ING Ha pagado hoy el dividendo de Lockheed Martin. 6’70 € brutos/acción. Me gusta mucho este valor, pero la doble retención es terrible…

Hola, pedren,

¿Por qué lo dices? ¿No te retienen el 15%?

Hola CZD, según pantallazo de ING (datos por acción):

Precio: 1,675 $

Retención en destino: 0.2525 $

Retención en origen: 0.27 $ (yo creo que esto esta al reves)

Si lo estoy calculando bien, en destino: 0.2525/1.675 = 15 % (bien)

En origen: 1.675-0.2525 = 1.4225; 0.27/1.4225 = 19 % (bien para los primeros 6.000 €).

Dividendo neto: 1.675-0.2525-0.27 = 1.1525 ($/accion)

Como son 4 liquidaciones al año = 1.1525 * 4 = 4.61 ($/accion)

Cotizando alrededor de los 267 $/accion.

La rentabilidad neta por dividendo queda 4.61/267 = 1.73 % (aprox.), frente a la bruta 6,7/267 = 2.5 %

Si parece que esta bien, pero como se resiente la RPD…

Que raro, no puedo comprar LMT en Degiro. Alguna experiencia ¿?

Gracias

Por fin he podido hacer la consulta con Degiro. LMT Contraviene el convenio internacional de bombas de racimo, asi que, por normativa holandesa no pueden ofrecer la compra de esta acción (en serio). Curioso porque en ING sí se puede comprar (tambien es holandesa). Legal y moralmente muy correcto. Pero para mi ha sido una faena…

Lockheed Martin Reports Second Quarter 2019 Results (23/07/2019)

- Net sales of $14.4 billion

- Net earnings of $1.4 billion, or $5.00 per share

- Generated cash from operations of $1.7 billion

- Achieved record backlog of $137 billion

- Increases 2019 outlook for all financial metrics

Lockheed Martin Corporation (NYSE: LMT) today reported second quarter 2019 net sales of $14.4 billion, compared to $13.4 billion in the second quarter of 2018. Net earnings in the second quarter of 2019 were $1.4 billion, or $5.00 per share, compared to $1.2 billion, or $4.05 per share, after severance charges of $96 million, in the second quarter of 2018. Cash from operations in the second quarter of 2019 was $1.7 billion, compared to cash used for operations of $(72) million after pension contributions of $2.0 billion in the second quarter of 2018.

“The corporation achieved another quarter of strong operational and financial results across all four of our businesses, which allowed us to grow our backlog to a new record level and to increase our financial outlook for 2019,” said Lockheed Martin Chairman, President and CEO Marillyn Hewson. “Our team remains focused on driving growth, investing in innovative solutions, and creating long-term value for shareholders.”

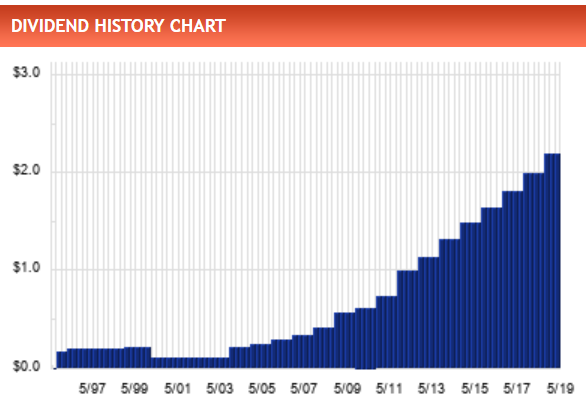

Hoy le he estado echando un vistazo a esta empresa

16 años incrementando dividendos por encima del 10%.

DGR1=9,90%, DGR3=10,10%, DGR5=11,40% y DGR10=16,20%

RPD a cotización actual 2,29%.

En máximos, pero ha dado oportunidades de entrar con RPDs alrededor del 3.5% no hace demasiado…

Me parece una empresa interesante, pero ha pegado un subidón importante en los últimos meses. La seguiremos de cerca

El incremento del dividendo en la web de la empresa:

https://news.lockheedmartin.com/2019-09-26-Lockheed-Martin-Declares-Fourth-Quarter-2019-Dividend

BETHESDA, Md., Sept. 26, 2019 /PRNewswire/ – The Lockheed Martin Corporation (NYSE: LMT) board of directors has authorized a fourth quarter 2019 dividend of $2.40 per share, representing an increase of $0.20 per share over last quarter. The dividend is payable on December 27, 2019, to holders of record as of the close of business on December 2, 2019.

Nota sobre la recompra de acciones. Pedazo de empresa…

BETHESDA, Md., Sept. 26, 2019 /PRNewswire/ – The Lockheed Martin Corporation [NYSE: LMT] board of directors has authorized the purchase of up to an additional $1.0 billion of Lockheed Martin common stock under its share repurchase program. With this increase, the total remaining authorization for future repurchases under the share repurchase program is approximately $3.3 billion. The number of shares purchased and the timing of purchases are at the discretion of management and subject to compliance with applicable law and regulation.

Lockheed Martin Reports Third Quarter 2019 Results (22/10/2019)

- Third quarter 2019 net sales of $15.2 billion, compared to $14.3 billion in the third quarter of 2018.

- Net earnings in the third quarter of 2019 were $1.6 billion, or $5.66 per share, compared to $1.5 billion, or $5.14 per share, in the third quarter of 2018.

- Cash from operations in the third quarter of 2019 was $2.5 billion, compared to cash from operations of $361 million after pension contributions of $1.5 billion in the third quarter of 2018.

Fourth Quarter And Full Year 2019 Results

- Fourth quarter 2019 net sales of $15.9 billion, compared to $14.4 billion in the fourth quarter of 2018.

- Net earnings in the fourth quarter of 2019 was $1.5 billion, or $5.29 per share, compared to $1.3 billion, or $4.39 per share, in the fourth quarter of 2018.

- Cash from operations in the fourth quarter of 2019 was $1.5 billion, after discretionary pension contributions of $1.0 billion, compared to cash from operations of $2.2 billion in the fourth quarter of 2018.

- Net sales in 2019 was $59.8 billion, compared to $53.8 billion in 2018.

- Net earnings in 2019 was $6.2 billion, or $21.95 per share, compared to $5.0 billion, or $17.59 per share, in 2018.

- Cash from operations in 2019 was $7.3 billion, after discretionary pension contributions of $1.0 billion, compared to cash from operations of $3.1 billion in 2018, after annual pension contributions of $5.0 billion.

Poco se habla de esta empresa. Merece una actualización:

A ver alguien que la siga y nos dice algo, yo ya estoy en el sector con GD.

Ya me ha hecho varias veces declarar el dividendo justo un día antes del día de pago del anterior. Qué maravilla

Yo la llevo en cartera, la considero la mejor empresa en el sector defensa, con el mejor ROE de todas ellas, siempre bate las expectativas de las ganancias, consigue grandes contratos por sus F35, incrementos de dividendos de casi dos dígitos en la última decada, ahora parece estar un poco por debajo de su PO.

Lástima que se escapara cuando tocó los 300$

A mi se me escapo cuando estaba a 90$ en 2012

Otro de mis grandes exitos

Nunca es tarde para entrar y el precio actual, pese a no ser una ganga, parece razonable.

Está noticia me ha parecido interesante y muestra la fortaleza y la previsible estabilidad de la empresa en cuanto a futuros ingresos se refiere: