Hilo creado a partir de este comentario

Cronología y motivos para una adquisición:

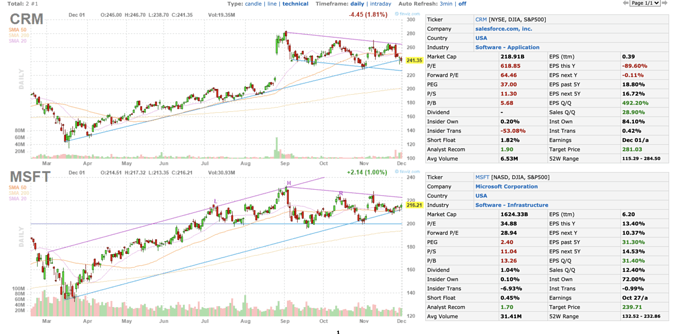

Cae un 5% en pre-market.

Abro posición a 218.60$

Yo me la jugué y metí un chupito ayer!!! Así que compré mas caro

(M*)

Wide-moat Salesforce reported strong results, including meaningful upside to both revenue and non-GAAP EPS, while guidance for the fourth quarter was mixed. Stealing the thunder from fine results was the formal announcement that the company is acquiring Slack, and this dominated the earnings call. We have mixed feelings on the Slack acquisition.

Salesforce has done a nice job identifying strategic targets and smoothly integrating both products and operations, so we think they can do the same with Slack, which was characterized as an opportunistic deal. That said, we think the price tag was steep at $28 billion in total and about $46 per share, based on deal terms of $26.79 in cash and 0.0776 shares of Salesforce common stock. This deal price compares with our $20 standalone fair value estimate for Slack.

We are maintaining our fair value estimate of $253 for Salesforce as good organic results are offset by the seemingly modest deleterious impact on shareholder value arising from the Slack acquisition. With the recent pullback, we think Salesforce shares are looking increasingly attractive.

Revenue grew 20% year over year to $5.419 billion, which blew through both our above-consensus estimate and guidance. All segments were ahead, with the most notable upside relative to our model coming from platform and marketing cloud, which were 5% and 4% ahead of our estimates, respectively. Demand remains strong on all fronts and attrition remains better than management anticipated. Billings and current remaining performance obligation, or CRPO, both grew more slowly than revenue, which is a bit of a blemish on an otherwise good quarter.

Non-GAAP operating margin was strong at 19.8%, compared with 19.4% a year ago and our above-consensus model at 17.7%. Non-GAAP EPS of $1.74 benefited by $0.86 from mark-to-market accounting, but were still $0.10 better than our above consensus estimate. Strong revenue and expense discipline drove margin and EPS upside.

Parece que hay unanimidad. Yo por si acaso ayer cargué 15 MSFT…

(M*)

Wide-moat Salesforce CRM reported solid fiscal fourth-quarter results, including upside to both revenue and non-GAAP EPS expectations. The company’s first-quarter revenue guidance was solid and we’re pleased to see the firm raise its full-year revenue target. We think Salesforce’s results are generally consistent with software peers who are experiencing robust demand arising from the need to accelerate the broad digital transformation efforts that were already underway. Deal sizes continue to grow larger as conversations are increasingly about digital transformation of a customer’s entire organization rather than just a specific area. Customers remain focused on the post-pandemic operating environment and want flexibility, which reinforces the rationale for the Slack acquisition.

We are raising our fair value estimate to $265 per share, from $253, based on rolling our forecast and the solid near-term results and guidance. With the recent pullback, we think shares are undervalued.

Revenue grew 20% year over year to $5.817 billion, which blew through both our above-consensus estimate and guidance. Both sales and service clouds were in line with our model, while both platform and other, along with marketing and commerce cloud, were nicely ahead. Demand remains strong on all fronts and attrition remains better than management anticipated. Billings grew 22% year over year, while current remaining performance obligation, or CRPO, grew 20% year over year, both of which were in line with or better than revenue growth, which is an improvement from last quarter and a positive indicator for revenue growth.

Non-GAAP operating margin was strong at 17.5%, compared with 15.4% a year ago and our slightly below-consensus model at 16.5%. Revenue strength and slightly lower operating expenses drove better than expected margins. We view results as consistent with long-term margin expansion by at least 100 basis points annually.

De cuando es el report?

Porque el hostiazo del viernes (volumen) fué épico.

Del 26 de Febrero, el propio día del piñajo.

Yo quise entrar cuando cotizaba a 215 y por esperar que bajara más se me escapó, así que esta vez voy a aprovechar antes de que se vaya para arriba de nuevo.

Aumenta sus ingresos trimestre a trimestre y supera siempre las espectativas de los analistas. No entiendo la caída del viernes pero la voy a aprovechar.

Junto a FB, BABA y LON:BATS el destino de mis ahorros en Marzo.

Pero, pero, pero ¿Y los dividendos?

Me he marcado un Roberto Carlos este mes. Está por ver si sabré regresar del lado oscuro.