Desconozco esa duda que planteas. No obstante repasando el hilo entero en el momento de la fusión se hablaba de subida de dividendos a finales de 2019, luego a finales de 2020 y ahora vamos ya por el 2022. Como dices igual hay exceso de prudencia, no me parece mal. Además ya que llevamos esperando dos años me gustaría que antes de subir el dividendo hicieran unas recompras de acciones.

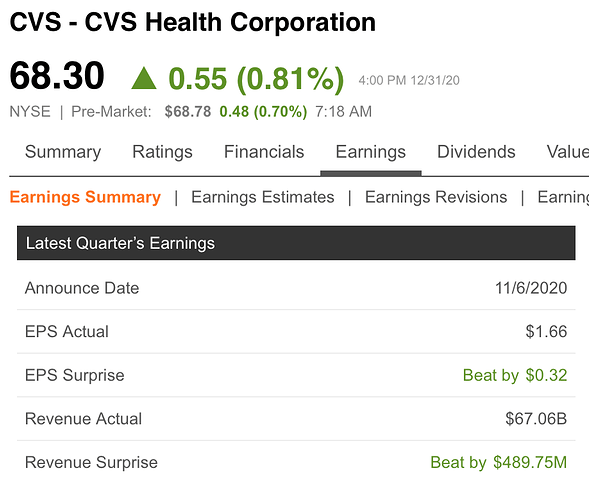

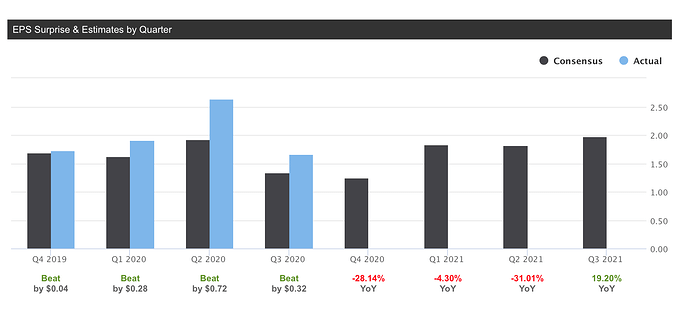

yo estoy mirando para cargar CVS y creo que va a dar oportunidades…

WBA también va para abajo en el pre market, -10%

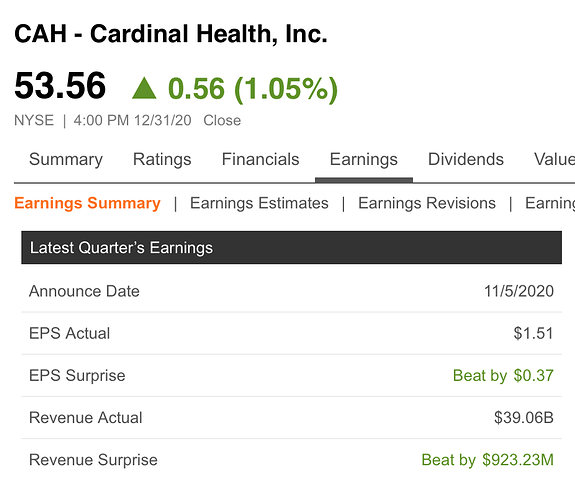

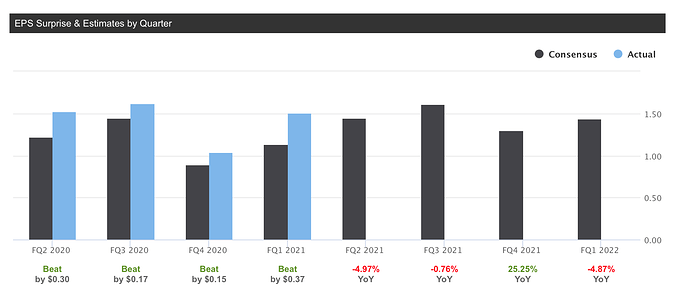

cardinal health no se mueve, no le afecta a él también?

Me temo que si se va a poner interesante …veremos a que precios cae…y ampliaremos por supuesto.

We are keeping our fair value estimate for CVS Health intact after Amazon revealed its long-awaited fully integrated pharmacy-services offering on its flagship website. While this service may add some competition for CVS, especially for its retail stores, we had already built in some long-term pressure on CVS’ business after Amazon’s purchase of PillPack in 2018. So Amazon’s announcement does not materially change our view of CVS or its narrow moat rating. Also, the diversity of CVS’ operations, including roughly 60% of profits from medical insurance and pharmacy benefits management, should provide some shelter from Amazon’s new online pharmacy business.

Overall, we think Amazon’s new service could put pressure on CVS, primarily in its retail store operations, and provide another hurdle to CVS reaching its goal of double-digit earnings growth by 2022. However, we would remind investors that there will still be a need for physical stores for acute prescription fulfillment and to accommodate patients with chronic needs. Also, CVS’ HealthHub strategy could bolster foot traffic at retail stores as a potentially more convenient option than booking an appointment with a primary care physician. Also, we see many ways to boost EPS growth from current lackluster levels at CVS, including synergies between the legacy operations (particularly the PBM) and the recently acquired medical insurance operations, lower interest expenses as the firm actively deleverages, and the reimplementation of share repurchases once the firm meets its leverage goal next year. Also, in early November, CVS announced a CEO transition, and we suspect this may add urgency to accelerate EPS growth at CVS once the new team takes control in 2021.

CVS’ profit growth remains weak compared with its managed-care peers, which has constrained shares. In our opinion, CVS shares remain undervalued at 9 times 2020 expected earnings and a dividend yield over 3%.

No sé, no sé…Demasiados argumentos

https://seekingalpha.com/news/3648191-cvs-health-is-among-value-stocks-deserving-fresh-look-barron-s

- Topping the healthcare sector in the list is CVS Health (NYSE:CVS, currently involved in the U.S. COVID-19 immunization efforts in long-term care facilities.

- Projecting that the CVS will play a central role in the U.S. vaccine rollout in 2021, Boyar says the company, with more than 9,900 retail locations, and ~1,100 medical clinics, is well-positioned to attract new patients into the network, expanding the database of customer information.

la aseguradora AETNA “empuja” a sus clientes a que vayan a farmacias CVS quitando de su lista a la cadena Walgreens

https://abc7chicago.com/aetna-insurance-walgreens-cvs-health-care/9311222/

Hay que recordar que Aetna fue comprada por Cvs. Que menos que darle preferencia a Cvs frente a Wba, dentro de la legalidad

Cada vez que baja de 60$, varios inversores que escriben y sigo en S.A., amplían posiciones.

La duda es, cuándo despertará la acción. Los resultados son realmente buenos en cada cuatrimestre, pero mucha presión hacia abajo y AMZN entrando en sector distribución de fármacos.

Algo similar pasa con CAH.

Ambas empresas llevan 2-3 años en modo “hibernación”.

Quizás ahora espabile, está cerca de romper los máximos anuales. Realmente es la empresa individual (sin BRK o ETFs) de mi cartera en la que más tranquilo me encuentro tanto por sector, perspectivas y valoración.

Eso sí, la espera para la subida del dividendo se está haciendo demasiado larga. Si siguen 2-3 trimestres en la misma línea y anuncian a finales de año subida del dividendo, veo a CVS en máximos históricos.

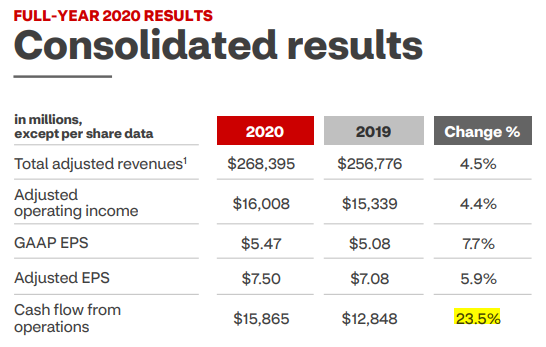

Presenta resultados del 2020:

https://investors.cvshealth.com/files/doc_financials/2020/q4/Q4-2020-Earnings-Release.pdf

https://investors.cvshealth.com/files/doc_financials/2020/q4/Q4-2020-Earnings-Presentation.pdf

El covid les ha ayudado en sus cuentas:

COVID-19 contributed 22 – 27 cents to FY 2020 GAAP and Adjusted EPS

Me parece brutal el dato de la caja generada:

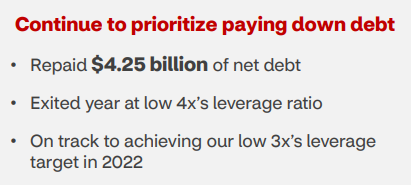

Eso sí, se está haciendo larga la espera a las subidas del dividendo:

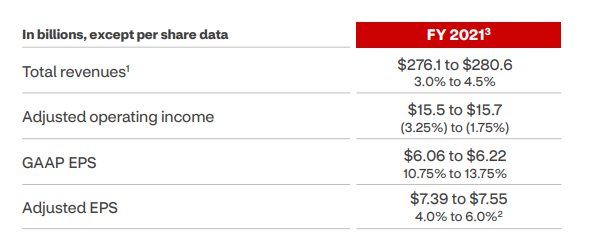

Y para 2021 esperan:

Con estos números creo que se podría justificar una cotización de $100.

Gracias por el resumen.

Gracias @juanjoo por la información.

Es uno de los valores que llevo en cartera y estoy muy contento, la pena no haber entrado cuando su cotización estaba más baja pero aún así creo que tiene bastante recorrido por delante.

CVS Guides Cautiously for 2021 After Strong 2020; Shares Undervalued

Narrow-moat CVS Health turned in fourth-quarter and 2020 results that beat our expectations, especially on the cash flow front, but its outlook for 2021 appears cautious. After incorporating the cash flow outperformance in 2020 into our model, we are keeping our fair value estimate at $92 per share after mildly trimming our 2021 estimates. The shares remain undervalued, in our opinion, and the market may continue to discount them until CVS materially accelerates its earnings growth on a sustainable basis.

For the quarter and full year, CVS beat our expectations substantially. In the quarter, CVS revenue reached $69.6 billion (4% growth), above FactSet consensus of $68.8 billion, and adjusted EPS hit $1.30, above consensus of $1.23. CVS also turned in much higher cash flows than previously anticipated, with 2020 operating cash flow of $15.9 billion, well above its most recently raised guidance of $12.75 billion-$13.25 billion.

With this outperformance in the fourth quarter, we were surprised that management’s guidance for 2021 was so cautious. In 2021, the company expects $7.39-$7.55 of adjusted EPS (4%-6% above its 2020 baseline of $7.10, which management continues to view as its jumping-off point after adjusting for COVID-19-related benefits and a recent divestiture), or slightly below our previous estimate of $7.58. Its operating cash flow range of $12.0 billion-$12.5 billion was also slightly below our previous expectation of $12.6 billion for 2021. Overall, management expects the ongoing pandemic to have a neutral effect on the company in 2021 with benefits in the retail/long-term care segment offset by challenges in the health insurance operations related primarily to higher than previously expected Medicare-related payments, which most other insurers have highlighted as a headwind for 2021. Positively, management also said its long-term goal of returning to low-double-digit adjusted EPS growth by 2022 remains the company’s target.

https://investors.cvshealth.com/files/doc_financials/2021/q1/Q1-2021-Earnings-Presentation.pdf

Presenta resultados. Muy en línea con los últimos. Siguen repagando deuda, el payout ronda el 25%, y esperan cumplir el objetivo de bajada de deuda en 2022. Se está haciendo algo larga la espera de subidas de dividendo.

Al mercado parece que le gustan y ponen la cotización en los 80$, que no se superan con cierta holgura en los últimos 5 años.

Exacto, yo la llevo desde finales de 2016 y parece que es ahora cuando empieza a digerirse la adquisición que hizo.

Esperemos que la paciencia dé sus frutos, y lleguen esos ansiados incrementos de dividendo