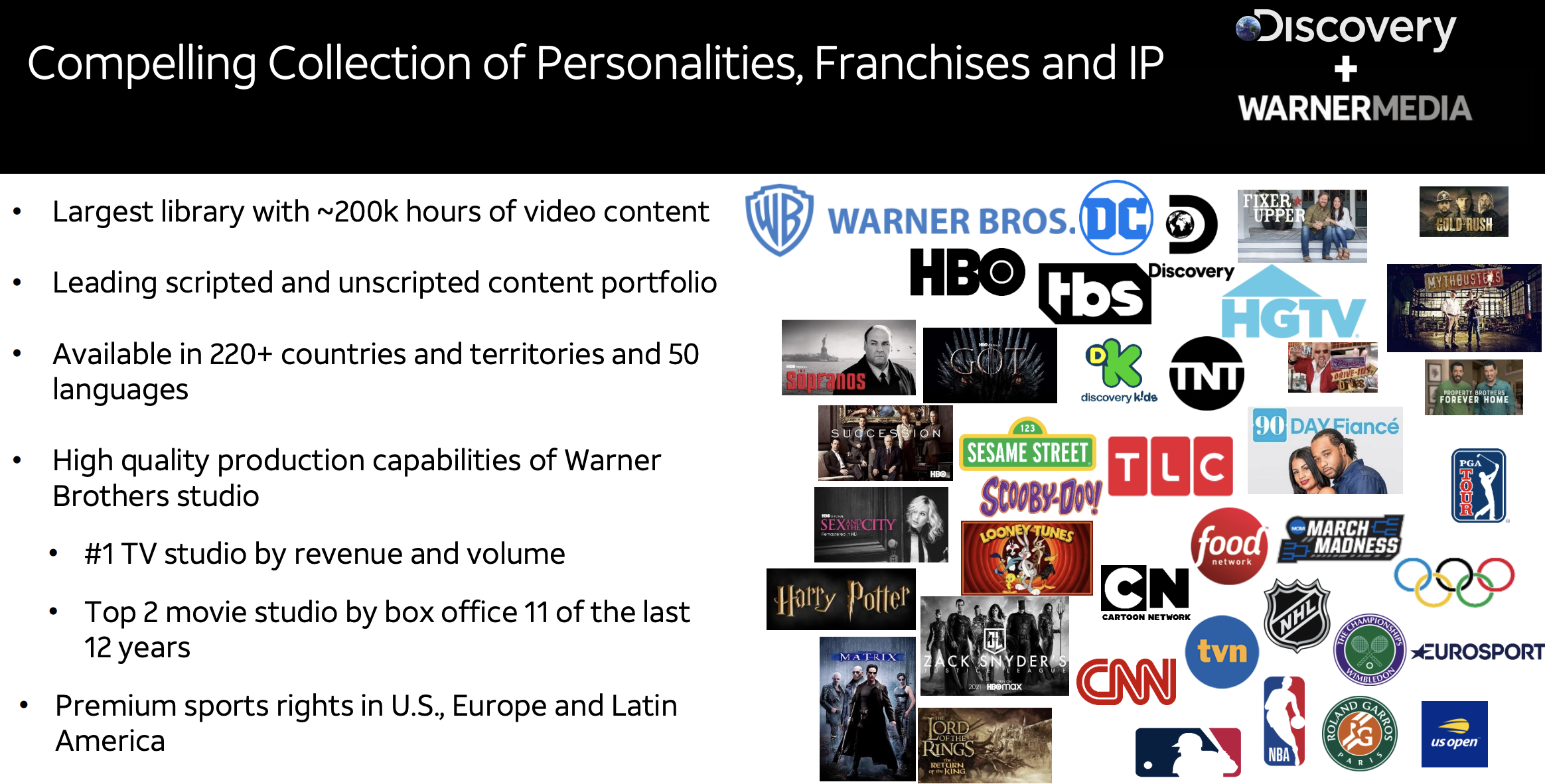

The combined business will be the second largest media company in the world by revenue after Disney, according to the Financial Times. Management sees opportunity to take out $3 billion of costs which will help fuel more investment across an already impressive programming lineup.

Discovery owns a portfolio of networks including the Discovery Channel, HGTV, Food Network, TLC, and Animal Planet. WarnerMedia will add some of its own cable channels such as HBO, CNN, TBS, and TNT as well as the Warner Bros. TV and movie studio.

Source: AT&T Investor Presentation

Thanks to Discovery’s strong international presence, the firm’s distribution will reach more than 220 countries. This provides more long-term expansion opportunities for the combined content portfolio.

Management ultimately sees potential to grow the media company’s pro forma revenue from $39 billion in 2020 to $52 billion in 2023, with at least $15 billion from direct-to-consumer streaming services.

With a larger content library, greater distribution, more scale, and an expected investment-grade credit rating, the combined company has potential to achieve a higher valuation than AT&T’s HBO Max streaming service could have attained on its own.

Overall, AT&T’s plans to spin off WarnerMedia have potential to unlock value by improving the management of its content and distribution businesses, simplifying its operations to appeal to different investor bases, and strengthening its balance sheet.

But unwinding AT&T’s sprawling operations will result in a dividend cut next year since the new media business will not pay dividends. While this is disappointing for income investors, these moves position AT&T for a more conservative and predictable future that has potential to deliver stronger total returns.

Depending on the new media stock’s valuation next year, investors determined to maximize dividends could offset some of the payout reduction by reinvesting proceeds from the spin-off into another dividend-paying stock.

AT&T accounts for less than 1.5% of our Conservative Retirees portfolio, and we plan to keep holding our shares for now. We will reevaluate our position when the separation draws nearer and will continue providing updates as needed."

Parece que T se quiere “Verizonear”, no? Después de quemar dinero, vuelve al punto de inicio, basicamente ser una compañia de telecomunicaciones.

Esto ha sido como si te coges un taxi en el aeropuerto de barajas para ir a “barajas pueblo” y te dan una vuelta por la puerta de alcalá. Terminas el viaje con menos dinero, perdiendo el tiempo pero has visto “mundo” y que es lo que había fuera de lo que era tu objetivo.

¿Y no te has planteado un ETF o una empresa/s alternativa/s?

Pallete oye a este chico!!!

Ha sido una apuesta fuerte que no ha salido bien, han sido valientes, si les hubiera salido tan bien como a Disney, nadie se quejaría. Esta es la parte de ser empresario donde se emprende con incertidumbre.

Para mi, el ADN de Disney, una empresa con una cultura innovadora, es una de las claves.

Yo me apunto a no hacer nada, solo poner la mano cada 3 meses

De momento no tengo nada visto. T era mi mayor posición y la única con una RPD del 6.5% (tenía cartera española pero vendí para la entrada de la vivienda).

Ahora mismo estoy en una encrucijada. No sé muy bien si deshacer todas mis posiciones y amortizar aprovechando las plusvalías del momento. No sé si seguir como hasta ahora guardado liquidez para comprar JNJ, PEP, etc. cuando caiga algo el mercado, o si olvidarme de aumentar los dividendos y combinar con ETFs o incluso la indexación.

Afortunadamente cuando todo está verde es más fácil decidir con calma y tiento.

Fuera, sin contemplaciones.

Acabó en negativo. Línea y bingo para usted, Ciguatanejo!

Ha bailado muchísimo hoy, y after hours roza los 30,50… Servidor vendería pero por pmc sin dividendos estoy con minusvalías y paso de palmar pasta. A ver si mañana no cae mucho más …