Todo eso de que Intel es muy grande y va a destruir a AMD es muy bonito hasta que le supera en CPUs market share desktop…

Hace ya algún tiempo que el tema del tamaño que dicen alcanzar las foundries se ha convertido en puro marketing. Adjunto una página con unas capturas interesantes y una conclusión final interesante :"Another metric, probably worth closer consideration is transistor density, as revealed by the chip fabricators. Intel 10 nm and TSMC 7nm processes both produce dies with approx 90 million transistors per sq millimetre. Moving forward both Intel and TSMC are targeting approx 150MT/mm² for their upcoming 7nm and 5nm processes, respectively. Again though, other factors make differences, like transistor type and chip architecture, that make direct comparisons difficult. "

Intel’s Q1 Bolstered by Strong PC Demand; Server Sales Weighed Down by Pricing Pressure From AMD

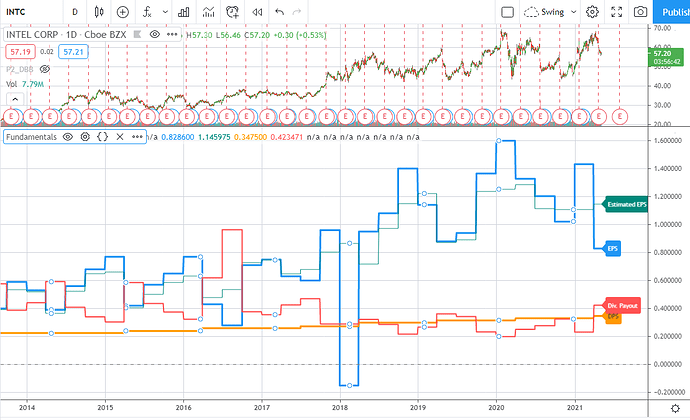

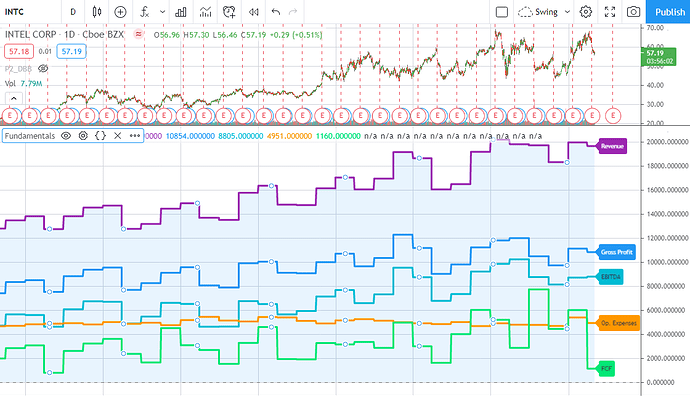

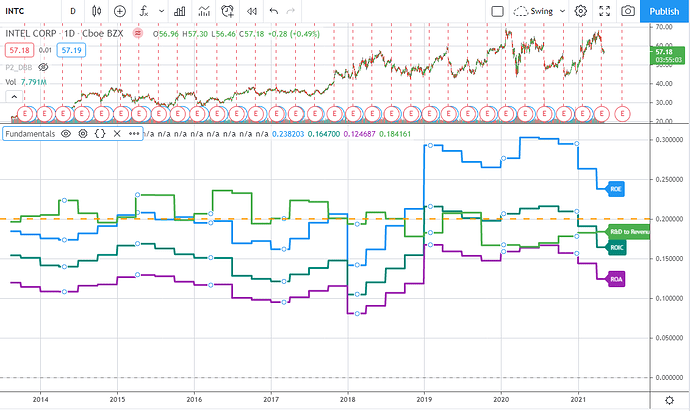

Intel reported first quarter results that exceeded its guidance, primarily due to stronger-than-expected laptop demand related to the ongoing work- and learning-from-home trends stemming from COVID-19. In contrast, data center group, or DCG, revenue and operating margins fell sharply. While management was adamant the lower DCG operating income was driven by lower sales, 10-nanometer ramp, and increased R&D investment, we think the biggest driver was renewed competition from AMD. We remain optimistic on Intel’s IDM 2.0 strategy to get its manufacturing back on track and develop a more meaningful foundry strategy. Nonetheless, we expect the next few quarters to be challenging, with 2021 sales flat year over year and gross margins down at least 150 basis points. We are maintaining our $65 fair value estimate for wide-moat Intel and see shares as fairly valued.

First quarter revenue was down 1% year over year to $19.7 billion, though it was about $1.1 billion above guidance. The client computing group, or CCG, was the main area of outperformance as notebook volume grew 54% year over year. We expect PC sales to remain above seasonal levels for the next few quarters. DCG sales fell 20% year over year due to a combination of weaker enterprise and government spending, cloud digestion, and competition from AMD. For the quarter, DCG platform ASPs were down 14% year over year. While we expect AMD to continue to gain market share, Intel’s newly launched 10-nm Ice Lake server CPU family and 2022 Sapphire Rapids product line should help Intel limit material share loss in server CPUs.

Management expects second quarter sales to be $18.9 billion, which would be down 4%. When factoring in lower modem and PC CPU sales to Apple, we think this is a reasonable outlook. Specifically, we think continued PC strength is being offset by weaker DCG sales, though we think the DCG revenue trajectory will improve over the course of 2021.

Supongo que el “tortazo” de hoy se corresponde con

“los ingresos y los márgenes operativos del grupo de centros de datos, o DCG, cayeron drásticamente”.

Durante los últimos 2 años cada vez que presenta resultados se come unas caídas de la leche…

Ah, si? No lo sabía y compré unas poquillas. A ver cómo resulta.

Genial para compras periodicas

A alguien más le ha llegado este correo ? Uso ING por cierto

INTEL CORP (US4581401001)

Hola, :

Te informamos que TUTANOTA, una compañía de responsabilidad limitada registrada en Delaware ha lanzado una oferta de adquisición de acciones de INTEL CORP (US4581401001, mercado NASDAQ).

Esta es una oferta no registrada ante la SEC, en la que la fecha de pago es a libre disposición del comprador, así como la aceptación de la oferta y las reglas del prorrateo. Por favor evalúa bien las condiciones de la oferta antes de tomar una decisión. Las opciones que tienes son las siguientes:

· Opción 1: Canjear cada acción por 63 USD por acción.

· Opción 2: No tomar acción ninguna (opción por defecto).

En caso de no recibir contestación antes de las 10:00 horas del próximo 30/06/2021, se seleccionará la opción por defecto (No acudir).

Yo lo acabo de mirar y a mi no me ha llegado nada.

No conviene hacer caso. Son empresas con poco capital que pretenden hacerse con mayor participación en grandes empresas a base de comprar a numerosos particulares pequeños paquetes. Nunca compran una participación importante.

Lo mismo ocurrió hace un par de años con AT&T y otras.

Hola

Como te dice el compañero, ni caso

Esto son “OPAs” por una pequeña parte de una empresa, que hacen empresas chungas, (me viene a la cabeza Ponos), que intentan comprar duros a 4 pesetas

Creo que ya se comentó alguna vez que es un tongo, Si suben de precio, te las compran por debajo y si no suben, no aceptan la compra … ¿era algo así, no?

Bastantes comentarios negativos en S.A. acerca de la compra de GlobalFoundries (GF) y el futuro de Intel.

Al parecer el más beneficiado de todos será Mubadala.

Pego este comentario de All Day Investor (DGR Chit-Chat Redux, 15 julio).

"As someone who has followed and admired Intel since I was a 13 year old kid, and then went on to work for the company for nearly two decades (some of which under Andy Grove’s leadership) as an engineer, engineering manager, and a senior computer architect, I can tell you Intel is in deep trouble. It brings nothing but pain to me to think that the company I spent much of my working life may become irrelevant or worst not exist. So I can’t help but think that Intel will be okay. However, as an investor, would I be okay with a leading technology focused company that is just doing okay? That’s the question one needs to ask if they are invested in a company like Intel.

As for the new leadership, Pat may be the right choice for the ceo now, but imo it’s a bit too late as the ship has taken a lot of water. He may or may not be able to bring Intel back to the old glory days. He may keep the ship floating or moving slowly for a long time or diversify into other areas (maybe what he is trying to do with the potential GF acquisition move).

Intel’s problems did not start when Bob Swan (who you mentioned as a bean counter) took over as a ceo. Intel’s problems started after Andy Grove left the company. It’s been a long-term decline since then with each new ceo being worst than the previous. Bob Swan was just the temporary choice when nobody wanted the job (not even Pat G wanted to come back to Intel). So why did Pat changed his mind? Who knows. Maybe he felt he had to safe his own legacy by doing whatever he could to safe the company where he started his own career.

As for Intel making ton of money, it has been able to make ton of money for decades because of its Wintel duoploy. They didn’t have much competition at the time. That duoploy has been having structural issues for several years and is unsustainable under the current competing architecuture environment and industry move to custom designs. The problem has become more severe for Intel with its loss of leadership advantage on the manufacturing side. They are not going to get that back with GF acquisition.

Sorry about the long comment, but at times I feel I’ve so much to say about Intel and whenever I see a comment from someone talking about how much money intel makes or reference to the “bean counter” ceo, I can’t help but share my thoughts. Though I’ll be excusing myself from future Intel discussions here.

Potential Intel and GlobalFoundries Combination Would Validate Intel Foundry Services Strategy

On July 15, the WSJ reported Intel is exploring a deal to acquire GlobalFoundries for about $30 billion. Ironically, GlobalFoundries was created by the divestiture of AMD’s manufacturing arm in 2009. As part of Intel’s IDM 2.0 strategy announced in March, the chipmaker intends to more meaningfully offer foundry services to fabless chip designers to take advantage of burgeoning demand in AI, automotive, 5G, and other promising end markets. We think a potential deal for GlobalFoundries would kickstart Intel Foundry Services, or IFS, as Intel would gain a captive fabless customer base, productive global fab capacity, and IP libraries and customer support capabilities. While TSMC dominates the foundry landscape with about 59% revenue share in 2020, GlobalFoundries is part of the second tier of foundries including UMC and Samsung, that had about 7% to 8% foundry share, each, in 2020, according to Gartner.

We think this deal would face some regulatory risk, though customers and governments alike would probably appreciate an additional foundry titan as the semiconductor industry grapples with the ongoing chip shortage. We believe the U.S. government would bless this deal that would create a more viable challenger to TSMC. As we contemplate a potential tie-up, we are maintaining our $65 fair value estimate for wide-moat Intel. Shares look modesty undervalued at current levels, though we note Intel faces near-term headwinds from pricing pressure and likely share loss to AMD.

GlobalFoundries is based in the U.S. but owned by Mubadala Investment Co., which is an investment arm of the Abu Dhabi government. Earlier this year, GlobalFoundries CEO Tom Caulfield noted the firm is contemplating an IPO in 2022, which we still view as a possibility if Intel is unable to reach an agreement. GlobalFoundries boasts fabs in the U.S. (New York), Germany (Dresden), and Singapore and generated $5.7 billion in revenue in 2020. Caufield expects revenue growth of at least 9% to 10% in 2021.

Veremos lo que pasa a medio plazo. Si es dificil acertar con el precio y la evolucion de una accion, cuanto mas dificil es acertar con el tema de fusiones y la “digestion” de las compradas con las compradoras.

Ejemplos relativamente recientes, de hace 1 año y pico o dos años. La compra de Celgene por BMY, y la compra de Allergan por ABBV.

En ambas todavia estan en fase de digestion y no hemos visto el resultado, aunque parece que el mercado se ha tomado mejor la compra de ABBV que la de BMY.

Veremos, hay mucho partido todavia

Yo confio en las 3

10 cuatrimestres batiendo estimaciones. Por supuesto cae un 2% en el after.