La pregunta es, que ETF me permite comprar clicktrade que tenga respaldo en plata fisica, porque cada vez hay menos opciones.

Si alguien me puede ilustrar…

Muchas gracias.

Edito: he visto que First Majestic si que me deja, ¿alguna opción mas?

En ING tienen el que debería ser el más extendido en Europa:

ETF SECURITIES PHYSICAL SILVER

Cotiza en Milán.

Biblia del Silver Squeeze para retards

Silver: the Epitome of Wall Street manipulation & Its Achilles’ heel - Why the AG short squeeze is very possible:

-

Naturally occuring, available quantity of gold/silver has a ratio of 1:8, yet the price ratio is 1:70! This ratio could drop massively, increasing the silver price. That’s not all (credits to u/Mintmoondog): Remember, silver is significantly lighter than Au, so most of the historic Ag mines were nearer the surface of the earth - most of those have been depleted and today over 2/3 of Ag is mined as a by-product of other mines. The actual above ground number of ounces of silver is LESS than Gold! That is because over 40% of annual mining production of Ag is consumed (non-recoverable). The above ground inventory is so tight that a small group of autists and retards could theoretically wipe out most dealers’ inventory in 30 minutes, using pocket change. This pushes the dealer to pressure the spot price.

-

Green & other future technologies will require a lot of silver for efficiency purposes, since it’s the absolute best element to conduct electricity and has other unique properties that no other element can substitute. Many central banks (ECB & FED) have talked about “green QE ” = buying corporate stocks that produce green energy technology = Central bank indirectly funds the future silver short squize!

-

Silver is still 50% down from its all time high 10 years ago! The quantity of silver mined has been far lower (end even decreasing) than the increase in inflation, and silver is a good hedge against BOTH inflation AND deflation , historically speaking. If accounted for monetary inflation, the natural equilibrium price should be around 1000$ , but this can be pushed higher due to the massive short interest of the bullion banks. They already made loss from their silver shorts in 2020, but that was a fraction of the short interest they still have.

-

Historic justice. Silver price has been artificially kept down for nearly 100 years. First by the US government from 1935-1970, because it was too effective as a hedge against inflation. Afterwards, and this was confirmed by wikileaks, the US & London bankers took over this role by pushing the creation of the precious metals section at the COMEX, so that banks could artificially keep the price down. You see, they let the COMEX or LBMA sell future contracts and options, and each time many contracts are near expiry and ITM (profitable), they pull a massive naked short. This has been going on for 50 years. But unlike the G** stock, it IS FUNDAMENTALLY UNDERVALUED.

-

The precedent. The silver squize has happened before - when it went from 6$ → 50$ from 1979-1980 - due to the Hunt brothers hoarding the physical and buying more via futures that were supposed to be delivered. But before this delivery, the COMEX changed the rules and demanded futures had to be backed by margin, which is why the brothers got an engineerd margin call. This caused the markets to panic-sell their silver, which ended the squize. If 2 brother can realize the silver squize, it could be possible retailers did the same: Silver Thursday - Wikipedia. Important to note here: the Hunts probably achieved their play because they uno-carded the big bullyon banks. More in this, and the legal details, here (p60-70): https://www.cftc.gov/sites/default/files/idc/groups/public/@swaps/documents/file/hrep97-565.pdf.

-

The retarded game of musical chairs. They have so much short interest, and vastly overstated stored silver reserves (due to double counting & other deceptive accountancy practices), that ther’s an ENORMOUS divergence between silver traded on paper and actual, physical silver: around 200-400x more paper silver than physical. GME is nothing compared to this. If every autistic retard here demands physical delivery or, even if staying stored in a vault, demands that their silver may not be lent out, the short squize of short squizes could easily be realized.

-

What if there’s not enough Silver? If they can’t hand over the physical silver, they will legally still be obligated to pay the price of that silver at the moment you exercised your ITM option/contract! But it gets better! If they indeed fail to deliver physical, they have to pay you the gains you made + a premium (extra money), to sort of buy you out of demanding the actual silver. If enough people would use their collective retardedness to decline this premium, the premium would only go up, as would the silver price! And since the counterparty of these options and contracts mostly are big investment banks, they absolutely have the $ to pay for this. Seems like a way more effective wealth transfer than stimmy.

-

Backwardation (or retardation for us) & Shadow contracts. Backwardation is the divergence between the spot price (= buy directly at this moment) and the futures price (buying in the future), more specifically, it means that the current price of spot is higher than the futures price. This is unnatural, and certainly in the present macro-economic environment, since it implies that financial actors expect that the price will drop. So why did we experience a lot of backwardation last year, during a bull run? Simple: there was such a strong demand that is was easier for providers to deliver later, since they didn’t have enough physical in inventory. More backwardation = more signs that there is a lack of actual physical inventory. In fact, there were many signs that the backwardation and actual demand that was (effectively) physically delivered, was suppressed with the use of “shadow contracts”. These contracts are probably deliveries of physical that they try to hide with big boy accountancy tactis. Increase in backwardation and shadow contract = squize squizing squizier till it will be squozed. It’s complicated but here’s a great source that explains this: Shadowcontracts and a History of Comex Manipulation in 2020. – Desogames.

-

Can’t issue more silver - unlike the fact you can issue more stocks! Furthermore, it’s an extremely safe store of value - as electronic means of payment ahem are dependant on electricity. When silver starts to moon, states - especially

authoritarian states - will scramble to get a strategic supply and thus feed us many a tendies. Also, it is an amazing hedge against the unavoidable, future inflation, which is necessary to monetize our global debt. Physical ownership also deters paper hands. Lastly, it takes YEARS to properly set u a mine. Today, there’s also a growing risk

authoritarian states - will scramble to get a strategic supply and thus feed us many a tendies. Also, it is an amazing hedge against the unavoidable, future inflation, which is necessary to monetize our global debt. Physical ownership also deters paper hands. Lastly, it takes YEARS to properly set u a mine. Today, there’s also a growing risk

states will nationalize their mines, further constricting supply. More on this from Silver billionaire Kaplan, who is now bullish silver again: https://www.youtube.com/watch?v=hvb-wvVl2D8.

states will nationalize their mines, further constricting supply. More on this from Silver billionaire Kaplan, who is now bullish silver again: https://www.youtube.com/watch?v=hvb-wvVl2D8. -

Alpha

JPM has our backs! JPM, due to its actions, is on a tight rope above a valley of agressive criminal lawsuits - for at least the coming few years. It has therefore ended most silver shorts and now only holds physical silver - while they used to often hold 90% of all silver shorts in years before. They know they can’t short anymore, because the schmuckery needed to manipulate such fundamentals would be gravely persecuted. This is great. The shorts have been taken over by smaller, Melvin-like institutions. These already showed they are way worse at manipulating. They are NOT too big to fail. The point is, JPM will ride the wave with us, since the worth of their own pyhysical would then grow multiples! We will ride the alpha

JPM has our backs! JPM, due to its actions, is on a tight rope above a valley of agressive criminal lawsuits - for at least the coming few years. It has therefore ended most silver shorts and now only holds physical silver - while they used to often hold 90% of all silver shorts in years before. They know they can’t short anymore, because the schmuckery needed to manipulate such fundamentals would be gravely persecuted. This is great. The shorts have been taken over by smaller, Melvin-like institutions. These already showed they are way worse at manipulating. They are NOT too big to fail. The point is, JPM will ride the wave with us, since the worth of their own pyhysical would then grow multiples! We will ride the alpha

to fuck the beta

to fuck the beta

. More on this, here: The Silver Shorts’ Last Stand? | SilverSeek

. More on this, here: The Silver Shorts’ Last Stand? | SilverSeek -

Technical case . If the above wasn’t enough, there’s also a very strong technical case to be made, my fellow technicals-loving-autists. The bull run is written in the stars, as technical patterns and indicators predict it better than the chance your wive’s boyfriend will eat your tendies and slap her ass behind your back. These are the technical analysts and chartists that provide invaluable information:

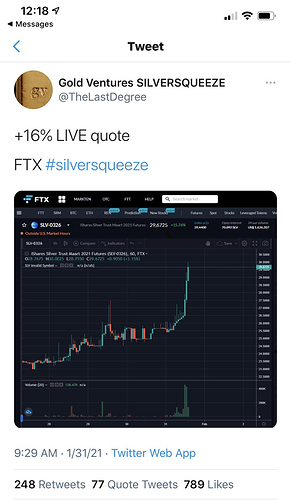

A) https://twitter.com/TheLastDegree (Michael Burry of precious metals)

B) https://twitter.com/badcharts1 (![]()

![]()

![]() )

)

C) https://twitter.com/Northst18363337 (![]() +:comet:)

+:comet:)

Buy? 100% physical-backed futures/options or just pure physical silver = a ) SLV calls - b) PSLV , c) AG & d) Miners (= less effiencient, since miner stocks follow the spot price.) e) Delivery from warehouses for you rich autists that can take them without margin.

!! DON’T BUY CDF’s or FOREX Silver or unbacked futures/option - they’re NOT backed and could prove worthless + they facilitate naked short manipulation !!

Signs the paper ponzi is already imploding: https://kingworldnews.com/no-silver-liquidity-in-london-this-could-destabilize-all-gold-silver-contracts/ .

As of writing, the spot price of silver already rose from $24,8 on 28/01 to 27,6$ on 29/01 . This is just the beginning. Give me Silver and tendies or give me death!

Debería haber una norma en este foro y es que cuando uno va a lanzar un ladrillo.

Resuma antes el impacto del mismo.

La caída de hoy puede haberse debido al cierre de cortos en valores con menos pérdidas preparándose para afrontar la embestidas de los Reddit??

Creo que las bolsas se van a agitar un poco, no vemos aún la magnitud de lo que ha sucedido

Es evidente que se están cerrando muchas posiciones cortas por miedo, y eso está haciendo salir mucho dinero del mercado

El cierre de cortos son compras, por eso suben las elegidas ( GameStop, AMC, etc…). Pero para comprarlas necesitan cash que lo obtienen de ventas, por eso (entre otras razones) baja el resto del mercado.

Y nos está jodiendo a la mayoría…

Y los cortos conllevan casi siempre (lo mismo me equivoco que no controlo las opciones) apalancamiento, al cerrar los cortos, también se está reduciendo el apalancamiento y, por tanto, el dinero que corre por la bolsa. Evidentemente, a eso hay que sumarle que el resto del dinero se está yendo a unas pocas elegidas

Me encanta. Menudo resumen!!. El único pero que le pondría es que no sigáis al twittero C. Llevo tiempo haciéndolo y sus gráficos son inútiles para intentar predecir. Como mucho sirve para que te detecte los puntos clave de inflexión donde o despega el precio o se despeña.

Con respecto a que esto esté haciendo bajar las bolsas…deberíais alegraros. Yo tengo una cartera de plata que es más de la mitad de la cartera de dividendos. La tengo hecha y solo quiero que suba de precio. Es una cartera especulativa y solo quiero incrementos de precio. En cambio, la cartera de dividendos está en construcción. Solo quiero que baje o se mantenga durante años. Los días que sube la bolsa y baja la plata me fastidian bastante. Me fastidian doblemente. En cambio los días que sube la plata y baja la bolsa son una fiesta. Aunque el balance final del día sea el mismo que en el anterior. La plata es para venderla, la cartera de dividendos NO. Eso marca una diferencia enorme.

¿Tu cartera se compone únicamente de ETFs de plata y mineras o tienes también plata física, acciones individuales de Junior/Major producers…?

La parte principal de mi cartera son ETNs apalancados de plata. Ahora mismo el mayoritario es a 2X y luego el 3X. En los últimos meses metí algo en mineras grandes y conocidas, entre ellas First Majestic, y más últimamente cantidades más pequeñas en Juniors canadienses. Estas últimas son casi testimoniales pero tienen un potencial muy alto.

No he hecho los deberes con las mineras. He copiado. Las considero como una única posición. Se compran juntas y se venden juntas. Si una me da un 300% y otra -99% pues me doy por satisfecho con el resultado global.

Interesante. A ver qué ocurre durante el lunes con el precio.

Según estoy leyendo en varios lugares, no sólo pasa en USA, aquí también nos animamos: “Después de la atención mediática acaparada por el subforo de Reddit, en España han surgido grupos en diferentes plataformas como Telegram, con el fin de “replicar el efecto Reddit en bolsa española”. El pasado viernes, uno de ellos contaba con ya con unos 4.000 usuarios.”

Si alguien se entera de algo que comente  , sería buena forma de sacar muertos del armario, que en el IBEX hay muchos

, sería buena forma de sacar muertos del armario, que en el IBEX hay muchos

Sprott Physical Silver Trust (PSLV)

WisdomTree Physical Silver (PHAG)

Ambos tienen soporte físico detrás. Dependiendo de cuantas acciones tengas hasta puedes pedir que te envíen la plata a casa.

Los de WSB parece que están boicoteando todo lo que tenga que ver con la plata para que los “retards” no se despisten y se centren en $GME.

Se ha creado una nueva página:

Tiene esto una pinta de irse para arriba…veo EN TODOS SITIOS a gente hablando del silversqueeze…

A ver como abre mañana. Los dealers no están cogiendo mas ordenes de plata fisica durante el fin de semana…algo que no habia pasado nunca anteriormente

Lol no había visto este hilo. Yo le metí el viernes a $AG poco más de $1K a $18.72

Empiezo a palpar euforia, muchos nos meteremos y quizás un tiempo de buenos resultados,pero cuidado porque no se sabe las consecuencias, saludos