Te dejo lo que dice la estrella de la mañana sobre el capital allocation:

We assign an Exemplary Capital Allocation Rating to PepsiCo, based on our view that the company has a sound balance sheet, a good track record of investments for long-term value creation, and an appropriate shareholder distribution practice blending cash dividends and share repurchases.

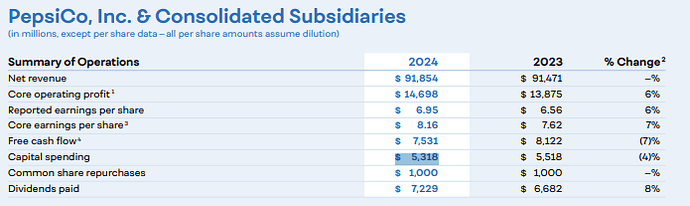

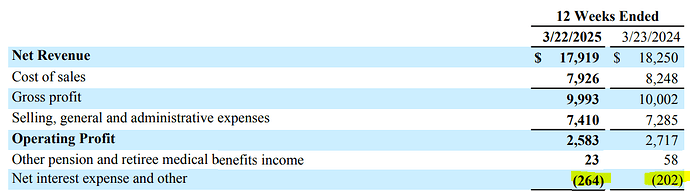

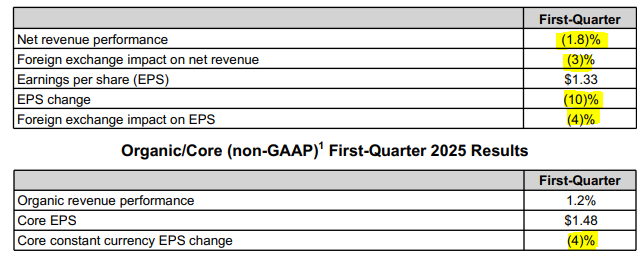

First, we view PepsiCo as in excellent financial health. It has a strong balance sheet, with net debt/EBITDA of 2.2 times in 2024 and projected to stay at or below that level in the next 10 years. As such, we don’t foresee any problem for the firm to maintain its Tier 1 commercial paper access to short-term funding at competitive rates when necessary. In addition, the firm has a solid cash position and a projected strong free cash flow to the firm generation ($12 billion on average per year, 11.3% of sales) over the next five years. All in, we believe the company is well-equipped financially to withstand external shocks and to fund its growth plans.

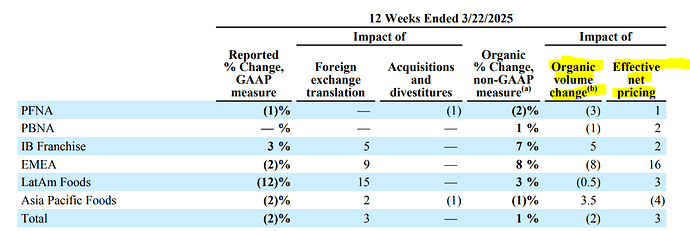

On the investment front, we give the company credit for heavy spending over the years behind its snack brand portfolio, distribution system, and research and development that has driven and should continue to result in solid organic growth, underpinning its global dominance in the structurally attractive snack business, where its market share is 9 times ahead of its closest competitor. While the beverage business underwent a period of underinvestment, the situation was rectified since current CEO Ramon Laguarta took the helm in 2018, as the company stepped up spending to refresh its core brands, while bringing to market versions of its classic recipes to cater to a growing health-conscious crowd. Mergers and acquisitions have always been a part of the firm’s growth roadmap, with PepsiCo scoring successes with deals such as the Quaker Oats acquisition in 2001, which gave PepsiCo dominant sports drink brand Gatorade and a long runway of growth in the nonsparkling category. Its more recent acquisitions in food (Pioneer Foods, Be & Cheery) and beverage (Rockstar), though smaller in size, fit a similar strategic profile and offer the firm exposure to attractive categories (energy drinks, nuts and seeds) and attractive emerging markets (Africa and China). The transactions for Be & Cheery and Pioneer Foods deals valued the two businesses at price/sales multiples of roughly 1 times and 1.2 times, respectively, which strikes us as reasonable. However, we view the Rockstar acquisition as richly valued, with price/sales at over 20 times. We appreciate the strategic value of Rockstar (2% global volume share in energy drinks per Euromonitor, popular in the convenience store channel) to PepsiCo (roughly 4% global volume share prior to the Rockstar deal, according to Euromonitor). Still, we believe the company overpaid in its push to refresh its sleepy energy drink lineup. In the coming years, we expect strategic M&A to remain part of PepsiCo’s long-term growth strategy.

On shareholder distributions, PepsiCo has returned cash to shareholders consistently with a combination of cash dividends and share buybacks. It maintained a payout ratio averaging 66% over the past three years, with dividends per share growing at a high-single-digit rate annually. Over our 10-year explicit forecast period, we forecast the payout ratio to gradually rise to 72% by 2033, with the dividend payment growing at 6% annually. Share buybacks have fluctuated from year to year, which we believe has been prudent, as we believe management should consider buybacks only when the stock trades below its intrinsic value, without committing to a yearly target at a fixed amount.

Mi opinión personal va en línea con eso. Aunque no estoy tan seguro de que estas inversiones vayan a ser tan rentables, más bien creo que en los próximos años el capital allocation lo cambiarán a standard