Intel’s Turnaround Plan Carries Risk But Dividend Continues to Look Sustainable

3.12%

96 Very Safe → 80 Safe

Downgraded Feb 23, 2022

Intel on February 17 hosted an analyst day to provide more details on its turnaround strategy, which seeks to restore the chip maker’s technological leadership position while also building a foundry business to manufacture semiconductors for others.

Expanding existing production and constructing new fabs, or chip factories, will require substantial capital investment. For example, Intel expects to spend $40 billion to build four fabs in Arizona and Ohio. Billions more will be spent on equipping current sites with advanced manufacturing technologies.

In total, Intel’s capital expenditures over the next few years are projected to average around $27 billion annually, or nearly double the firm’s historical norm. R&D spending will jump, too.

During this period of heavy investment, free cash flow will evaporate. Management expects negative free cash flow of $1 billion to $2 billion in 2022, down from an average of $15 billion in recent years and well short of Intel’s $6 billion annual dividend.

Despite facing a cash flow deficit, Intel stated it remains “committed to a healthy and growing dividend,” which has been paid without interruption since 1992 and was raised 5% last month.

Management’s commitment to the payout is backed by Intel’s low leverage, A+ credit rating, and nearly $30 billion of cash and investments on the balance sheet, providing ample liquidity.

We expect Intel’s dividend to remain secure, but in recognition of the turnaround plan’s steep costs and weak dividend coverage expected over the medium term, we are downgrading the company’s Dividend Safety Score from Very Safe to Safe.

While the dividend should keep rolling in, investors must wait several years to see if Intel’s capital splurge pays off. If all goes well, the company anticipates revenue growth increasing from a low single-digit pace this year to 10% to 12% by 2026.

Growth is expected to be fueled by emerging opportunities outside of Intel’s legacy focus on PCs and data centers, including automotive, graphics cards, networking, the Internet of Things, and a ramping foundry business.

By 2026, Intel expects its capital intensity to moderate and margins to rise, returning the company to its cash cow status with a well-covered dividend and stronger underlying growth.

Intel’s plan has been met with skepticism following the firm’s numerous missteps over the past decade, which include missing out on the smartphone wave and losing its lead in process technology to foundry rival TSMC for the first time in the company’s history.

Intel’s manufacturing delays in recent years have caused its processors to fall a step behind those designed by rivals such as AMD and Nvidia, which outsource their manufacturing to TSMC’s leading-edge fabs in order to make smaller but more efficient chips.

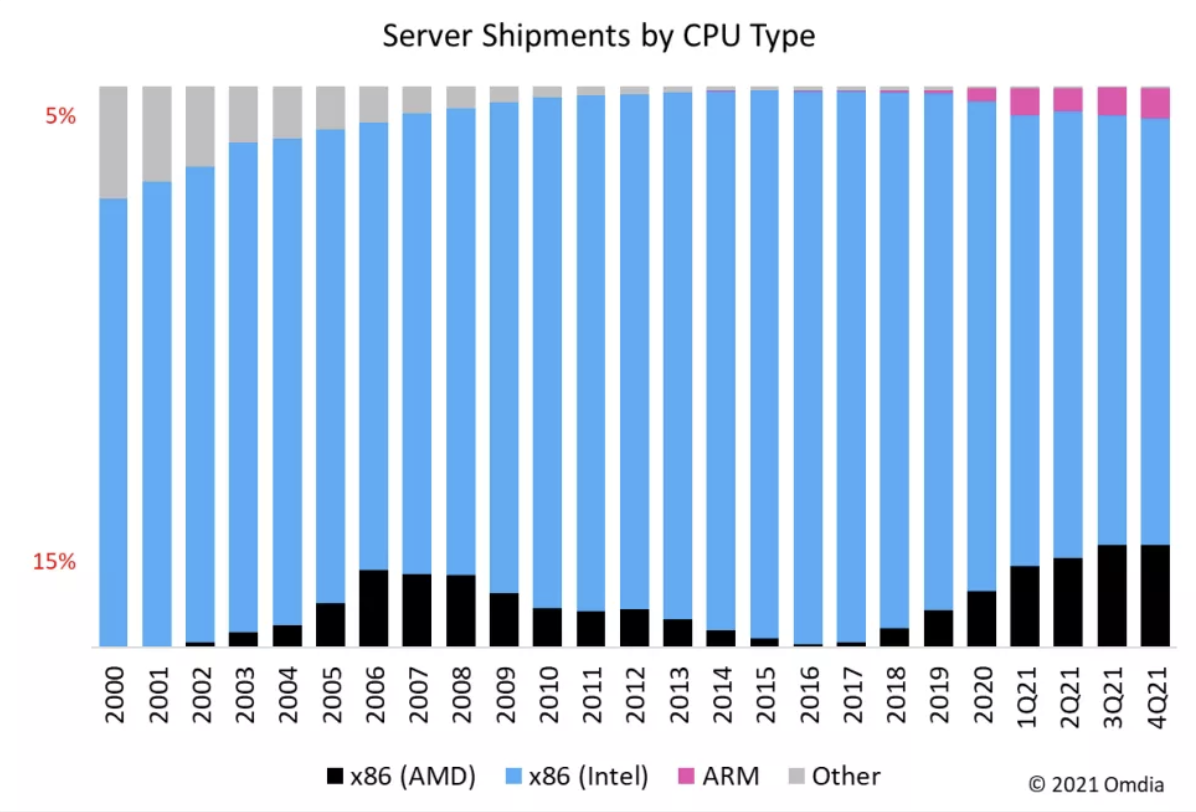

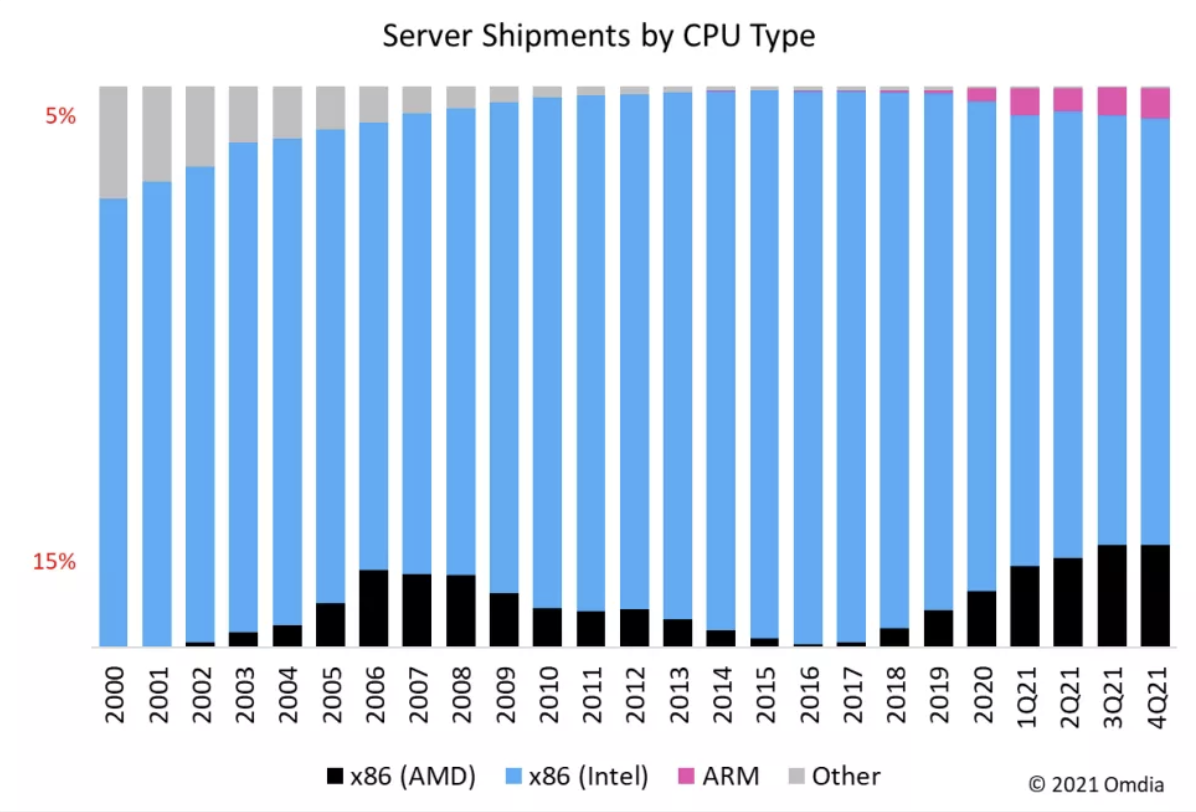

As a result, Intel’s dominant grip on processors and chipsets used in PCs and servers has begun to loosen. Intel still enjoys a strong position, as seen in the server shipments market share chart below, but the firm must catch up with TSMC’s process improvements in the years ahead to protect both its market share and premium margins.

Source: TomsHardware.com

Intel’s efforts to jump back to the leading edge and build a foundry business come at a significant cost, and there are never any guarantees that technology advancements will play out as management expects.

As we discussed in our October 2020 note, we generally prefer to own businesses with more stable competitive advantages and clearer paths to long-term growth.

That said, income investors can take comfort in knowing that Intel has the financial resources to support its dividend while embarking on its turnaround. And with the stock trading at around 8x last year’s earnings, expectations appear low. CEO Pat Gelsinger’s goal to double Intel’s multiple may not be all that crazy:

“I want to double the earnings of this company and double the multiple of this company as you build confidence in what we’re doing, a 4x increase in total shareholder value. The Intel turnaround train is leaving the station, and I hope you all get on board.”

However, anyone considering owning the stock should understand this will be a multiyear process with no quick fixes or guarantees of success as Intel battles from an unfamiliar position of runner-up in semiconductor manufacturing processes.

We will continue monitoring Intel’s turnaround and provide updates as needed.