Por si a alguno le interesa.

Morningstar

Michael Hodel

Director

Analyst Note | by Michael Hodel Updated Nov 06, 2019

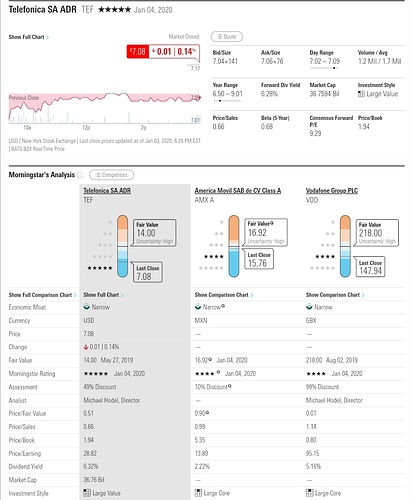

Telefonica’s gradual top-line recovery continued into the third quarter, with reported revenue increasing 1.7% year over year, the first growth in more than two years. Results improved in Spain, Germany, and Brazil, while currency pressure in Latin America also eased. We don’t expect significant changes to our EUR 12.50 per share fair value estimate, and our narrow moat rating is unchanged. We continue to believe the shares are significantly undervalued.

In Spain, revenue grew 1.0%, modestly accelerating versus the past several quarters. Telefonica’s effort to drive more customers to its fiber-based network has helped lift revenue per customer, even as efforts to bundle multiple services (its Fusion offering) have slowed. Fusion added only 10,000 net new customers during the quarter, its weakest showing since 2017, but average revenue per customer increased 1.6% versus a year ago to a record EUR 90.60 per month. Wholesale revenue growth also accelerated as this business continues to rapidly transition to the fiber network. Telefonica took a large charge in Spain during the quarter related to employee separations, which the firm expects will add nearly two percentage points to margins in the country. Excluding this charge, the EBITDA margin was roughly flat versus a year ago at 40.1%.

Telefonica’s business in Germany showed nice improvement during the quarter, with revenue up 1.9% year over year. The prepaid business has stabilized over the past couple quarters after nearly two years of heavy customer losses, while revenue per prepaid customer increased nearly 9% year over year. The firm also continues to add postpaid customers at a steady clip, though revenue per customer remains under pressure in this segment. Margins in Germany continue to contract, absent accounting changes, but the pace has slowed, as EBITDA in the country declined less than 1% year over year.

Business Strategy and Outlook | by Michael Hodel Updated May 27, 2019

Telefonica has faced upheaval in Spain (about a quarter of total revenue) over the past decade, where economic turmoil and fierce competition have cut the firm’s revenue by 40%. It remains the dominant telecom carrier in the country, however, at more than twice the size of its closest rivals, Orange and Vodafone. In Latin America (more than 40% of revenue), Telefonica is, along with America Movil, one of two dominant operators. The remainder of the business resides in Germany and the U.K., where it holds solid market share, but its position isn’t as strong. We don’t expect Telefonica will produce much growth in the coming years, but it should generate solid cash flow, enabling debt reduction and a steady dividend.

Telefonica has been a leader in delivering converged offerings, bundling fixed-line Internet access, pay TV, and wireless services. The firm has led the way in laying fiber in order to increase broadband speeds, passing around 22 million customer locations, nearly the entire country. Telefonica holds about 40% share of the Internet access market directly and roughly another 10% through wholesale partners, including Vodafone. Telefonica is also the largest wireless carrier in Spain, with about 30% market share, a position that should strengthen further as it increasingly ties fixed-line and wireless services together.

Elsewhere in Europe, Telefonica is primarily a wireless carrier, leaving it at a relative disadvantage. The firm consolidated the German market with the acquisition of E-Plus, but growth in margins have remained anemic. Telefonica also attempted to exit the U.K., but so far has been unsuccessful.

In Latin America, Telefonica’s 74%-owned Brazilian subsidiary holds a dominant position in the wireless business, with more than 40% share of postpaid market. The firm holds a sizable position in the fixed-line business as well. Beyond Brazil, Telefonica holds solid positions in Argentina, Chile, and Peru, but it has struggled elsewhere. The decision to sell off operations in Central America should improve the firm’s focus in the region. Economic and political struggles remain the biggest issue facing Telefonica in Latin America, though.

Economic Moat | by Michael Hodel Updated May 27, 2019

We believe Telefonica has a narrow moat based on cost advantages and efficient scale. The firm is one of the largest telephone operators in the world. It dominates its home country of Spain with market shares of about 40% and 30% in the Internet access and wireless markets respectively. The firm also serves about 10% of the Internet access market though wholesale partners, including Vodafone. Telefonica has rebuilt much of its fixed-line infrastructure in recent years, replacing copper facilities with fiber optics, enabling far faster data speeds and improved reliability. The wholesale relationship with Vodafone speaks to the scale advantage Telefonica enjoys in Spain. Vodafone acquired Ono, the largest Spanish cable company, in 2014 but has chosen to partner with Telefonica to resell fiber-based services rather than invest heavily in its cable networks.

Telefonica’s deep fiber infrastructure should also serve it well as wireless data services increase in popularity. Future generations of wireless technology will likely need robust fixed-line networks to function most efficiently. The firm is already aggressively moving customers into packages that combine fixed-line and wireless services, which should increase customer loyalty and improve returns on network investments. Despite Spain’s weak economy and reduced revenue from a few years ago, Telefonica’s EBITDA margin in the country, at around 40%, is among the highest in Europe. In addition, the firm’s size allows it to get better pricing on handsets and equipment than smaller operators.

In many Latin American wireless markets, Telefonica competes with America Movil and one or two far smaller rivals. In Brazil, which accounts for about half of its revenue in the region, Telefonica dominates the wireless market. It holds a bit more than 30% customer share overall in a four-player market, but this figure understates its position. The firm claims 40% of the postpaid market, leaving much of the far less lucrative (and rapidly shrinking) prepaid business to rivals. As a result, Telefonica Brasil generates nearly twice as much revenue as its closest competitor. The firm also holds significant assets in the Brazilian fixed-line business, claiming about a quarter of the Internet access market. Much of the firm’s network is lower quality, though, and it has struggled to maintain share against America Movil’s cable business.

In Germany, Telefonica Deutschland is the largest wireless carrier following the 2014 acquisition of E-Plus. That deal also reduced the number of players in the market to three, a level that typically facilitates rational competition among carriers. However, Deutsche Telekom, as the incumbent phone company, and Vodafone, via the acquisition of Kabel Deutschland and pending Liberty Global transaction, have pursued aggressive convergence strategies. Average revenue per wireless customer at Telefonica Deutschland has drifted steadily lower since the E-Plus deal, limiting growth and profitability. Also, Germany is currently holding a spectrum auction that has drawn the interest of potential new entrant 1&1 Drillisch. Bidding in the auction has been very aggressive.

Fair Value and Profit Drivers | by Michael Hodel Updated May 27, 2019

We are reducing our fair value estimate for Telefonica’s ADR to $14 from $14.50, primarily as a result of a higher valuation ascribed to minority owners in its subsidiaries, including Telefonica Deutschland and Telefonica Brasil. We use an exchange rate of EUR 0.89 to the dollar as of May 25, 2019.

With currencies in Brazil and Argentina stabilizing somewhat, we expect Telefonica will reports only a small decline in revenue (less than 1%) during 2019, with positive growth in local currencies in all major countries. Beyond 2019, we believe Telefonica can accelerate growth in Spain as the benefits of its converged service offering begin to clearly outweigh revenue pressure from the decline of legacy phone services and the impact of termination rate cuts. We don’t expect much growth in the U.K. or Germany. While we expect Latin America’s subscriber growth to slow, we think increasing data revenue usage will enable revenue growth to improve in the region, but this assumption also depends on the heath of these economies. Overall, we expect revenue growth to average about 2% annually from 2020 through 2023.

Telefonica remains ahead of schedule on integrating its acquisitions of E-Plus in Germany and GVT in Brazil, which is benefiting its margins. However, we don’t expect much long-term margin expansion relative to recent results, outside of the impact of the new lease accounting standard. We expect Telefonica’s EBITDA margin to reach about 34% in 2023 versus 32% in 2018, which implies roughly flat margins given the new lease standard. Management also stated it expects its capital expenditures to fall to about 15% of revenue in 2019. We expect spending will hold near this level over the next few years.

Risk and Uncertainty | by Michael Hodel Updated May 27, 2019

Telefonica operates in mature markets that offer only modest growth opportunities, yet competitive pressures often force the firm to invest heavily in network equipment and spectrum or cut prices to retain customers. In Latin America, economies and currencies are notoriously volatile. For example, the firm generated EUR 4 billion in revenue in Venezuela as recently as 2013; the firm has virtually written off this business. Other currencies in Latin America dropped significantly during 2014 and 2015, with additional declines in 2018 from the Brazilian real and the Argentine peso. In short, Telefonica produces modest revenue growth in good times and can see significant declines during periods of stress.

Telefonica operates with a relatively heavy debt load. After several years of reducing leverage, net debt still stands at more than 2.6 times EBITDA. This level leaves little cushion against a downturn in the business, especially given that the firm pays out around 60% of free cash flow in dividends to shareholders. In 2016, Telefonica cut its dividend from EUR 0.75 per share to EUR 0.40 in order to provide more cash to reduce debt. There is some concern in the market that the dividend could be cut again, but we believe management will maintain it.

Stewardship | by Michael Hodel Updated May 27, 2019

We believe Telefonica’s stewardship is Standard. In 2016, longtime CEO Cesar Alierta stepped down and was replaced as CEO and chairman by Jose Maria Alvarez-Pallete Lopez, who has held many executive positions with Telefonica in both Latin America and Europe. Most recently, he was the firm’s COO. CFO Laura Abasolo Garcia de Baquedano started at Telefonica in 1999 and has served in many finance positions. Prior to Telefonica, she worked at Goldman Sachs.

We think the huge premium paid for Portugal Telecom’s stake in Vivo and the ensuing debt expansion–which led to the elimination of the 2012 dividend–demonstrate that management doesn’t always act in the best interest of its shareholders. There was a time when we considered Telefonica to have one of the best management teams in European telecom, but no longer. That said, we think management has learned from its mistakes. We believe the prices paid for E-Plus and GVT were much more reasonable, with a clear strategic purpose. We also like its convergence and fiber strategy, where it has led the way. Telefonica has also made good on its pledge to repair the balance sheet and maintain an appropriate dividend policy, despite challenging market conditions.