El tema de los fondos es complicado

¿Es Terry Smith un buen gestor? El consenso dice que si

¿Lo ha hecho bien su fondo Fundsmith? Mejor que bien

¿Lo ha hecho bien su fondo Fundsmith Emerging Equities que sigue la misma filosofia pero en mercados emergentes? No

¿Y que decia Terry Smith sobre ello hace varios años? Basicamente las mismas excusas que dicen los gestores Value. Que si los fondos indices, que si la gente no invierte en su universo de empresas, que si … y que no pasaba nada que todo iria bien

Where next for emerging markets?

What then, I ask, is the outlook for emerging markets? Fundsmith’s emerging markets investment trust, known as FEET for short, was launched in 2014 with a mandate to buy similar kinds of stocks to those in the main global equity fund – with a high return on capital, powerful brand names or similar competitive advantages. Quite a few are locally-listed subsidiaries of the big consumer brand companies, such as Unilever and Nestle.

The trust, though, unlike its open-ended equivalent, has been a relatively slow performer to date. The shares, which typically trade at a small premium to net asset value, are up around 20% since then, creditable but a fair way behind the other trusts in its sector, as well as the average emerging markets open-ended fund. Emerging markets in general have been a standout performer this year, particularly for sterling investors.

Smith acknowledges the relative performance, but denies he is worried. “You are quite right that we are lagging the benchmark. The peer group and the index are pretty indistinguishable,of course. What happens if you get an upturn in emerging markets, which we certainly have so far this year, is that people either go and buy an ETF, or they go and buy one of the major funds, the Aberdeen fund, or the Templeton fund, or whatever, and of course the Aberdeen and Templeton funds are pretty close to the index. They have to be. They’re big funds”.

“If you look at the sort of things that they’re likely to own, they’re not the sort of things that we’re likely to own. We’re only interested, in round number terms, in 20% of the index. That’s the consumer discretionary, consumer staples and healthcare portion of the emerging markets. By and large, they’re not the kind of things that are either big in the index, big in those funds or likely to get your pulse racing if you’re having a quick speculative dive timing

the turn”.

“If what we’re seeing is a genuine turn after a three and a bit years of underperformance in emerging markets – I don’t know if it is, I think it probably is, but I don’t know – we’re quite relaxed because eventually what’s going to happen is the money’s going to find our stuff. And the money’s going to find our stuff because it is good stuff. After all you’re not likely, before the turn in the markets, to rush out and buy an Egyptian croissant baker. You’re more likely to buy Samsung. But it will find our stuff”.

“I think we probably are [seeing a genuine turn] for the simplest of all reasons. The big downturn in commodities, which is what’s driven the last three years, we’ve now completely seen that. People have now been living for two to three years with the downturn. We basically have got to the point, where things are not getting worse as a result. In fact, they’re probably at the margin getting a bit better, as people come to terms with it and learn to structure their economy to cope with it”.

“So the other thing is: do we own good things? I’m absolutely convinced that we own good things. The return on capital employed in our portfolio is 54%. That’s not a spot number. Our average company was founded in 1953, and they’re growing at the moment at something like 11% in terms of revenue and about 20% in terms of earnings or cash flows. If that turns out to be the trough of the business cycle, and I think there’s a reasonable chance that it is, this will look like a good portfolio in years to come”.

“If you go back to our main global fund. 30% of the revenues are from the emerging world. So the companies now will be listing in the developed world but operate in developing world. And I would bet – if anybody wants to take me on – that over the same ten years forward, if we didn’t change a single share, that 30% would increase. And it tells you something. It tells you that clearly the epicentre of growth is not going to be Europe, or even North America, and definitely not Japan, over this period”.

¿Que ha pasado despues de 5 años? Que su fondo de emergentes sigue igual de mal

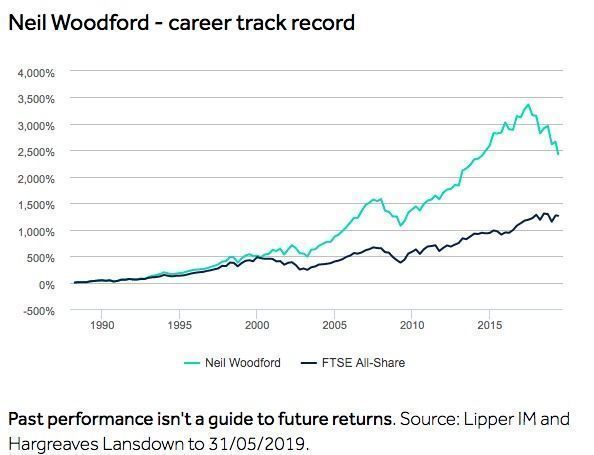

¿Que pensariamos de Terry Smith si solo existiese su fondo de emergentes? Que es un inutil, que engaña a la gente hablando de las bondades de su estrategia, etc

El mundo de las inversiones tiene la cosa de que tu puedes tener razon pero si no tienes la rentabilidad adecuada parece que no la tienes y viceversa, puedes hacer todo mal pero si das un pelotazo el mundo te considerara un guru y escuchara todo lo que digas aunque sean boludeces