Seth

4 Marzo, 2022 19:34

3437

Atentos a la noticia de Cazatalentos

Coca-Cola Hellenic (33% exportación a Rusia),Basf (25% exportación a Rusia),Adidas 13% exportación a Rusia),E.on (11% exportación a Rusia),Metro AG (9% exportación a Rusia)Henkel (6% exportación a Rusia).

British American Tobacco (8% exportación a Rusia)Philip Morris (10% exportación a Rusia),PepsiCo (7% exportación a Rusia) yAvon (5% exportación a Rusia).

En el caso de Francia aparecen Danone 11% exportación a RusiaRenault 8% exportación a RusiaPernord Ricard 5% exportación a Rusia

6 Me gusta

Esto es lo bueno que tiene el tabaco…que se nos va al carajo el 8% de las ventas…pues subimos un 8% los precios…es lo bueno que tiene la droga…

4 Me gusta

jgr23

5 Marzo, 2022 10:39

3439

(Hay que darle a expandir o hacer scroll lateral abajo del todo de la tabla para ver todas las columnas)

Star Rating: ★★★★★

Moat: Narrow | Wide

FV: Fair Value (M*)

FV Q: Fair Value Quantitative (M*)

PT: Price Target (Consenso)

Exchange

Ticker

Title

Sector

P/FV

P/PT

P/FV Q

Moat

Star Rating

Uncertainty

Stewardship

Fwd P/E

Fwd P/E 5-Yr

PEG

LSE

IMB

Imperial Brands PLC

Consumer Defensive

0.53

0.78

0.71

Wide

★★★★★

Medium

Poor

6.63

8.87

1.9

XMAD

ITX

Industria De Diseno Textil SA

Consumer Cyclical

0.64

0.68

Narrow

★★★★★

Medium

Exemplary

15.65

25.5

0.68

MIL

NEXI

Nexi SpA

Technology

0.58

0.51

0.71

Narrow

★★★★★

Medium

Standard

18.69

HKSE

9988

Alibaba Group Holding Ltd Ordinary Shares

Consumer Cyclical

0.54

0.6

Wide

★★★★★

High

Exemplary

10.99

1.74

HKSE

6993

Blue Moon Group Holdings Ltd

Consumer Defensive

0.54

0.59

Narrow

★★★★★

Medium

Standard

1.13

HKSE

384

China Gas Holdings Ltd

Utilities

0.43

0.52

Narrow

★★★★★

High

Standard

6.63

14.33

0.7

HKSE

941

China Mobile Ltd

Communication Services

0.58

0.68

Narrow

★★★★★

Medium

Poor

6.92

10.81

2.1

HKSE

1801

Innovent Biologics Inc

Healthcare

0.4

0.41

0.47

Narrow

★★★★★

Very High

Exemplary

-33.78

HKSE

823

Link Real Estate Investment Trust

Real Estate

0.75

0.72

0.82

Narrow

★★★★★

Low

Exemplary

19.61

25.87

HKSE

2313

Shenzhou International Group Holdings Ltd

Consumer Cyclical

0.65

0.71

Narrow

★★★★★

Medium

Exemplary

21.37

25.09

1.25

HKSE

1099

Sinopharm Group Co Ltd H

Healthcare

0.64

0.84

0.6

Narrow

★★★★★

Medium

Standard

8.03

HKSE

1972

Swire Properties Ltd

Real Estate

0.73

0.75

Narrow

★★★★★

Low

Standard

13.68

1.3

HKSE

700

Tencent Holdings Ltd

Communication Services

0.48

0.59

Wide

★★★★★

High

Exemplary

22.68

32.55

2.15

HKSE

1997

Wharf Real Estate Investment Co Ltd

Real Estate

0.74

0.75

Narrow

★★★★★

Low

Standard

14.64

NASDAQ

DOCU

DocuSign Inc

Technology

0.42

0.31

0.51

Narrow

★★★★★

Very High

Standard

42.55

2.83

NASDAQ

FB

Facebook Inc Class A

Communication Services

0.5

0.59

Wide

★★★★★

High

Exemplary

15.41

25.19

0.92

NASDAQ

GRFS

Grifols SA ADR

Healthcare

0.65

0.63

Narrow

★★★★★

Medium

Standard

8.82

15.49

2.81

NASDAQ

INCY

Incyte Corp

Healthcare

0.6

0.71

0.77

Narrow

★★★★★

High

Standard

17.92

69.75

NASDAQ

GRUB

Just Eat Takeaway.com NV ADR

Consumer Cyclical

0.21

0.31

Narrow

★★★★★

High

Exemplary

-9.66

NASDAQ

OKTA

Okta Inc A

Technology

0.57

0.53

0.7

Narrow

★★★★★

High

Exemplary

-126.58

4500

NASDAQ

VIAC

ViacomCBS Inc Class B

Communication Services

0.59

0.67

0.63

Narrow

★★★★★

High

Standard

11.99

9.92

0.82

NYSE

BABA

Alibaba Group Holding Ltd ADR

Consumer Cyclical

0.54

0.06

0.6

Wide

★★★★★

High

Exemplary

10.91

26.4

1.71

NYSE

ATUS

Altice USA Inc Class A

Communication Services

0.4

0.37

0.48

Narrow

★★★★★

High

Standard

7.66

33.9

0.22

NYSE

BUD

Anheuser-Busch InBev SA/NV ADR

Consumer Defensive

0.62

0.8

Wide

★★★★★

Medium

Exemplary

17.51

20.26

NYSE

BBWI

Bath & Body Works Inc

Consumer Cyclical

0.59

0.7

Narrow

★★★★★

Medium

Standard

10.38

13.16

1.34

NYSE

BWA

BorgWarner Inc

Consumer Cyclical

0.52

0.7

0.66

Narrow

★★★★★

High

Standard

8.46

11.05

0.48

NYSE

SAM

Boston Beer Co Inc Class A

Consumer Defensive

0.5

0.61

0.5

Narrow

★★★★★

Medium

Exemplary

23.98

36.6

1.3

NYSE

EFX

Equifax Inc

Industrials

0.67

0.79

0.89

Wide

★★★★★

Medium

Exemplary

25.97

23.65

1.84

NYSE

GWRE

Guidewire Software Inc

Technology

0.7

0.68

0.8

Wide

★★★★★

Medium

Standard

-344.83

135.87

NYSE

HBI

Hanesbrands Inc

Consumer Cyclical

0.6

0.69

0.74

Narrow

★★★★★

Medium

Standard

8.48

10.45

0.75

NYSE

PLTR

Palantir Technologies Inc Ordinary Shares - Class A

Technology

0.35

0.44

0.47

Narrow

★★★★★

High

Exemplary

57.8

5.65

NYSE

PINS

Pinterest Inc

Communication Services

0.4

0.35

0.49

Narrow

★★★★★

Very High

Standard

23.92

NYSE

RNG

RingCentral Inc Class A

Technology

0.42

0.29

0.49

Narrow

★★★★★

High

Exemplary

66.23

189.17

3.78

NYSE

RBLX

Roblox Corp Ordinary Shares - Class A

Communication Services

0.42

0.48

0.48

Narrow

★★★★★

High

Exemplary

98.04

NYSE

CRM

Salesforce.com IncTechnology

0.63

0.63

0.71

Wide

★★★★★

Medium

Standard

43.67

62.8

4.34

NYSE

TSM

Taiwan Semiconductor Manufacturing Co Ltd ADR

Technology

0.59

0.8

Wide

★★★★★

Medium

Exemplary

20.45

20.61

1.8

NYSE

TWLO

Twilio Inc Class A

Communication Services

0.4

0.35

0.43

Narrow

★★★★★

Very High

Exemplary

-625

1372.69

29.98

NYSE

UBER

Uber Technologies Inc

Technology

0.41

0.45

0.57

Narrow

★★★★★

Very High

Standard

-93.46

NYSE

VNT

Vontier Corp Ordinary Shares

Technology

0.56

0.55

0.66

Narrow

★★★★★

Medium

Standard

7.62

0.86

NYSE

WSM

Williams-Sonoma Inc

Consumer Cyclical

0.73

0.8

0.76

Narrow

★★★★★

Medium

Standard

11.6

14.81

1.48

NYSE

YUMC

Yum China Holdings Inc

Consumer Cyclical

0.59

0.71

0.69

Wide

★★★★★

Medium

Standard

29.07

31.95

2.08

XAMS

TKWY

Just Eat Takeaway.com NV

Consumer Cyclical

0.22

0.25

0.31

Narrow

★★★★★

High

Exemplary

-9.83

XBRU

ABI

Anheuser-Busch InBev SA/NV

Consumer Defensive

0.63

0.69

0.8

Wide

★★★★★

Medium

Exemplary

17.67

20.22

XPAR

ALO

Alstom SA

Industrials

0.5

0.45

0.55

Narrow

★★★★★

Medium

Standard

7.96

19.53

1.32

XPAR

SAF

Safran SA

Industrials

0.65

0.74

0.86

Wide

★★★★★

Medium

Standard

26.32

24.58

0.88

XPAR

SW

Sodexo

Industrials

0.66

0.76

0.86

Narrow

★★★★★

Medium

Standard

14.53

20.56

0.21

XPAR

UBI

Ubisoft Entertainment

Communication Services

0.56

0.66

0.73

Narrow

★★★★★

High

Exemplary

17.99

37.6

1.61

XPAR

WLN

Worldline SA

Technology

0.44

0.47

0.57

Narrow

★★★★★

Medium

Standard

15.53

33.77

0.99

OTCPK

BASFY

Basf SE ADR

Basic Materials

0.64

0.18

0.77

Narrow

★★★★★

Medium

Standard

7.24

14.67

0.69

OTCPK

BMWYY

Bayerische Motoren Werke AG ADR

Consumer Cyclical

0.51

0.64

Narrow

★★★★★

High

Standard

4.78

8.03

0.24

OTCPK

IMBBY

Imperial Brands PLC ADR

Consumer Defensive

0.5

1.05

0.71

Wide

★★★★★

Medium

Poor

6.43

8.96

1.92

OTCPK

RHHBY

Roche Holding AG ADR

Healthcare

0.77

0.12

0.95

Wide

★★★★★

Low

Exemplary

16.05

14.84

2.9

OTCPK

TCEHY

Tencent Holdings Ltd ADR

Communication Services

0.47

0.59

Wide

★★★★★

High

Exemplary

22.12

32.48

2.11

XSWX

ROG

Roche Holding AG

Healthcare

0.76

0.87

0.95

Wide

★★★★★

Low

Exemplary

15.85

14.84

2.89

TPE

2454

MediaTek Inc

Technology

0.57

0.77

0.76

Narrow

★★★★★

High

Standard

12.39

20.41

0.39

TPE

2330

Taiwan Semiconductor Manufacturing Co Ltd

Technology

0.6

0.78

0.8

Wide

★★★★★

Medium

Exemplary

20.7

19.44

1.68

TSE

4452

Kao Corp

Consumer Defensive

0.6

0.63

0.77

Wide

★★★★★

Medium

Standard

20.37

25.16

2.91

TSE

6976

Taiyo Yuden Co Ltd

Technology

0.58

0.7

0.67

Narrow

★★★★★

High

Standard

11.99

15.57

1.24

XETR

BMW

Bayerische Motoren Werke AG

Consumer Cyclical

0.54

0.64

Narrow

★★★★★

High

Standard

4.86

8.02

0.24

XETR

CON

Continental AG

Consumer Cyclical

0.44

0.56

0.54

Narrow

★★★★★

High

Standard

7.59

13.26

0.4

XETR

DHER

Delivery Hero SE

Consumer Cyclical

0.35

0.25

0.4

Narrow

★★★★★

High

Standard

-8.38

XETR

FRE

Fresenius SE & Co KGaA

Healthcare

0.54

0.57

0.6

Narrow

★★★★★

High

Standard

8.4

15.17

1.43

XETR

HEN

Henkel AG & Co KGaA

Consumer Defensive

0.63

0.66

0.7

Narrow

★★★★★

Low

Standard

13.42

15.98

1.19

XETR

HEN3

Henkel AG & Co KGaA Pfd Shs - Non-voting

Consumer Defensive

0.64

0.67

0.7

Narrow

★★★★★

Low

Standard

13.66

17.79

1.27

23 Me gusta

Y Adobe y Unilever que están a un solo pasito de entrar en este selecto grupo.

Tremenda lista, gracias @jgr23

4 Me gusta

jgr23

5 Marzo, 2022 13:43

3441

Si interesa pongo las 4* luego cuando tenga el PC a mano. Aunque son bastantes más, sino pongo el Top 50/100 ordenado por P/FV ascendente.

Tengo que ver que pasa con algunos PT que debería estar encontrando

5 Me gusta

jgr23

5 Marzo, 2022 15:46

3442

(Hay que darle a expandir o hacer scroll lateral abajo del todo de la tabla para ver todas las columnas)

Star Rating: ★★★★

Moat: Narrow | Wide

P/FV: Top 100 mas bajo

FV: Fair Value (M*)

FV Q: Fair Value Quantitative (M*)

PT: Price Target (Consenso)

Exchange

Ticker

Title

Sector

P/FV

P/PT

P/FV Q

Moat

Star Rating

Uncertainty

Stewardship

Fwd P/E

Fwd P/E 5-Yr

PEG

ASX

WTC

WiseTech Global Ltd

Technology

0.71

1

0.86

Narrow

★★★★

High

Exemplary

71.43

85.3

HKSE

1177

Sino Biopharmaceutical Ltd

Healthcare

0.71

0.7

Narrow

★★★★

Very High

Standard

11.63

33.33

0.63

HKSE

1193

China Resources Gas Group Ltd

Utilities

0.68

0.71

Narrow

★★★★

Medium

Standard

10.12

15.23

1.48

HKSE

1288

Agricultural Bank of China Ltd Class H

Financial Services

0.71

0.71

Narrow

★★★★

High

Standard

3.54

4.8

0.53

HKSE

1877

Shanghai Junshi Biosciences Co Ltd Class H

Healthcare

0.64

0.8

0.67

Narrow

★★★★

Very High

Exemplary

-84.03

HKSE

2020

ANTA Sports Products Ltd

Consumer Cyclical

0.67

0.77

Narrow

★★★★

High

Exemplary

25.38

25.85

0.95

HKSE

2382

Sunny Optical Technology (Group) Co Ltd

Technology

0.67

0.71

Narrow

★★★★

High

Standard

20.92

27.2

0.95

HKSE

241

Alibaba Health Information Technology Ltd

Healthcare

0.69

0.62

Narrow

★★★★

High

Standard

-208.33

HKSE

2607

Shanghai Pharmaceuticals Holding Co Ltd Class H

Healthcare

0.68

0.6

0.95

Narrow

★★★★

High

Standard

7.17

2.17

HKSE

288

WH Group Ltd

Consumer Defensive

0.61

0.64

Narrow

★★★★

High

Standard

7.18

0.45

HKSE

392

Beijing Enterprises Holdings Ltd

Industrials

0.68

0.71

Narrow

★★★★

Medium

Standard

4.1

6.21

0.57

HKSE

914

Anhui Conch Cement Co Ltd Class H

Basic Materials

0.59

0.76

Narrow

★★★★

High

Standard

5.8

10.03

HKSE

9618

JD.com Inc Ordinary Shares - Class AConsumer Cyclical

0.64

0.41

0.73

Wide

★★★★

High

Exemplary

32.68

1.28

HKSE

9999

NetEase Inc Ordinary Shares

Communication Services

0.62

0.16

0.7

Narrow

★★★★

High

Standard

17.39

1.1

LSE

HSBA

HSBC Holdings PLC

Financial Services

0.66

0.69

0.76

Narrow

★★★★

High

Standard

9.22

11.93

0.26

LSE

LLOY

Lloyds Banking Group PLC

Financial Services

0.63

0.76

0.75

Narrow

★★★★

Very High

Standard

6.7

9.11

0.23

LSE

PSON

Pearson PLC

Communication Services

0.7

0.85

0.72

Narrow

★★★★

High

Standard

15.62

15.19

2.27

LSE

SDR

Schroders PLC

Financial Services

0.7

0.78

0.82

Narrow

★★★★

High

Standard

11.9

15.51

3.13

LSE

VOD

Vodafone Group PLC

Communication Services

0.67

0.64

0.74

Narrow

★★★★

High

Standard

15.29

20.37

LSE

WPP

WPP PLC

Communication Services

0.7

0.82

0.84

Narrow

★★★★

High

Exemplary

10.5

11

1.7

NASDAQ

ADBE

Adobe Inc

Technology

0.72

0.64

0.83

Wide

★★★★

Medium

Exemplary

32.57

36.33

2.36

NASDAQ

AMZN

Amazon.com IncConsumer Cyclical

0.71

0.7

0.88

Wide

★★★★

High

Exemplary

50.25

83.94

2.52

NASDAQ

BIIB

Biogen Inc

Healthcare

0.61

0.59

0.66

Wide

★★★★

High

Standard

13.53

11.81

NASDAQ

BKNG

Booking Holdings Inc

Consumer Cyclical

0.71

0.78

0.9

Narrow

★★★★

High

Exemplary

23.58

31.55

0.26

NASDAQ

DISCA

Discovery Inc Registered Shs Series -A-

Communication Services

0.64

0.69

0.67

Narrow

★★★★

High

Standard

8.45

9.6

0.57

NASDAQ

DISCK

Discovery Inc C

Communication Services

0.64

0.69

0.67

Narrow

★★★★

High

Standard

8.43

8.93

0.55

NASDAQ

ETSY

Etsy Inc

Consumer Cyclical

0.69

0.64

0.75

Wide

★★★★

High

Standard

39.22

70.91

3.26

NASDAQ

JD

JD.com Inc ADRConsumer Cyclical

0.61

0.1

0.73

Wide

★★★★

High

Exemplary

30.96

73.18

1.26

NASDAQ

LYFT

Lyft Inc Class A

Technology

0.53

0.51

0.63

Narrow

★★★★

Very High

Standard

-71.94

NASDAQ

MELI

MercadoLibre Inc

Consumer Cyclical

0.67

0.51

0.75

Wide

★★★★

High

Exemplary

136.99

513.01

1.46

NASDAQ

MLCO

Melco Resorts and Entertainment Ltd ADR

Consumer Cyclical

0.71

0.66

0.7

Narrow

★★★★

Very High

Standard

-10.67

31.98

NASDAQ

NICE

NICE Ltd ADR

Technology

0.71

0.86

Narrow

★★★★

High

Exemplary

31.45

27.41

3.41

NASDAQ

NTES

NetEase Inc ADR

Communication Services

0.62

0.1

0.7

Narrow

★★★★

High

Standard

17.3

20.38

1.09

NASDAQ

PDD

Pinduoduo Inc ADR

Consumer Cyclical

0.62

0.05

0.63

Narrow

★★★★

High

Standard

29.94

NASDAQ

PEGA

Pegasystems Inc

Technology

0.63

0.51

0.75

Narrow

★★★★

High

Standard

123.46

222.46

NASDAQ

PYPL

PayPal Holdings Inc

Financial Services

0.69

0.31

0.6

Narrow

★★★★

High

Standard

21.55

37.84

1.85

NASDAQ

SWKS

Skyworks Solutions Inc

Technology

0.65

0.64

0.78

Narrow

★★★★

High

Exemplary

11.79

15.06

0.79

NASDAQ

TEAM

Atlassian Corporation PLC A

Technology

0.63

0.55

0.73

Narrow

★★★★

High

Standard

147.06

127.73

6.79

NASDAQ

TER

Teradyne Inc

Technology

0.65

0.73

0.73

Wide

★★★★

High

Standard

23.36

20.64

NASDAQ

TRIP

TripAdvisor Inc

Consumer Cyclical

0.64

0.51

0.66

Narrow

★★★★

High

Standard

23.75

67.45

NASDAQ

TROW

T. Rowe Price Group Inc

Financial Services

0.71

0.67

0.73

Wide

★★★★

Medium

Exemplary

10.67

15.07

1.53

NASDAQ

VOD

Vodafone Group PLC ADR

Communication Services

0.66

8.45

0.75

Narrow

★★★★

High

Standard

14.62

20.55

NASDAQ

ZM

Zoom Video Communications Inc

Technology

0.68

0.31

0.56

Narrow

★★★★

Very High

Standard

31.06

2.87

NYSE

AMG

Affiliated Managers Group Inc

Financial Services

0.7

0.68

0.76

Narrow

★★★★

High

Exemplary

6.49

8.58

0.68

NYSE

APD

Air Products & Chemicals Inc

Basic Materials

0.69

0.72

0.86

Narrow

★★★★

Medium

Exemplary

22.22

24.1

1.46

NYSE

BLK

BlackRock Inc

Financial Services

0.7

0.72

0.79

Wide

★★★★

Medium

Exemplary

16.47

18.18

2.77

NYSE

C

Citigroup Inc

Financial Services

0.68

0.67

0.73

Narrow

★★★★

Medium

Standard

7.63

10.4

0.76

NYSE

CS

Credit Suisse Group AG ADR

Financial Services

0.48

0.68

0.68

Narrow

★★★★

Very High

Poor

6.86

11.04

0.57

NYSE

DASH

DoorDash Inc Ordinary Shares - Class A

Communication Services

0.55

0.44

0.58

Narrow

★★★★

Very High

Standard

-212.77

NYSE

FIS

Fidelity National Information Services Inc

Technology

0.67

0.55

0.67

Narrow

★★★★

Medium

Standard

12.41

20.14

1.25

NYSE

FMS

Fresenius Medical Care AG & Co. KGaA ADR

Healthcare

0.7

0.37

0.8

Narrow

★★★★

Medium

Standard

13.3

16.34

1.87

NYSE

FTV

Fortive Corp

Technology

0.69

0.71

0.83

Narrow

★★★★

Medium

Exemplary

19.57

22.72

1.64

NYSE

GE

General Electric Co

Industrials

0.67

0.76

0.81

Narrow

★★★★

High

Exemplary

25.77

30.17

0.28

NYSE

GPN

Global Payments Inc

Industrials

0.69

0.57

0.7

Narrow

★★★★

Medium

Standard

13.44

22.79

0.81

NYSE

HSBC

HSBC Holdings PLC ADR

Financial Services

0.65

4.61

0.76

Narrow

★★★★

High

Standard

8.71

11.96

0.26

NYSE

HUBS

HubSpot Inc

Technology

0.72

0.56

0.78

Narrow

★★★★

High

Standard

188.68

213.77

8.44

NYSE

ING

ING Groep NV ADR

Financial Services

0.59

0.72

0.68

Narrow

★★★★

High

Standard

6.68

10.07

0.66

NYSE

INGR

Ingredion Inc

Consumer Defensive

0.71

1.14

0.87

Narrow

★★★★

Medium

Standard

12.03

13.81

1.23

NYSE

IVZ

Invesco Ltd

Financial Services

0.68

0.62

0.67

Narrow

★★★★

High

Standard

6.4

9.07

0.84

NYSE

KKR

KKR & Co Inc Ordinary Shares

Financial Services

0.7

0.73

0.76

Narrow

★★★★

High

Standard

15.82

14.26

NYSE

KT

KT Corp ADR

Communication Services

0.64

0

0.71

Narrow

★★★★

High

Standard

7.43

9.72

1.68

NYSE

LYG

Lloyds Banking Group PLC ADR

Financial Services

0.61

3.95

0.75

Narrow

★★★★

Very High

Standard

6.72

9.06

0.22

NYSE

PHG

Koninklijke Philips NV ADR

Healthcare

0.69

0.73

Narrow

★★★★

Medium

Standard

16.23

20.09

2.6

NYSE

PII

Polaris Inc

Consumer Cyclical

0.64

0.81

0.83

Wide

★★★★

High

Exemplary

11.38

16.03

1.15

NYSE

PSO

Pearson PLC ADR

Communication Services

0.66

1.14

0.72

Narrow

★★★★

High

Standard

15.24

15.19

2.27

NYSE

SAN

Banco Santander SA ADR

Financial Services

0.66

0.77

0.72

Narrow

★★★★

High

Standard

5.62

9.43

0.51

NYSE

T

AT&T Inc

Communication Services

0.68

0.73

Narrow

★★★★

High

Poor

7.64

10.26

10.09

NYSE

TPR

Tapestry Inc

Consumer Cyclical

0.7

0.69

0.87

Narrow

★★★★

High

Standard

8.98

13.81

1.43

NYSE

TV

Grupo Televisa SAB ADR

Communication Services

0.71

0.65

Narrow

★★★★

High

Exemplary

16.61

20.9

NYSE

VEEV

Veeva Systems Inc Class A

Healthcare

0.68

0.55

0.81

Wide

★★★★

Medium

Standard

46.73

71.25

3.51

NYSE

VMW

VMware Inc Class A

Technology

0.68

0.68

0.89

Narrow

★★★★

High

Standard

17.12

22.27

1.22

NYSE

WCC

WESCO International Inc

Industrials

0.71

0.83

0.85

Narrow

★★★★

Medium

Standard

9.54

12.14

0.71

NYSE

WPP

WPP PLC ADR

Communication Services

0.69

5.4

0.84

Narrow

★★★★

High

Exemplary

10.09

11.01

1.7

NYSE

ZBH

Zimmer Biomet Holdings Inc

Healthcare

0.69

0.65

0.75

Wide

★★★★

Medium

Exemplary

18.38

17.11

1.29

OCSE

DANSKE

Danske Bank A/S

Financial Services

0.59

0.79

0.76

Narrow

★★★★

Very High

Poor

6.49

10.66

0.24

OSTO

SWED A

Swedbank AB Class A

Financial Services

0.69

0.7

0.76

Narrow

★★★★

Very High

Poor

7.96

10.9

1.18

OTCPK

BAYRY

Bayer AG ADR

Healthcare

0.64

0.23

0.81

Wide

★★★★

High

Poor

7.49

10.66

94.36

OTCPK

EADSY

Airbus SE ADR

Industrials

0.71

0.19

1.05

Wide

★★★★

High

Standard

18.73

24.04

OTCPK

FANUY

Fanuc Corp ADR

Industrials

0.68

0

0.82

Wide

★★★★

High

Exemplary

21.23

39.81

1.51

OTCPK

IFNNY

Infineon Technologies AG ADR

Technology

0.66

0.71

0.71

Narrow

★★★★

High

Standard

16.08

22.49

0.97

OTCPK

JBAXY

Julius Baer Gruppe AG ADR

Financial Services

0.68

0.15

0.76

Wide

★★★★

High

Exemplary

8.76

12.26

0.9

TSE

2269

Meiji Holdings Co Ltd

Consumer Defensive

0.68

0.84

0.83

Narrow

★★★★

Medium

Standard

14.9

17.59

3.71

TSE

6981

Murata Manufacturing Co Ltd

Technology

0.66

0.67

0.77

Narrow

★★★★

High

Standard

14.33

18.76

6.93

XAMS

ABN

ABN AMRO Bank NV

Financial Services

0.59

0.78

0.67

Narrow

★★★★

High

Standard

8.63

13.4

XAMS

AKZA

Akzo Nobel NV

Basic Materials

0.71

0.7

0.84

Narrow

★★★★

Medium

Exemplary

14.88

19.1

1.47

XAMS

INGA

ING Groep NV

Financial Services

0.64

0.66

0.68

Narrow

★★★★

High

Standard

6.79

10.07

0.66

XAMS

PHIA

Koninklijke Philips NV

Healthcare

0.71

0.6

0.73

Narrow

★★★★

Medium

Standard

16.45

20.09

2.6

XAMS

UMG

Universal Music Group NV

Communication Services

0.59

0.68

0.74

Narrow

★★★★

High

Exemplary

22.73

XETR

BAS

Basf SE

Basic Materials

0.7

0.65

0.77

Narrow

★★★★

Medium

Standard

7.28

14.66

0.69

XETR

BAYN

Bayer AG

Healthcare

0.69

0.83

0.81

Wide

★★★★

High

Poor

7.55

10.63

93.91

XETR

HEI

HeidelbergCement AG

Basic Materials

0.63

0.61

0.72

Narrow

★★★★

High

Standard

5.88

10.95

1.12

XETR

IFX

Infineon Technologies AG

Technology

0.69

0.65

0.71

Narrow

★★★★

High

Standard

16.39

22.49

0.97

XETR

KGX

KION GROUP AG

Industrials

0.7

0.66

0.8

Narrow

★★★★

Medium

Standard

13.28

15.33

0.71

XMAD

GRF.P

Grifols SA B

Healthcare

0.67

0.39

0.63

Narrow

★★★★

Medium

Standard

9.05

15.5

2.83

XMAD

SAN

Banco Santander SA

Financial Services

0.68

0.7

0.72

Narrow

★★★★

High

Standard

5.73

9.47

0.52

XPAR

AC

Accor SA

Consumer Cyclical

0.69

0.78

0.85

Narrow

★★★★

Medium

Standard

68.03

152.98

XPAR

AMUN

Amundi SA

Financial Services

0.61

0.65

0.71

Narrow

★★★★

High

Standard

8.82

13.12

5.47

XSWX

BAER

Julius Baer Gruppe AG

Financial Services

0.69

0.68

0.76

Wide

★★★★

High

Exemplary

8.86

12.33

0.9

XSWX

CSGN

Credit Suisse Group AG

Financial Services

0.49

0.63

0.68

Narrow

★★★★

Very High

Poor

6.9

11.06

0.57

XSWX

DUFN

Dufry AG

Consumer Cyclical

0.58

0.55

0.58

Narrow

★★★★

Very High

Standard

33.72

9 Me gusta

anbax

5 Marzo, 2022 16:28

3443

Listas enormes pero juraria que hay pocas DGI USA clasicas en ambas

romano

5 Marzo, 2022 17:51

3444

Ty por la info, bro. La verdad es que la munición es limitada y uno no sabe bien donde apuntar para disparar. Por mi parte, me quedan dos disparos y tengo en el radar googl, amazon, fb, lvmh, crm, veeva, trow y poco más.

1 me gusta

espoo

5 Marzo, 2022 19:33

3445

Mi lista de la compra para esta semana, las que tengo a menos de 15% de precio de compra. Aunque hay unas cuantas que no compraría porque no acaben de convencerme o porque no quiero que pesen más, pero bueno.

InditexSalesforce.com INC

9 Me gusta

anbax

5 Marzo, 2022 21:50

3446

Cuando la lista de la compra es mas larga que el listado de acciones del SP500 chungo …

6 Me gusta

espoo

5 Marzo, 2022 22:25

3447

Me has hecho romperme bastante la cabeza, luego si compro otra no quiero quejas

InditexSalesforce.com INC

10 Me gusta

Seth

6 Marzo, 2022 06:54

3448

Hay que ser más selectivo que nunca y eso nos obligará a esperar más que nunca porque las favoritas seguro que bajarán, pero tardarán más que las otras. Y el dinero es limitado…

4 Me gusta

Cerri2

6 Marzo, 2022 20:10

3449

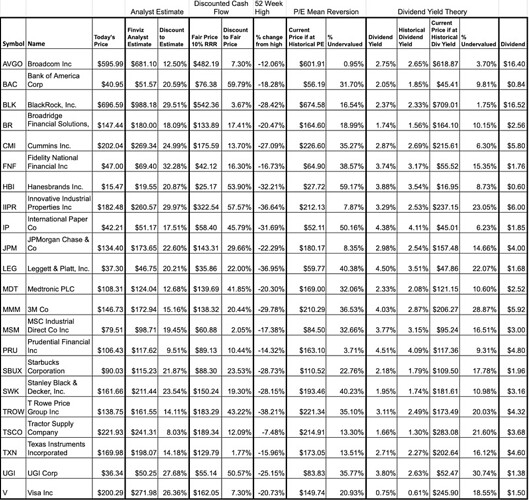

Cortesía de Dividend Stockpile

9 Me gusta

Si fueran tiempos ortodoxos el manual nos indicaria que con una estanflacion en ciernes habria que abstenerse de comprar y acumular efectivo para cuando entremos en una recesion severa. Pero como son tiempos extraños, tipos al cero-inflacion-guerra-…, que jamas antes se habian vivido conjuntamente, la ortodoxia pasa a un segundo plano y es facil dejarse llevar mas por la precipitacion o la intuicion. Cuidado con gastar todos los cartuchos antes de tiempo. Probablemente habra mejores oportunidades.

10 Me gusta

Se “arregla” con hacer las compras normales mensuales (o el periodo que cada uno tenga marcado) y aumentar dichas compras si hay caídas fuertes (lo que cada cual considere). Lógicamente para los que siempre tengamos liquidez.

Saludos.

7 Me gusta

¿Cuál es la mejor empresa que comprar en la bolsa española? Lo pregunto por el batacazo de hoy y poder estar pendiente de una sola

1 me gusta

Tienes Logista e Inditex muy baratas ahora mismo y son las que tengo yo en el punto de mira.

Si no, siempre tienes a Telefónica

1 me gusta

jgalesco:

bolsa española

Empezamos a ver muy buenos precios, de las que sigo LOG debajo de 15, LDA también muy descontada, IBE sobre 8,40…

Creo que lo difícil es si cuando abra la bolsa americana veremos una caída de dimensiones similares y entonces la pregunta es qué comprar en la bolsa americana, ya que las balas son limitadas.

Por otro lado si en cuanto abra la bolsa americana esta se pone a subir y se contagia la europea se acaban las rebajas.