Dividend Talk is a weekly podcast where two europeans discuss Dividend Growth Investing and related news about the stock market from within our community.

https://anchor.fm/dividend-talk/episodes/EP-40--Should-Dividend-Investors-be-worried-about-rising-interest-rates-et1olm/a-a50b1mq

Episode 40 is another Jam Packed Episode with news on some of our favorite companies such as Danone and Nike. Our main topic addresses investor sentiment regarding rising interest rates. And finally, we answer questions from the Community.

EMF (Engineer My Freedom) discusses:

EMF (Engineer My Freedom) discusses:

- The Roblox IPO and if he is buying shares

- Nike Earnings

- Diageo’s Expansion in the US market

EDGI (European Dividend Growth Investor) discusses:

EDGI (European Dividend Growth Investor) discusses:

- Emmanuel Faber, Danone CEO, quits after investor pressure

- Starbucks and the “rejected” $50 million reward proposal

For the main topic, we discuss the difference in Inflation and Interest Rates and what this means for Dividend Growth investors.

11 Me gusta

https://anchor.fm/dividend-talk/episodes/EP-41-Are-Intel-a-Classic-Turnaround-company-etjr9a

EMF Discusses

EMF Discusses

- Suez Canal

- European companies at loggerheads with China

EDGI Discusses

EDGI Discusses

- Siemens Healthineers acquisition

For the main topic, We discuss our latest thoughts on Intel

1 me gusta

https://anchor.fm/dividend-talk/episodes/EP-42---Q1-2021-Portfolio-Review-eu4dss

EMF Discusses

EMF Discusses

- WBA Earnings

- Microsoft army contract

.

EDGI Discusses

EDGI Discusses

- TMSC $1oo Billion Dollar Investment

For the main topic, both hosts discuss their purchases and sales over the last 3 months, who the top performers are, and also how far to financial freedom they are.

4 Me gusta

https://anchor.fm/dividend-talk/episodes/EP-44--A-conversation-with-Ian-Lopuch-about-Dividend-Growth-Investing--Part-2-ev1tpa

In part 2 of this series we chatted about the following topics which were mainly driven by the listener questions:

- What Retail investors could be more aware about

- How PPC Ian developed his strategy over the years

- Whether he owns any Tech stocks and his thoughts about investing in Tech

- Philosophy regarding cash

- His thoughts about Danone vs Nestle

- How to avoid value traps

- How to engage kids with investing

- The sweet spot for dividend yield and dividend growth

2 Me gusta

El podcast (especialmente esta segunda parte) me ha parecido una “joyita”. Posiblemente no se explique nada que no sepamos ya a estas alturas pero este pollo (“Ian”) es un gran comunicador. Aunque se enrolla como una persiana en cada respuesta es admirable la forma que tiene de refrescarnos los conceptos más fundamentales de la estrategia DGI basándose en su propia experiencia vital. Altamente recomendable.

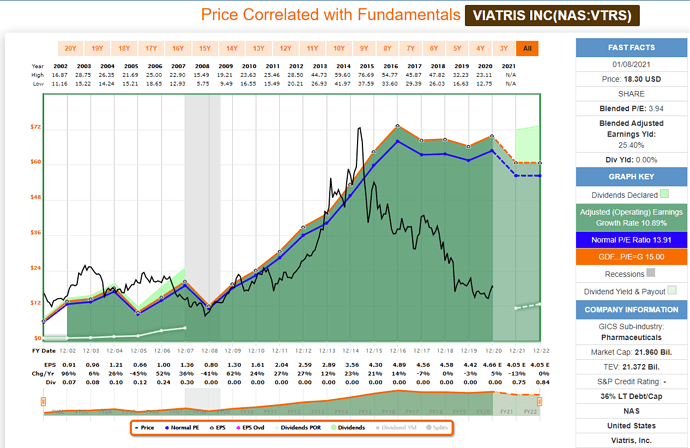

p.s. en su opinión Viatris es un chollo ahora mismo

4 Me gusta

en un video de Chuck Carnevale, este tambien considerabab que Viatris estaba “tirado” de precio… Lo que no me queda claro es si sería una estrategia de comprar y acumular o comprar esperando que vuelva a su valor mientras cobras dividendos y una vez en precio vender con plusvalias.

2 Me gusta

Este es un gráfico de principios de año cuando cotizaba a 18.30$. Ahora lo hace a 13.40$.

Me suena que tenían intención de pagar su primer dividendo en Junio. Alrededor de 0.11$, lo que vendría ser un yield del 3.30%

5 Me gusta

https://anchor.fm/dividend-talk/episodes/EP-45--Q1-Earnings-2021--T-NESN-KO-BN-INTC-OR-IBM-KMB-eviah2

EDGI shares news on a potential merger with Chubb

EDGI shares news on a potential merger with Chubb

EMF shares his reflection on the European Superleague. Do you think it was a good Idea?

EMF shares his reflection on the European Superleague. Do you think it was a good Idea?

Main topic:

A brief look at the different companies reporting their Q2 2021 earnings. $T, SWX: NESN, $KO, $BN , $INTC , EPA: OR, $IBM and $KMB

2 Me gusta

https://anchor.fm/dividend-talk/episodes/EP-46---Small-Cap-Dividend-stocks-with-Russ-from-Dapper-Dividends-e101jqp

A new episode in which we discuss investing in small cap dividend stocks. Special guest: Russ from Dapper Dividends.

https://anchor.fm/dividend-talk/episodes/Ep-47--More-Q1-Earnings-2021-e10gq0p

EDGI chats about the performance of last years growth darlings

EDGI chats about the performance of last years growth darlings

EMF jokes that IBM are back as they share some positive news regarding 2nm chips

EMF jokes that IBM are back as they share some positive news regarding 2nm chips

Main topic:

A brief look at the different companies reporting their Q2 2021 earnings.

$CVS, ETR: MUV2, $ABBV, $O and AMS:DSM

https://anchor.fm/dividend-talk/episodes/EP-48---Growth-investing-with-Wolf-of-Hardcourt-Street-e10u4c3

In this episode, we chat with the wolf of Harcourt street.

Wohs is an Irish resident but has a different approach to investing from EMF.

Muy interesante el podcast de este fin de semana con un invitado que ha abandonado temporalmente el DGI para centrarse en el value y el growth (por motivos principalmente fiscales)

2 Me gusta

https://anchor.fm/dividend-talk/episodes/Ep-49--Are-we-buying-or-selling-ATT--And-more-CSCO-ABBV-Listener-questions-e11c7kn

We start a little off-topic as we both discuss Eurovision and why it’s our guilty pleasure.

We discuss ABBV who have been in the news in the US before rounding up the news of the weeks with a look at CSCO earnings.

Main topic:

We both give our take on AT&T spinning off its WarnerMedia segment. Is it a good deal and which one of us is holding and which one is selling?

3 Me gusta

https://anchor.fm/dividend-talk/episodes/EP-50-Has-Bayer-made-the-worst-acquisition-of-the-decade-e11pgom

In this episode, we discuss Bayer and its acquisition of Monsanto. With the ongoing litigation, is this the worst acquisition of the decade?

3 Me gusta

Debe estar ahí ahí con WarnerMedia

1 me gusta

DirectTV no le debe andar a la zaga…la verdad es que el capital allocation de ATT es un absoluto desastre.

1 me gusta

![]() EMF (Engineer My Freedom) discusses:

EMF (Engineer My Freedom) discusses:![]() EDGI (European Dividend Growth Investor) discusses:

EDGI (European Dividend Growth Investor) discusses: