Pues sí, la cosa cambia. No me caracterizo por mi espléndido inglés… Sorry

En Twitter varios nativos también se preguntan sobre el verdadero significado de la frase. Nada que disculpar.

Y según va la cosa…pocas gallinas van a entrar. Esperaremos a mejores tiempos

El del segundo trimestre no va a ser muy bueno pero si mantienen lo de distribuir todo el taxable income, la cosa deberia ir a mejor en el tercero y en el cuarto.

+1, es una doble retórica muy peligrosa la usada, pero bueno, toca aguantar

(Dividend Growth Investor)

Simon Property Groups (SPG) is Ambiguous on Dividends

I read the latest press release for Simon Property Group (SPG). I was expecting them to announce their dividend announcement as part of that release, given the fact that they are about 2 weeks late to their usual dividend declaration.

They did mention the word dividend in their latest press release but I found it to be very ambiguous.

Simon’s Board of Directors will declare a common stock dividend for the second quarter before the end of June. Simon intends to maintain a common stock dividend paid in cash and expects to distribute at least 100% of its REIT taxable income.

This is a very carefully crafted message that probably took their investor relations team 10 days to come up with. It gives the company some time to defer the difficult decision on cutting the dividend. They remind me of a teen-ager who procrastinates on a difficult assignment, because they do not want to do it, and face the consequences.

On one hand they are announcing that they will pay a dividend, in order to maintain REIT status. But they leave open the possibility that there will be a dividend cut. The way this was worded, implies a dividend cut in my opinion.

I will stick to my strategy for now, and not sell. I may change my mind too - I will keep you informed. I am pretty certain that they are cutting the dividend with this ambiguous message, but I will not sell until they state it firmly. That being said, I am disgusted by corporate double-speak. I am perhaps sticking to this stock for educational purposes only, because owning a stock forces me to keep up on it, as I am fed press releases, 10-k and 10-q reports on it.

I do not find Simon’s management to be frank and upfront with investors. I also do not like the fact that they have not shared the percentage rent collected from tenants, which is a statistic that is now commonly shared by many REITs. It sounds to me like they are trying to hide something, when we all know and expect to hear that things are not rosy.

It also seems to me that the Taubman Centers acquisition may have to be re-negotiated. Back in February, Simon (SPG) decided to acquire Taubman (TCO) for $53/share in cash. Subsequently, we had all the lockdowns, the economy going into a tailspin, but this deal is still going as if it is going to happen at the original terms. This deal needs to be renegotiated, because those assets are impaired as of today. It is basically lighting shareholder funds on fire, if they really were to acquire Taubman at the original terms from February.

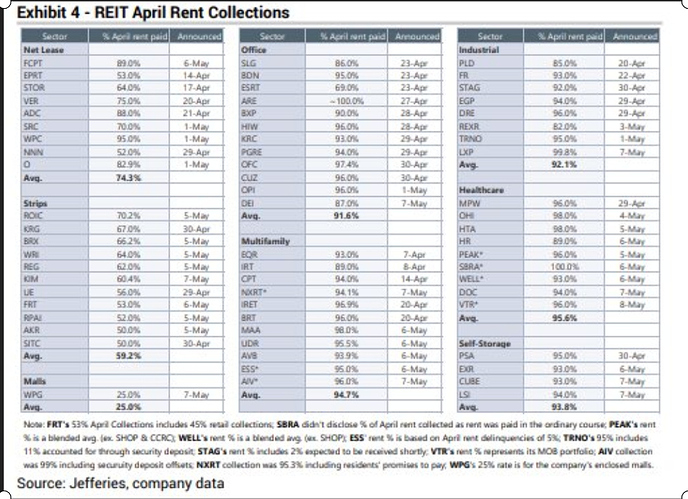

If I were to sell Simon Property Group, and keep the money in REITs, I would probably replace it with W.P. Carey (WPC) or Realty Income (O). The first one received a 95% collection rate on rent, while the second company collected on 83% of rent in the most recent month. Sadly, National Retail Properties (NNN) collected only 52% of rent last month. I believe NNN is at a high risk of a dividend cut. I will turn off the DRIP for this stock too.

This is an interesting chart I found on Twitter, which shows April rent collection rates. If you want to think about which dividend is at risk, think about this chart and collection rates. A low collection rate in 12%, such as Tanger Factory Outlets is basically telling you that the dividend is toast (it was suspended today)

Simon Property Group is not on this list, and very likely will not appear on it for some time.

¿Alguien sabe algo de si pagan dividendo o han suspendido?. Muchas gracias.

Parece que aun no han dicho nada.

Muchas gracias Jcs!

En los resultados el CEO dio alguna pista más. Se deduce que no cortarán (o desearían no cortar) más del 50% ![]()

Let me turn to the dividend. The board will declare a second quarter dividend before the end of June and that dividend will be paid in cash. We expect to pay out at least 100% of our taxable income in 2020 in cash. As a point of reference, there had been over 175 public companies who have either suspended or reduced their common stock dividend by 50% or more. We will not be one of those companies.

Vaya palo a los que estaban dentro… Yo que estoy en SPG creo que en este momento es acertado y veo el divi un poco más probable

yo estoy dentro y me da la sensación que la subida ha sido por todos los que compraron con el rumor, y que han vendido ahora que sale la noticia.

por ahora, me quedo.

Han demandando a TCO y a GPS en la misma semana. Igual hay que invertir en firmas de abogados…

Yo voy a largo plazo y creo que SPG va a seguir existiendo, al igual que O, ha tenido muchos vientos en contra, pero es de las empresas que seguirá en el futuro, las personas creo que continuarán yendo a los centros comerciales, el dividendo posiblemente lo recorten, estas subidas de los últimos días seguramente han sido por lo de TCO, tanto O como SPG cuentan con calificación A por parte de S&P, son empresas de calidad que sobrevivirán.

Tirando de cotización los reit tienden a probar el suelo cada varios lustros o décadas. Ya pasó en la anterior crisis y está pasando en esta.

Históricamente ha sido rentable invertir en ellos pero hay que asumir mayores movimientos en la cotización y suspensión de dividendos según los ciclos económicos.

A pesar del cambio de hábitos por el covid 19 y de la pérdida de capacidad adquisitiva de muchas personas al perder sus empleos, en el futuro se recuperarán los viejos hábitos y el consumo.

Coincido en el análisis, más importante que nunca mantener la perspectiva del largo plazo, comprar en momentos difíciles conlleva más riesgos pero a la larga mejores rentabilidades

Yo he construido medias posiciones estos meses en SPO y O, el retail va a seguir existiendo y han cotizado barato. Lastima SPG que la he comprado 2 de las veces en maximos mensuales pero bueno, si vas a largo de verdad un 5-10% arriba o abajo en una compra, dentro de 10 años deberia dar igual.

Espero noticias del dividendo a ver cuanto lo recortan.

¿Del divi nada aún no? Dijeron antes de final de junio así que lunes o martes deberían decir algo…