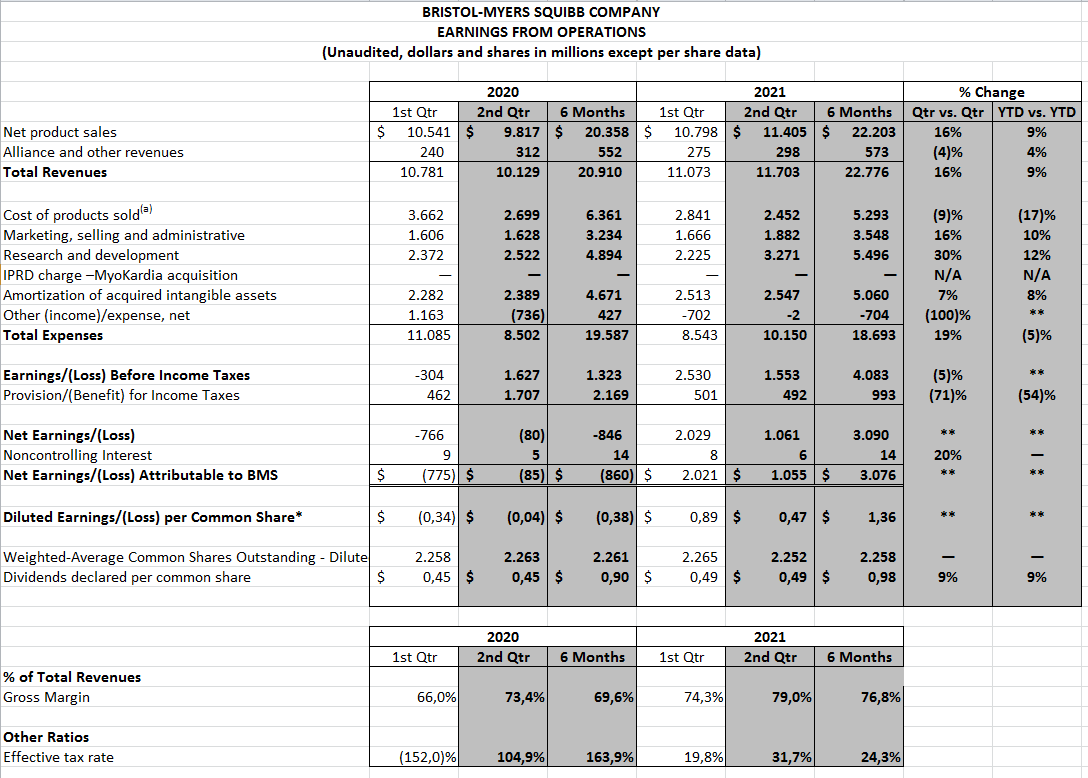

No parecen malos resultados

Muy interesante el análisis. Gracias por compartirlo!

Curiosidad, estoy haciendo cursos de machine learning con Kaggle (que es de Google) y me encuentro en las competiciones esta: Bristol-Myers Squibb – Molecular Translation | Kaggle

Supongo que el premio sale del presupuesto de IT o de R&D ![]()

otro pequeño ejemplo de la llamada “nueva economía”

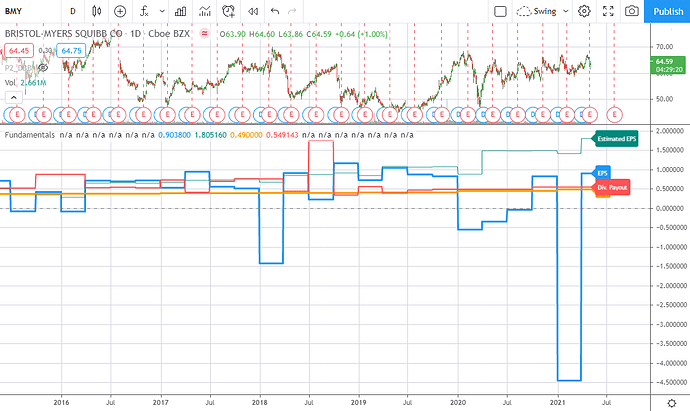

-5% parece que no han gustado los resultados

(M*)

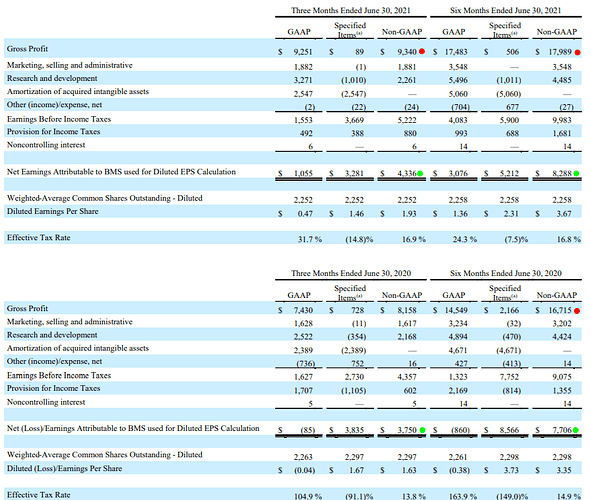

Bristol reported first-quarter results slightly below our expectations partly due to COVID-19 headwinds, but we don’t expect any major changes to our fair value estimate based on the minor underperformance. We view the company as moderately undervalued with the market underappreciating one of the best developing late-stage pipelines, which also reinforces our wide moat rating.

In the quarter, sales increased 1% as COVID-19 buying patterns (negative 7% impact) weighed on results, but we expect an acceleration of growth for the remainder of the year as COVID-19 vaccine utilization increases and year-over-year comparisons ease. Top drug Revlimid (26% of sales) for multiple myeloma posted only 1% growth as inventory reversals weighed on results. We expect accelerating growth for Revlimid until generics launch in March 2022, but the staggered market volumes agreed on by generic firms likely mean more modest but increasing pressure through early 2026, when restrictions are lifted. Posting almost as much sales as Revlimid, cardiology drug Eliquis gained 9%, but with the opportunity to replace warfarin (21% share in the U.S.) falling, we expect decelerating sales. Cancer drug Opdivo (15% of sales) fell 3%, but we believe pressure from Merck’s Keytruda in lung cancer is subsiding and that Opdivo should return to growth, driven by new indications, including first line-non-small cell lung cancer.

In the pipeline, Bristol is making excellent strides. We expect data on immunology drug deucravacitinib (TYK2) outperforming Amgen’s Otezla will help drive peak annual sales over $3 billion. Also, rare disease drug mavacamten should gain approval in early 2022 setting up potential peak annual sales above $2 billion. The recent launches of CAR-T cell therapies Breyanzi (non-Hodgkin’s lymphoma) and Abecma (multiple myeloma) along with Onureg (acute myeloid leukemia) and Zeposia (multiple sclerosis and likely ulcerative colitis) should help Bristol weather approaching Revlimid generics.

Bristol-Myers Squibb - Don’t Miss Out On This

In this market, there are less than 5 companies where I see the investment being so clear in the potential upside.

You should be in Bristol-Myers Squibb if you’re any sort of conservative value, dividend, or income investor wanting your money to grow. If you’re not, I highly recommend that you check the company out and look deeper. If you’re not and don’t intend to buy, I’d love to hear why that is.

For now, this is my first “Very Bullish” rating in a very long time.

BMY is a “BUY.” The upside is potentially massive but even conservatively appealing.

Tarde o temprano se tendran que ver los resultados de la compra de Cellgene, yo espero y cuento que seran positivos

Un nuevo paso adelante, en cancer, para BMY

Entre el ASCO y el ANIS, puede pasar cualquier cosa.

Empresa tranquilita donde las haya, sin sustos, pasito a pasito, para tener de “fondo de armario”

Tenía la esperanza que se acercara aún que sea a los 65$ pero no va a ser hoy el día… Una pena.

Según bajo de 65$ amplíe jajajaja, ya sabéis que tengo 0 paciencia. Como no siguió bajando, pero me es igual, si cae de 62/61 le daré otro tiro.