Jajajajajaja, creo que es casualidad

![]()

![]()

![]()

Seguramente esto os alegrará un poco más.

Why has tobacco traditionally been such a significant portion of your Staples exposure?

NS: In a nutshell, we believe that as an industry it has one of the finest compounding profiles here is, driven by the most robust pricing power in Staples. In most markets, excise tax makes up the largest portion of the retail price of a pack of cigarettes, lowering the impact of manufacturer led price rises. For example, in the UK, excise tax is over 80% of the retail price. This means a customer only sees a 1% increase on a pack for a 5% manufacturer price rise. So, on a notional £10 pack, with tax at £8.0, the manufacturer–raises its £2 to £2.10, increasing the retail pack price to £10.10—a barely noticeable increase to the consumer, but a material 5% goes straight to the bottom line for the manufacturer. Tax increases occur regularly and consumers expect it, so manufacturers typically raise prices in tandem, baking-in price inflation. Pricing discipline in the sector is high given its consolidated nature.

Tobacco companies have been hugely profitable. The average Return on Operating Capital for DM cigarette companies is 96%, nearly 5x that of the broader market.15 Generally, these high returns generate very strong cash flows which are returned to shareholders by management teams that typically exhibit good capital discipline. Finally, the earnings profiles tend to be very resilient indeed. During the Global Financial Crisis, the broader market’s earnings fell 42% and took six years to get back to where they came from. Tobacco earnings fell only 10%, and recovered within six months.16 There are challenges of course—regulation, litigation, health awareness and innovation—and we assess them regularly. However, for the industry these are not new and ones we believe they will likely continue to overcome.

Today, tobacco valuations are compelling relative to Staples. The current price to earnings multiple is below their relative 10-year average. This comes at a point in time when the risk of e cigarettes has subsided and the recent U.S. industry consolidation is boosting U.S. and UK listed near-term earnings via synergies. Due to this consolidation, greater pricing discipline is taking hold in the U.S., one of the cheapest cigarette markets in the world. It takes only 21 minutes of labor to purchase 20 cigarettes in the U.S. compared to 60 minutes in the UK or 87 minutes in Indonesia.17 So in our view there is plenty of room to increase prices for a number of years.

Dicen que fumar vuelve a ser cool

Fitch: Un repaso al sector: pocas perspectivas de crecimiento…

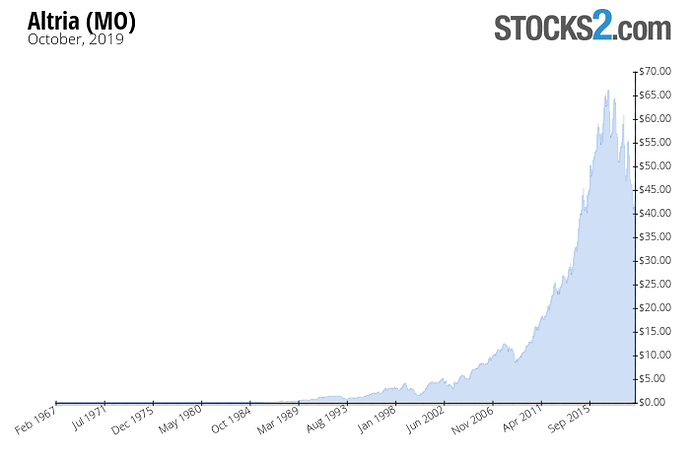

Estas en 1997 ¿Invertirias en una empresa que en 1997 vendia 235.200 millones de unidades de producto y que en 2018 venderia solo 109.800 millones?

In 1997, Altria’s domestic cigarette business shipped 235.2 billion units, which generated $13.6 billion in revenue and $3.3 billion in operating income. Fast forward to 2018, when Altria’s domestic cigarette volumes fell to 109.8 billion units - a decline of more than 50%. For any other industry, this might have been a disaster… but not for Big Tobacco. Despite losing half of their volumes, Altria generated $22.3 billion in revenue and $8.4 billion in operating income from its domestic cigarette business last year - gains of 64% and 155%, respectively.

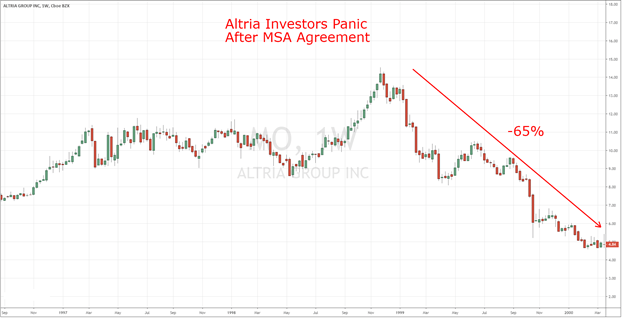

Estas en 1998 ¿Invertirias en una empresa que cayo un 65% durante el mayor mercado alcista de la historia?

¿Invertirias en 1997 en un sector que seria sentenciado a pagar costes de mas de 200.000 millones durante los siguientes 25 años y cuyos CEOs mintieron bajo juramento sobre la adiccion de sus productos?

The 1990s MSA legislation effectively transformed the previously competitive U.S. tobacco industry into a de facto cartel.

The MSA required every American tobacco company to pay “damages” based on the idea that cigarettes caused billions in past and future public healthcare costs. Now, given the stated reason for these damages, you might expect that these payments would be calculated on some kind of analysis of public health costs… but that’s not what happened. Instead, the damages formula was based on the level of price increases cigarettes companies could impose on their customers, without sustaining a significant loss in sales.

A key component of the agreement contained a clause stating that, if the combined big four tobacco companies lost more than 2 percent market share, then their damages owed would decline by three times the market share loss beyond the 2 percent threshold. You can probably see where this is going, but it gets better…

Any tobacco company that did not sign the MSA would still be required to set aside potential damages (proportionate to cigarette volumes sold) into an escrow account for 25 years to satisfy any potential liability that might arise from future legal actions. And if a non-signatory tobacco company decided to sign onto the MSA agreement at any point in the future, it could avoid setting aside the potential damage payments into the escrow account. But here’s the catch – the new signatory would only be allowed to increase its market share up to 125% of its 1997 level.

The agreement locked in market share for the existing players that dominated the market, while crushing the prospects of any potential upstart competitors. With an addicted customer base and no need for investments into protecting market share, tobacco companies enjoyed windfall profits even as U.S. smoking rates entered into secular decline.

Consideraciones morales aparte la historia del tabaco en el mundo de las inversiones es cuando menos sorprendente.

¿Y el futuro?

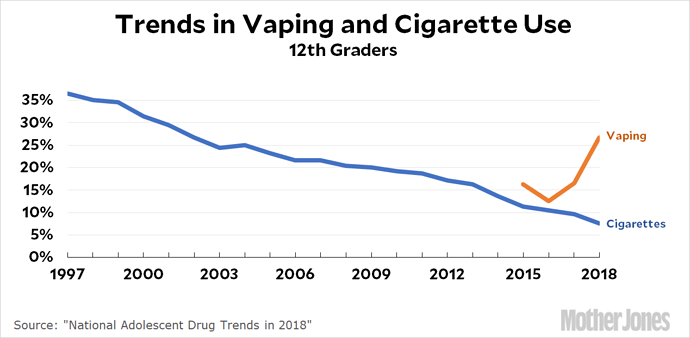

Parece que la marihuana reduce el consumo de alcohol y aumenta el de tabaco

- Alcohol: Recreational marijuana legalization’s impact on “alcohol searches is negative and significant, indicating reduced interest in alcohol when cannabis is legalized and becomes more available.” Consequently, the authors “can infer a reduction of 10.9% in alcohol searches after recreational cannabis legalization.”

Conclusion: “cannabis appears to be a substitute for alcohol.”

- Tobacco: Findings here were the opposite of alcohol, with adult-use marijuana legalization increasing tobacco-related search volumes. It actually “enhances consumer interest in tobacco products”, with their analysis suggesting “an increase of 7.8% in tobacco searches” following legalization.

Bottom line: the researchers concluded that cannabis and liquor appear as substitute goods, and marijuana and tobacco as complementary ones:

- While “historically, both alcohol and tobacco companies have been… strongly concerned that legal marijuana may pose threats to them… our results suggest that tobacco companies may need to reexamine their presumption.” Marijuana legalization “in fact leads to increased interest in tobacco.”

Yo como buen chico de provincias que soy, venido a la capi fui a tomar una cerveza para ir conociendo la ciudad

En la zona de Alonso Martinez había un edificio antiguo muy bonito en el que había una terraza muy cool.

Pues resulta ser que el edificio y la terraza era de IQOS.

La terraza estaba llena, pero no llegué a ver nadie vapeando eso sí, todos con bebida en mano.

Si quieres mantenerte en pie no mezcles alcohol y marihuana o lo pagaras caro…y lo sabes😂

Regla numero uno del fumeta.

“La guerra de Sánchez y Pfizer contra el cigarrillo electrónico: millones de euros públicos para castigar al sector”

“Además, el monto de la subvención no es despreciable: 30 millones, que saldrán de la hucha de la Seguridad Social. Pero ahí no queda la cosa. ¿Cómo puede ser que la subvención sea superior a las ventas del producto? Pues así es. En 2018, las ventas de Champix alcanzaron los 18 millones . De este modo, teniendo en cuenta que los ciudadanos aportan una media de un 40% del precio del medicamento prescrito por la Seguridad Social, implicaría unas ventas por un importe total de 50 millones de euros -de los que, recuerden, 30 millones los ponemos todos los españoles-.”

Saludos.

Los chinos quieren los puros:

He mirado un poco al comprador y no tiene mala pinta (su cotización si).

Diversificado en sectores, principalmente en consumo de salsas, aromas, tabaco…, Crece en ventas, buen dividendo, balance razonablemente prudente. Me la apunto, aunque estas cosas tan exóticas dan bastante respeto.

Tengo una duda que me está matando, ack ack. ¿Alguien en el foro que lleve tabaco en cartera tiene alguna en verde? Porque yo es que no doy crédito con los palos que nos están cayendo

Llevo IMB a 21,6 … Altria a 48 y BATS a 25,5 y hasta esta última que aguantaba bien se me está descalabrando (de nuevo) Y yo que pensaba que estaba comprando a precios de saldo…

Yo solo llevo en verde PM, con +6%.

MO con -6% , BAT con -12,8% y IMB con -12,7%.

No me preocupa mucho.

BATS -30% e IMB -40%. Pero toda la familia sana y feliz

La salud y la familia es lo primero. Y si no fuman mejor