A mí en Self Bank me marca 156 acciones a 17,86 libras.

Spinoff

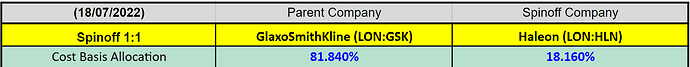

195 GSK (2800,20 GBP) se convierten en 195 GSK (2291,68 GBP) + 195 HLN (508,52 GBP)

Reverse Stock Split

156 GSK (2291,68 GBP)

¿Te coincide el cálculo con la conversión que te hizo el bróker?

Nunca he sido accionista de GSK. Sorry

No tenía ni idea de esto. Me acabo de enterar.

GlaxoSmithKline has renamed its company to simply GSK. The pharma giant announced the decision to change its name to GSK in an April 27 earnings release, but officially made the change May 16, 2022. The company said the name change will soon be reflected in the London Stock Exchange and the New York Stock Exchange.

Vaya vaya ![]()

![]()

![]()

Earlier today (Tuesday), it was reported that Haleon, the consumer health business spun of from GSK, is evaluating potential deals, including potentially combining with Sanofi’s $30B consumer-health business.

Besides tomorrow’s quarterly results, GSK will also also be keenly waiting for FDA’s decision on daprodustat, a drug for anemia caused by chronic kidney disease, which is also expected on Wednesday.

Alguien tiene controlada la nueva GSK. Hoy ha presentado resultados:

Parece estar a Per menor de 10 y con visos de crecer cerca del 10% los EPS en el 2023.

Tiene pinta de venirse para arriba

Mi dardo a las farmacéuticas en mi ya exigua cartera ha ido para GSK. Me gusta mucho más desde que se quitó el Consumer Health (HLN) y tiene buenas perspectivas en lo suyo (Oncología, Respiratorio, Vacunas, etc.)

Y ya más secundario… no tenía retención en origen para dividendos y eso también pesó a la hora de elegir.

Acabo de entrar. Me gusta que por ahora está “limpia” de spinoffs, que no tiene retención en origen y que paga en meses que quería reforzar.

Parece que las perspectivas a medio plazo son buenas, a ver cómo evoluciona.

Tiene una buena cartera en investigacion con inyectables

(M*)

GSK reported fourth-quarter results and provided 2023 guidance that ran slightly above our expectations, but we don’t expect any major changes to our GSK fair value estimate based on the update. We continue to view the stock as undervalued, with the market likely overly concerned about Zantac litigation and not appreciating GSK’s steady growth outlook, which also supports its wide moat.

In the quarter, sales grew operationally 9% (excluding Covid product sales), a trend that should continue for several years with limited near-term patent losses and several growing products. HIV drugs grew 21%, buoyed by long-acting and prevention treatments (Cabenuva and Apretude) along with Dovato (potentially offering fewer side effects). This segment looks well positioned for growth through 2027, when patents begin to expire on older HIV drugs Tivicay and Triumeq. Also adding to growth, shingles vaccine Shingrix, respiratory treatment Trelegy, and several specialty drugs posted strong gains, setting up broad growth that should continue over the next four years.

While longer-term patent losses start to emerge in 2027, GSK is making solid pipeline progress. GSK’s RSV vaccine has reported leading efficacy and will likely be one of the first RSV vaccines to market. Also, despite a mixed advisory vote for kidney disease drug daprodustat, we believe the drug still holds potential in the dialysis setting. We expect approvals for these products in the first half of 2023 with peak sales potential above $1 billion annually for each.

On the Zantac litigation front, recent rulings and a large amount of clinical data reinforce our view that the lawsuits will be settled for under $1 billion (much less than the initial market capitalization loss of over $30 billion). The favorable December court ruling combined with 13 epidemiologic studies showing no Zantac cancer causation likely reduces litigation concerns. We expect several more court rulings, with the next major case to start in February.

Hola!

GSK cotiza en algún otro mercado que no sea en libras tipo Unilever?

Gracias ![]()

Tienes el ADR en la bolsa americana

Era por si con suerte cotizaba en euros jeje ![]() No me da la vida, si el capital por supuesto, para tener otra divisa mas en IB

No me da la vida, si el capital por supuesto, para tener otra divisa mas en IB

Cuál es la diferencia de comprarla aquí o en libras?

Mi broker es ING, por si lo decís por eso.