Clorox anuncia acuerdo para adquirir Nutranext, fabricante productos dietetica, por $700M

De momento no hay subida del dividendo trimestral.

Fíjate que ésta es una clásica en las carteras americanas y a mí nunca me ha llamado la atención…

¡Fantásticas estas clásicas que pasan desapercibidas! Lo mejor es cuando pasan por malas épocas y se acercan al 4% de RPD.

Cuando digo que no llama la atención me refiero que al no ser una empresa que venda nada aquí pues prefiero otras similares que me son más conocidas como CocaCola, Pepsi, Colgate,…

Hay tantas y tampoco se pueden tener todas…

Kellogs está bien pero me gusta más el portafolio de marcas de GIS.

Una gran empresa con muchas marcas que son líderes del mercado.

A mi tampoco teniendo ya unas UNA CL KMB en cartera.

Por eso me gusta a mí. No llama la atención. Vende lejias y jarras depuradoras de agua de grifo y es de las recesion ressistant, es una aristócrata o casi… ¡Y va y aumenta un 10% el dividendo!

Otro aumento más…

“OAKLAND, Calif., May 20, 2019 /PRNewswire/ – The Clorox Company (NYSE: CLX) today announced that its board of directors has declared a 10% increase in the quarterly dividend, from 96 cents to $1.06 per share on the company’s common stock. The dividend is payable Aug. 16, 2019, to stockholders of record as of the close of business on July 31, 2019.”

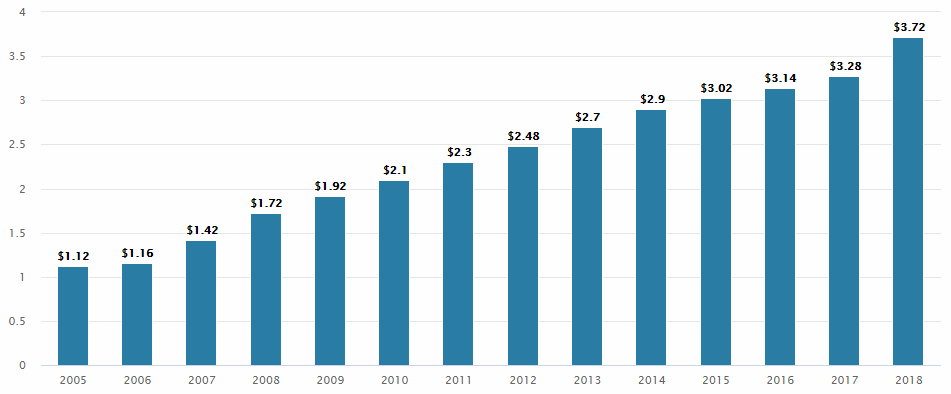

Histórico sin contar este incremento extraído de su web:

Clorox Reports Q4 and Fiscal Year 2019 Results, Provides Fiscal Year 2020 Outlook (01/08/2019)

Fiscal Fourth-Quarter Results

- The company’s fourth-quarter gross margin increased 110 basis points to 45.1% from 44.0% in the year-ago quarter. The increase in gross margin was driven primarily by the benefit of price increases and cost savings, partially offset by higher trade spending as well as higher manufacturing and logistics costs.

- Clorox delivered earnings from continuing operations of $241 million compared to $217 million in the year-ago quarter. This translates to a 13% increase in diluted EPS — to $1.88 from $1.66 in the year-ago quarter. Diluted EPS results reflect a lower effective tax rate, primarily from the benefit of U.S. tax reform, as well as higher gross margin, partially offset by lower sales and increased advertising and sales promotion spending.

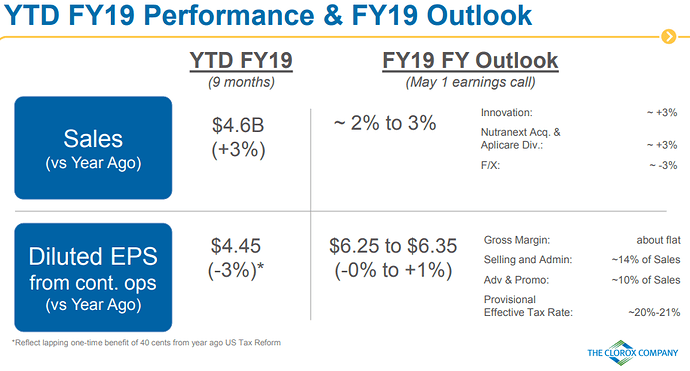

Fiscal Year 2019 Results

- In fiscal year 2019, Clorox delivered sales growth of 1%, reflecting 3 points of net benefit from the Nutranext acquisition and Aplicare divestiture, offset by the negative 3-point impact from unfavorable foreign currency exchange rates. Fiscal-year sales also included the benefit of pricing net of trade spending.

- Fiscal year gross margin increased 20 basis points to 43.9% from 43.7% in the year-ago period. The increase in fiscal year gross margin was driven primarily by the benefits of price increases and cost savings initiatives, partially offset by higher manufacturing and logistics costs as well as unfavorable commodity costs.

- Clorox delivered earnings from continuing operations of $820 million versus $823 million in fiscal year 2018. Fiscal year 2019 diluted EPS was $6.32 versus $6.26 in fiscal year 2018, an increase of 1%. Diluted EPS results reflect a lower effective tax rate, primarily from the benefit of U.S. tax reform, and higher gross margin, partially offset by increased advertising and sales promotion spending.

- Fiscal year 2019 net cash provided by continuing operations was $992 million, compared with $976 million in fiscal year 2018. The increase was driven primarily by year-over-year improvements in working capital and current-year benefits from U.S. tax reform, partially offset by a higher contribution to employee retirement income plans.

Clorox Provides Fiscal Year 2020 Outlook

- Clorox anticipates sales growth ranging from flat to 2%, primarily driven by the continued strong performance of the company’s innovation program, partially offset by about 1 point of negative impact from foreign currency headwinds. First-half sales assumptions are at the low end of the range, with the expectation that first-quarter sales will be down as the company works to restore growth to the Charcoal and Bags and Wraps businesses. The company anticipates second-half sales to be at the higher end of the range, based on the expectation that these two businesses will return to growth in the second half of the fiscal year.

- Gross margin is expected to be about flat to down slightly, reflecting about flat gross margin prior to investments the company is making on two strategic initiatives that are planned to generate long-term value, including the rollout of compaction of Clorox® liquid bleach starting in the back half of the fiscal year.

- Advertising and sales promotion spending is expected to be about 10% of sales.

- Clorox anticipates selling and administrative expenses to be about 14% of sales.

- The company’s effective tax rate is expected to be in the range of 22%-23%.

- Net of all these factors, Clorox anticipates fiscal year 2020 diluted EPS from continuing operations to be in the range of $6.30 to $6.50. Diluted EPS is expected to be more muted in the first half than in the second half as the company works to return to growth in the Charcoal and Bags and Wraps businesses, mirroring fiscal year sales progression.

Clorox Reports Q1 Fiscal Year 2020 Results, Confirms Sales and EPS Outlook (31/10/2019)

Fiscal First-Quarter Results

- 4% sales decrease (2% organic sales decrease1)

- $1.59 diluted EPS (2% decrease)

- The company’s first-quarter gross margin increased by 60 basis points to 44% from 43.4% in the year-ago quarter.

- First-quarter net cash provided by operations was $271 million, compared to $259 million in the year-ago quarter.

Clorox Confirms Fiscal Year 2020 Sales and EPS Outlook

- Low single-digit decrease to 1% increase in sales (1% to 3% organic sales growth)

- $6.05 to $6.25 diluted EPS range (4% to 1% decrease)

- Gross margin is still expected to be down slightly.

- Clorox continues to anticipate fiscal year 2020 diluted EPS to be in the range of $6.05 to $6.25.

Q2 Fiscal Year 2020 Results, Updates Fiscal Year Outlook (04/02/2020)

- 2% sales decrease (at organic sales)

- $1.46 diluted EPS (4% increase)

Fiscal Year 2020 Outlook Update

- Low single-digit decrease to 1% increase in sales (at to 2% organic sales growth)

- $6.10-$6.25 diluted EPS range (3% to 1% decrease versus year-ago)

https://theconservativeincomeinvestor.com/clorox-stock-will-underperform-the-market/

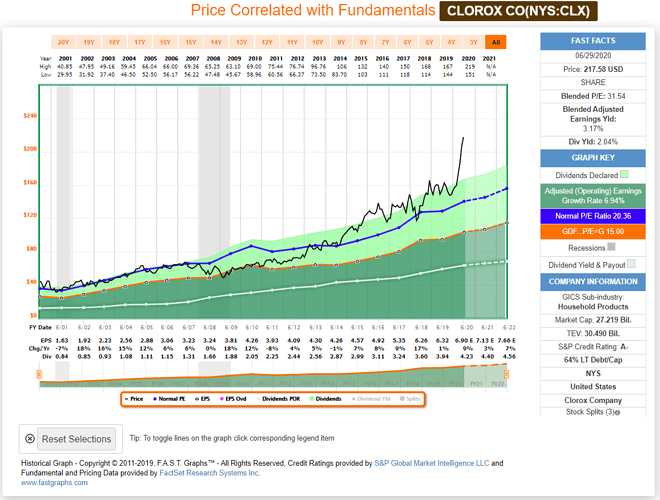

In today’s age, there are certain businesses like Campbell Soup and Clorox that are not super-compounders in terms of earnings growth anymore. Yes, they are “safe stocks” in the sense that you won’t lose 80% over ten years with them, but the growth is going to be slow in the middle single-digit rate. If you pay fair value, you won’t get market-beating returns. The only time to add them is if something happens that brings the valuation down to below 14x earnings or so.

With Clorox right now, investors are buying at an all-time high in terms of valuation this generation. All-time high valuations and middling long-term growth is not a winning formula. When you see a customer buy the Clorox off the shelves right now, it is not going to translate into market-beating wealth a decade from now.

Esta la vendió Terry Smith en Abril ¿no?

Si, solo la tuvo 4 meses en cartera

Yo queria saber si alguien sabe porque la cotizacion de CLX esta tan baja ahora mismo?Estuve viendo en la pagina nueva de la empresa pero no decian nada al respecto,incluso buscando noticias relacionadas con una posible cancelacion de dividendos , no e encontrado nada , por ello mi incredulidad del precio actual de esta empresa.

Tampoco es que esté especialmente barata, lo que pasa es que viene de muy arriba. Aún así, ya empieza a cotizar a unos múltiplos más razonables, yo acabo de abrir posición hace unos días