Con la última subida de dividendo trimestral (de $1.13 a $1.19) fijo que es JNJ

Boomer: dícese de la persona que al despertar prefiere una taza de café a tener sexo.

Sexo por la mañana, entre semana?? Pero qué somos, actores porno o algo??

¿Sexo? Juas!! Yo estoy casado y con un niño…

Yo por la mañana prefiero que lo más verde en google finance sean ADM, BATS e IMB por ese orden

Ya no hay esperanza para mi

![]()

![]()

Este año no me está gustando nada levantarme de la cama

![]()

https://twitter.com/TCII_Blog/status/1684279938537467906

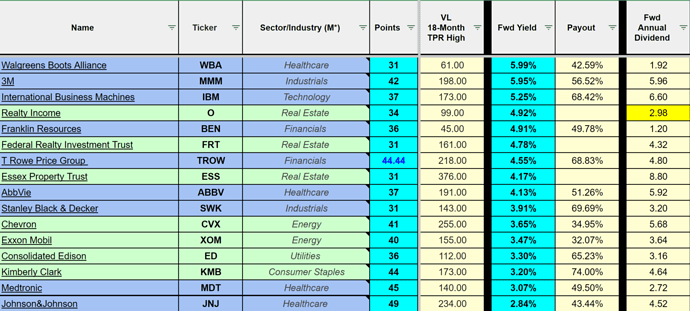

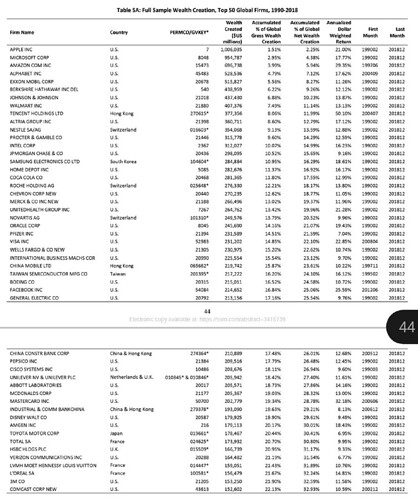

Treat Table 5A as your Master List and go from there.

¿El tabaco también? ![]()

No

Do not buy the IPO. Check out the stock a year later, and if you’re still interested, buy it at the 30-50% lower price then.

It’s “One Weird Trick” that works over 90% of the time.

Over the past 45 years, United States small-cap value indices have delivered 12.2% annual returns. This is perhaps the hardest index to beat over a lifetime, and perhaps should be the go-to investment in a 401(k) plan consisting of index fund offerings.

![]()

![]()

![]()

Ben Graham, directly influenced by the Great Depression, recommended a minimum floor of 25% of one’s household assets in high-quality bonds/Treasuries. From 2008 through 2022, it was understandable to ignore both the letter and spirit of this recommendation when rates were unfathomably low from a historical point of view. Now, with rates above 5%, investors can use the present time to increase their Treasury holdings and cure any imbalance that may have arisen during the generation of super-low rates. Also, your household can probably handle recessions better if you have a meaningful source of guaranteed assets throwing off $4 to $5 per month on every $1,000 invested accordingly.