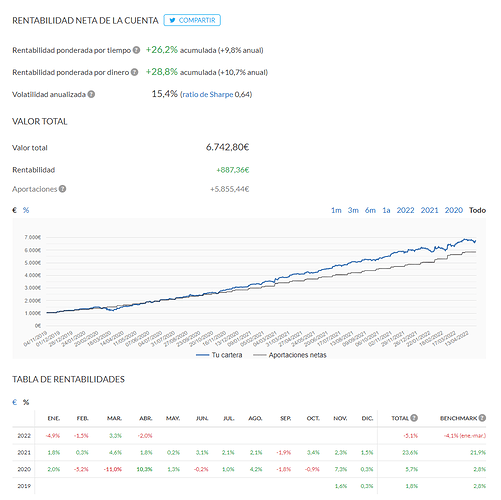

Termina Abril y ya vienen los turistas y la playa y como de costumbre le echamos un vistazo a la cuenta de Indexa de mi hijo. El objetivo para 2039 es de 218.569,10 EUR (¡como sube la inflación! ). Actualmente llevamos acumulado 6.742,80 EUR y la rentabilidad actual es del 10,7%. Aunque ha sido un mes regulero seguimos teniendo rentabilidad de dos dígitos. En fin, aún nos quedan 202 meses por delante y unos 212.000 euros para conseguir el objetivo (cada vez más lejos). La aportación mensual debería ser de 337,09 EUR .

Me quedan 6 meses de euribor negativo en el -0,237%. Asumo que acabaremos el año entorno al 1%. La próxima revisión aplicará en diciembre con la media de octubre; ya veremos que hacemos. Este mes he cobrado el bonus y estoy pensando en entrar en Starbucks. Por otro lado, la cartera se está comportando fenomenal. La más rezagada es Verizon, el resto en verde, incluyendo Gilead y Unilever que vuelven a estar por arriba de lo que las compre, además la fortaleza del dólar ayuda también.

13 Me gusta

@Marcos_Torcal_Garcia para tu hijo inviertes en indexados, pero para ti?

Sigues una estrategia DGI? En que criterios te fijas para comprar o no una accion?

Saludos

Invierto en acciones individuales y también en Indexa. Los criterios seleccionar acciones son solidez financiera, ventajas competitivas duraderas (moat), rentabilidad por dividendo por encima de la media, y un total return esperado de al menos un 10% (en el peor de los casos).

5 Me gusta

Cuando hablas de RPD superior a la media, te refieres que sea superior a la media de los últimos 5 años como creo que recomendaba G.Weiss?. El Total return esperado del 10% lo miras con el número de chowder?

Saludos y gracias

La RPD del sp500 es del 1,5% aprox. Lo que hago es multiplicar este número por 1,5, y me da 2,25%. Me centro en acciones que tengan una RPD mayor que esa aunque no es una regla irrompible.

El total return lo calculo tal como lo hace Josh Peters en su libro The Utimate Dividend Playbook . También me fijo en las estimaciones del Value Line.

5 Me gusta

Muchas gracias Marcos, me leeré ese libro

La lista de la compra de este mes:

SecId

Ticker

Name

Sector

Industry

Currency

Last

Div Yield

Div frequency

M* Moat

M* Moat Trend

M* MoatQ

M* MoatQ Score

M* Stewardship

M* Uncertainty

M* UncertaintyQ

M* UncertaintyQ Score

M* distance to Default

Safety™

Timeliness™

Financial Strength Rating

Technical Rank

Earnings Predictability

Price Growth Persistence

Price Stability

FV

FVQ

M* P / FV

FT Target Price

Upside Potential

Proj Low TTL Return

Proj High TTL Return

Proj % Annual Total Return

18 Month Pricing Band

0P0000000I

XNYS:MMM

3M Co

Industrials

Conglomerates

USD

144.22

4.11%

Quarterly

Wide

Wide

0.9997

Standard

Medium

High

0.1549

0.6959

1

4

A++

4

95

45

95

186.00

165.04

0.822

161

11.6%

14%

19%

17%

30.0%

0P00000016

XNYS:ABB

ABB Ltd

Industrials

Electrical Equipment & Parts

USD

29.87

2.97%

Annually

Wide

Wide

0.9986

Standard

Medium

Medium

0.1339

0.6953

2

2

B++

1

65

30

90

38.00

32.10

0.852

39.33

31.7%

10%

18%

14%

30.0%

0P0000004C

XNYS:ACN

Accenture PLC

Information Technology

Information Technology Services

USD

300.36

1.26%

Quarterly

Wide

Wide

0.9994

Exemplary

Medium

Medium

0.1370

0.7580

1

3

A++

3

100

95

100

258.00

281.69

1.113

390

29.8%

10%

15%

13%

30.0%

0P0000005M

XNAS:ADBE

Adobe Inc

Information Technology

Software - Infrastructure

USD

395.95

—

Quarterly

Wide

Wide

0.9999

Exemplary

Medium

High

0.2843

0.6679

1

1

A+

4

70

95

80

615.00

519.46

0.698

570

44.0%

15%

21%

18%

65.0%

0P0000005S

XNYS:AAP

Advance Auto Parts Inc

Consumer Discretionary

Specialty Retail

USD

199.63

2.25%

Quarterly

Narrow

Narrow

0.9753

Exemplary

Medium

Medium

0.1375

0.6315

3

3

A

3

75

50

50

233.00

209.34

0.903

266

33.2%

10%

21%

16%

30.0%

0P00000075

XNYS:AMG

Affiliated Managers Group Inc

Financials

Asset Management

USD

125.57

0.03%

Quarterly

Narrow

Narrow

0.9703

Exemplary

High

High

0.1753

0.5105

3

3

B++

3

10

15

45

185.00

174.86

0.698

172.5

37.4%

17%

30%

24%

35.0%

0P0000007L

XNYS:APD

Air Products & Chemicals Inc

Materials

Specialty Chemicals

USD

234.07

2.61%

Quarterly

Narrow

Wide

0.9928

Exemplary

Medium

High

0.2537

0.7215

1

3

A++

5

100

70

95

317.00

269.23

0.799

300

28.2%

11%

16%

14%

25.0%

0P00012BBI

XNAS:GOOG

Alphabet Inc

Communication Services

Internet Content & Information

USD

2,299.33

—

—

Wide

Wide

0.9993

Exemplary

High

Very High

0.4673

0.7783

1

1

A++

2

75

100

95

3,600.00

3,006.12

0.696

3150

37.0%

17%

23%

20%

60.0%

0P000000B7

XNAS:AMZN

Amazon.com IncConsumer Discretionary

Internet Retail

USD

2,485.63

—

—

Wide

Wide

0.9993

Exemplary

High

High

0.3063

0.6313

1

1

A++

4

30

90

75

3,850.00

3,225.33

0.703

3760

51.3%

16%

22%

19%

55.0%

0P000000F0

XNAS:AMGN

Amgen Inc

Health Care

Drug Manufacturers - General

USD

233.19

3.10%

Quarterly

Wide

Wide

0.9995

Exemplary

Medium

High

0.1527

0.6745

1

4

A++

4

100

75

100

260.00

234.84

0.942

250

7.2%

12%

18%

15%

10.0%

0P000000FH

XNAS:ADI

Analog Devices Inc

Information Technology

Semiconductors

USD

154.38

1.83%

Quarterly

Wide

Wide

0.9979

Exemplary

Medium

Medium

0.1457

0.6668

1

2

A+

3

80

85

85

172.00

171.96

0.898

208

34.7%

10%

15%

13%

35.0%

0P000000PH

XNYS:BK

Bank of New York Mellon Corp

Financials

Asset Management

USD

42.06

3.23%

Quarterly

Wide

None

0.1919

Standard

Medium

High

0.2746

0.8997

2

2

A

1

90

50

80

55.00

58.38

0.742

54

28.4%

15%

23%

19%

10.0%

0P000000UD

XNYS:SAM

Boston Beer Co Inc

Consumer Staples

Beverages - Brewers

USD

375.00

—

—

Narrow

Narrow

0.9725

Exemplary

Medium

Very High

0.4708

0.5813

3

4

A+

3

25

55

40

740.00

748.79

0.504

388.5

3.6%

14%

26%

20%

30.0%

0P000000YD

XNAS:CHRW

C.H. Robinson Worldwide Inc

Industrials

Integrated Freight & Logistics

USD

106.15

2.00%

Quarterly

Wide

Wide

0.9969

Exemplary

Medium

Medium

0.1352

0.6352

2

5

A

3

65

45

90

96.00

104.33

1.060

115

8.3%

13%

21%

17%

10.0%

0P000001DB

XNAS:CMCSA

Comcast Corp

Communication Services

Entertainment

USD

39.76

2.57%

Quarterly

Wide

Wide

0.9966

Standard

Medium

High

0.1805

0.6148

1

2

A+

4

90

85

100

60.00

56.87

0.680

60

50.9%

18%

22%

20%

40.0%

0P000001BI

XNAS:CSGP

CoStar Group Inc

Industrials

Real Estate Services

USD

63.62

—

—

Wide

Wide

0.9964

Exemplary

Very High

High

0.1704

0.7354

2

3

A+

3

70

95

70

73.00

78.26

0.841

76

19.5%

11%

20%

16%

30.0%

0P0000943F

XNYS:DFS

Discover Financial Services

Financials

Credit Services

USD

112.46

1.73%

Quarterly

Narrow

None

0.6850

Exemplary

High

High

0.3216

0.8649

3

4

A

3

40

75

35

138.00

133.38

0.829

142

26.3%

14%

25%

20%

30.0%

0P000001R9

XNYS:DPZ

Domino’s Pizza Inc

Consumer Discretionary

Restaurants

USD

338.00

1.16%

Quarterly

Wide

Wide

0.9972

Exemplary

Medium

High

0.2242

0.5564

2

3

A

3

95

95

75

416.00

389.93

0.839

427.5

26.5%

10%

18%

14%

60.0%

0P0000020J

XNAS:ERIE

Erie Indemnity Co

Financials

Insurance Brokers

USD

160.28

2.68%

Quarterly

—

Wide

0.9936

—

—

High

0.2793

0.7590

2

4

A

4

95

65

90

—

160.95

0.996

115

-28.3%

10%

17%

14%

45.0%

0P00000232

XNYS:FICO

Fair Isaac Corp

Information Technology

Software - Application

USD

373.51

—

Quarterly

—

Wide

0.9916

—

—

High

0.2889

0.5737

3

2

B++

1

95

90

60

—

379.89

0.983

538

44.0%

10%

22%

16%

50.0%

0P000002AB

XNYS:BEN

Franklin Resources Inc

Financials

Asset Management

USD

24.59

4.64%

Quarterly

Narrow

Narrow

0.8872

Exemplary

High

Medium

0.1372

0.5553

3

3

B++

3

55

5

60

33.00

34.71

0.726

28

13.9%

21%

30%

26%

50.0%

0P000002FD

XNAS:GILD

Gilead Sciences Inc

Health Care

Drug Manufacturers - General

USD

59.34

4.82%

Quarterly

Wide

Wide

0.9989

Standard

Medium

High

0.1717

0.6859

1

2

A

5

25

30

100

81.00

68.34

0.795

69

16.3%

11%

17%

14%

25.0%

0P000002X8

XNAS:INTC

Intel Corp

Information Technology

Semiconductors

USD

43.59

3.23%

Quarterly

Wide

Wide

0.9960

Standard

High

High

0.2893

0.6647

1

2

A++

4

95

70

70

65.00

56.95

0.715

50.5

15.9%

25%

30%

28%

10.0%

0P000004FA

XNYS:LIN

Linde PLC

Materials

Specialty Chemicals

USD

311.96

1.39%

Quarterly

Narrow

Wide

0.9921

Standard

Medium

Medium

0.1395

0.6996

2

3

A

3

–

–

90

333.00

320.91

0.954

370

18.6%

10%

18%

14%

10.0%

0P000003JU

XNYS:MDT

Medtronic PLC

Health Care

Medical Devices

USD

104.36

2.41%

Quarterly

Wide

Wide

0.9986

Standard

Medium

High

0.1572

0.7046

1

3

A++

4

75

80

95

129.00

117.60

0.846

124

18.8%

10%

15%

13%

35.0%

0P0000W3KZ

XNAS:FB

Meta Platforms Inc

Communication Services

Internet Content & Information

USD

200.47

—

—

Wide

Wide

0.9989

Exemplary

High

Very High

0.3808

0.6325

3

1

A+

4

65

95

50

384.00

343.47

0.551

300

49.6%

31%

42%

37%

30.0%

0P000002L4

XNAS:MNST

Monster Beverage Corp

Consumer Staples

Beverages - Non-Alcoholic

USD

85.68

—

—

Narrow

Wide

0.9947

Standard

Medium

Medium

0.1174

0.7592

1

2

A+

5

100

75

90

82.00

80.01

1.058

100

16.7%

10%

16%

13%

25.0%

0P000003ZC

XNYS:NVS

Novartis AG

Health Care

Drug Manufacturers - General

USD

88.03

3.78%

Annually

Wide

Wide

0.9988

Standard

Low

Medium

0.1032

0.7508

1

4

A++

4

55

30

100

91.00

86.22

0.993

105

19.3%

11%

16%

14%

15.0%

0P0000042B

XNAS:OMCL

Omnicell Inc

Health Care

Health Information Services

USD

109.17

—

—

—

Wide

0.9905

—

—

High

0.2795

0.6950

3

3

B++

1

30

100

65

—

125.39

0.871

181

65.8%

11%

23%

17%

55.0%

0P0000043L

XNYS:ORCL

Oracle Corp

Information Technology

Software - Infrastructure

USD

73.40

1.74%

Quarterly

Narrow

Wide

0.9942

Poor

Medium

High

0.2567

0.5955

1

3

A++

2

100

85

95

63.00

76.44

1.053

89

21.3%

11%

16%

14%

20.0%

0P0001KOSE

XNYS:PLTR

Palantir Technologies Inc

Information Technology

Software - Infrastructure

USD

10.40

—

—

Narrow

Narrow

0.9623

Exemplary

High

Extreme

1.0514

0.6189

3

–

B++

–

–

–

–

31.00

22.51

0.389

15.5

49.0%

26%

39%

33%

135.0%

0P00016CGN

XNAS:PYPL

PayPal Holdings Inc

Information Technology

Credit Services

USD

87.93

—

—

Narrow

Wide

0.9905

Standard

High

High

0.2317

0.5812

3

1

A

3

65

90

45

139.00

140.72

0.629

118

34.2%

18%

30%

24%

40.0%

0P000004EA

XNYS:PII

Polaris Inc

Consumer Discretionary

Recreational Vehicles

USD

94.94

2.66%

Quarterly

Wide

Wide

0.9960

Exemplary

High

Very High

0.5776

0.5462

3

5

A

4

55

15

40

184.00

137.72

0.590

133

40.1%

13%

25%

19%

45.0%

0P000004J4

XNAS:QCOM

Qualcomm Inc

Information Technology

Semiconductors

USD

139.69

1.95%

Quarterly

Narrow

Wide

0.9952

Standard

High

High

0.2174

0.5963

3

2

A+

2

60

35

50

163.00

162.56

0.858

200

43.2%

14%

25%

20%

40.0%

0P000003IL

XNYS:SPGI

S&P Global Inc

Financials

Financial Data & Stock Exchanges

USD

376.50

0.82%

Quarterly

Wide

Wide

0.9997

Exemplary

Medium

High

0.1648

0.7755

2

1

A

2

100

95

95

430.00

383.53

0.926

475

26.2%

10%

16%

13%

40.0%

0P000004R4

XNYS:SAP

SAP SE

Information Technology

Software - Application

USD

100.80

2.24%

Annually

Narrow

Wide

0.9948

Poor

Medium

High

0.1832

0.7124

2

3

A

3

85

60

80

141.00

120.06

0.772

141.83

40.7%

13%

22%

18%

30.0%

0P000004XO

XETR:SIE

Siemens AG

Industrials

Specialty Industrial Machinery

USD

117.78

3.72%

Annually

Narrow

Narrow

0.9875

Exemplary

Medium

Medium

0.1317

0.5590

2

3

A

3

80

25

75

145.00

137.37

0.834

175

48.6%

16%

25%

21%

40.0%

0P000004ZF

XNAS:SWKS

Skyworks Solutions Inc

Information Technology

Semiconductors

USD

113.30

1.92%

Quarterly

Narrow

Narrow

0.9769

Exemplary

High

High

0.2467

0.6325

3

3

A

3

70

65

55

210.00

184.50

0.574

165

45.6%

18%

30%

24%

70.0%

0P00000546

XNAS:SBUX

Starbucks Corp

Consumer Discretionary

Restaurants

USD

74.64

2.52%

Quarterly

Wide

Wide

0.9994

Exemplary

Medium

High

0.2039

0.6300

1

2

A++

3

45

70

85

106.00

98.70

0.729

105

40.7%

11%

17%

14%

40.0%

0P0000054E

XNYS:STT

State Street Corporation

Financials

Asset Management

USD

66.97

3.33%

Quarterly

Wide

None

0.1806

Standard

High

High

0.2723

0.8695

3

3

A

1

85

35

60

92.00

93.49

0.722

95

41.9%

14%

25%

20%

60.0%

0P0000059E

XNAS:TROW

T. Rowe Price Group Inc

Financials

Asset Management

USD

123.04

3.61%

Quarterly

Wide

Wide

0.9966

Exemplary

Medium

High

0.1927

0.7503

1

3

A+

4

90

45

85

195.00

194.56

0.632

143

16.2%

18%

23%

21%

50.0%

0P000005AR

XNYS:TSM

Taiwan Semiconductor Manufacturing Co Ltd

Information Technology

Semiconductors

USD

92.93

2.08%

Quarterly

Wide

Wide

0.9993

Exemplary

Medium

Very High

0.5514

0.7971

1

3

A++

2

80

95

75

171.00

130.47

0.617

150

61.4%

10%

18%

14%

75.0%

0P000002VU

XNYS:TT

Trane Technologies PLC

Industrials

Specialty Industrial Machinery

USD

139.89

1.74%

Quarterly

Narrow

Wide

0.9922

Standard

High

High

0.2216

0.6852

3

–

A

–

–

–

55

124.00

148.21

1.028

181

29.4%

13%

25%

19%

40.0%

0P000005M8

XNYS:UL

Unilever PLC

Consumer Staples

Household & Personal Products

USD

46.26

4.33%

Quarterly

Wide

Wide

0.9998

Standard

Low

High

0.1587

0.6649

1

5

A+

4

80

45

100

56.00

48.69

0.884

62

34.0%

16%

21%

19%

10.0%

0P000005P1

XNYS:VFC

VF Corp

Consumer Discretionary

Apparel Manufacturing

USD

52.00

3.81%

Quarterly

Narrow

Narrow

0.9843

Exemplary

Medium

High

0.1584

0.6019

3

5

A

4

50

50

55

68.00

68.81

0.760

71

36.5%

10%

21%

16%

60.0%

0P000005V9

XNYS:WAT

Waters Corp

Health Care

Diagnostics & Research

USD

303.02

—

Annually

Wide

Wide

0.9984

Exemplary

Medium

High

0.1597

0.7003

2

4

A

2

95

90

90

250.00

263.99

1.179

340

12.2%

14%

25%

20%

20.0%

0P00018WBW

XNYS:YUMC

Yum China Holdings Inc

Consumer Discretionary

Restaurants

USD

41.80

1.15%

Quarterly

Wide

Wide

0.9963

Standard

Medium

Very High

0.3878

0.6904

3

–

B++

–

65

90

60

86.00

69.27

0.538

60

43.5%

16%

28%

22%

50.0%

8 Me gusta

Marcos, a ver si te animas a añadir esta lista de compra a la ECSS, a la que por cierto toca rebautizar con otras siglas que tengan más tirón comercial. Sería un formato más amigable.

Tomo nota. A partir del próximo mes añadiré una pestaña con cada mes que entre. Así también podremos ver en retrospectiva si han funcionado bien.

2 Me gusta

Veo que hay dos enlaces funcionando (New List CZD y Lista ECSS). Actualizas únicamente el primero ¿verdad?

List

Name,M* SecID,M* Ticker,GF Ticker,País,Sector,Industry,NA,Points,NA,Moat,Moat Trend,MoatQ,MoatQ Score,M* Stewardship,Uncertainty,UncertaintyQ,UncertaintyQ Score,Distance to Default,NA

CRH PLC,

Este es el bueno. Aparecen la estimación de dividendos futuros y de eps del Financial Times.

Pondré fecha de actualización para que no se pierda nadie.

8 Me gusta

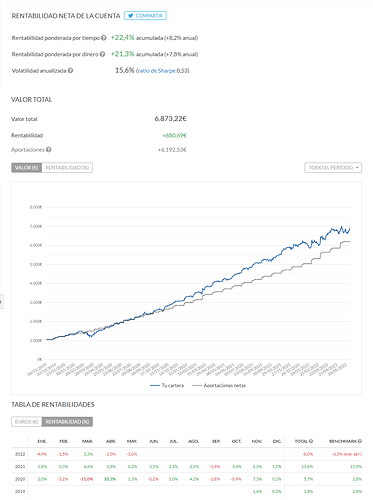

Despedimos Mayo y el calorcito ya aprieta y como de costumbre le echamos un vistazo a la cuenta de Indexa de mi hijo. El objetivo para 2039 es de 218.569,10 EUR . Actualmente llevamos acumulado 6.873,22 EUR y la rentabilidad actual es del 7,8%. Ya se nota la corrección, estamos en rentabilidades más moderadas y sostenibles, aunque con la inflación esto no hay quien lo aguante. En fin, aún nos quedan 201 meses por delante y unos 212.000 euros para conseguir el objetivo. La aportación mensual debería ser de 481,57 EUR .

De momento no he comprado nada. A la espera de pillar algo bueno a buen precio. Sin prisa, intentando evitar errores. Quizá me quite del medio GILD, ya que no estoy contento con ella; fue un error y me precipité. ¿Cometeré un error vendiendo?

2 Me gusta

anbax

1 Junio, 2022 07:52

114

Si que ha cambiado la cosa en un mes

1 me gusta

No te “preocupa” que “donando” tales cantidades mensuales al mes, hacienda te pegue un toque Marcos?

Al margen de esto y como curiosidad también te pregunto: ¿a que es debido esa cantidad objetivo en concreto? Es decir, 200k por algo en particular? (es mera curiosidad)

Un saludo y gracias por lo que aportas.

De momento NO. Si algún día vienen por este tema procuraré hacer todo el ruido mediático posible, y lo pelearé en los tribunales si es preciso.

Es una cantidad razonable para gastar en sus estudios o formación, si es que decide estudiar. Ese dinero es para que tenga más opciones, si quiere irse a USA, a UK o a otro sitio. Aunque si es así seguramente se quede corta (pero paro eso están sus padres también).

Saludos

1 me gusta

la lista de la compra de junio:

SecId

Ticker

Name

Sector

Industry

Currency

Last

Div Yield

Div frequency

Moat

MoatQ

MoatQ Score

Stewardship

Uncertainty

UncertaintyQ

UncertaintyQ Score

Distance to Default

Safety™

Timeliness™

Financial Strength Rating

Technical Rank

Earnings Predictability

Price Growth Persistence

Price Stability

FV

FVQ

M* P / FV

FT Target Price

Upside Potential

Proj Low TTL Return

Proj High TTL Return

Proj % Annual Total Return

18 Month Pricing Band

0P00009QS2

XETR:SIE

Siemens AG

Industrials

Specialty Industrial Machinery

EUR

122.44

3.37%

Annually

Narrow

Narrow

0.9816

Exemplary

Medium

Medium

0.1483

0.5551

2

4

A

4

80

25

75

145.00

137.94

0.87

167.5

37%

16%

25%

21%

25%

0P0000005M

XNAS:ADBE

Adobe Inc

Information Technology

Software - Infrastructure

USD

416.48

—

Quarterly

Wide

Wide

1.0000

Exemplary

Medium

High

0.2561

0.6502

1

1

A+

4

70

95

80

615.00

517.78

0.74

560

34%

15%

21%

18%

15%

0P000000FH

XNAS:ADI

Analog Devices Inc

Information Technology

Semiconductors

USD

168.40

1.72%

Quarterly

Wide

Wide

0.9974

Exemplary

Medium

Medium

0.1187

0.6644

1

2

A+

3

80

85

85

172.00

175.71

0.97

205

22%

10%

15%

13%

25%

0P000000B7

XNAS:AMZN

Amazon.com IncConsumer Discretionary

Internet Retail

USD

2,404.19

—

—

Wide

Wide

0.9991

Exemplary

High

High

0.2895

0.6020

1

1

A++

3

30

90

75

3,850.00

3,398.33

0.66

3500

46%

16%

22%

19%

60%

0P000001DB

XNAS:CMCSA

Comcast Corp

Communication Services

Telecom Services

USD

44.28

2.30%

Quarterly

Wide

Wide

0.9960

Standard

Medium

Medium

0.1456

0.6143

1

2

A+

4

90

85

100

60.00

59.23

0.74

56

26%

18%

22%

20%

25%

0P000001BI

XNAS:CSGP

CoStar Group Inc

Industrials

Real Estate Services

USD

60.94

—

—

Wide

Wide

0.9967

Exemplary

Very High

High

0.1973

0.7241

2

3

A+

3

70

95

70

73.00

76.70

0.81

76

25%

10%

19%

15%

35%

0P0000020J

XNAS:ERIE

Erie Indemnity Co

Financials

Insurance Brokers

USD

167.75

2.56%

Quarterly

—

Wide

0.9940

—

—

High

0.2006

0.7496

2

4

A

3

95

65

90

—

168.00

1.00

115

-31%

12%

21%

17%

25%

0P0000W3KZ

XNAS:FB

Meta Platforms Inc

Communication Services

Internet Content & Information

USD

193.64

—

—

Wide

Wide

0.9987

Exemplary

High

High

0.3423

0.6181

3

1

A+

4

65

95

50

384.00

345.58

0.53

297.5

54%

31%

42%

37%

35%

0P000002FD

XNAS:GILD

Gilead Sciences Inc

Health Care

Drug Manufacturers - General

USD

64.85

4.41%

Quarterly

Wide

Wide

0.9986

Standard

Medium

Medium

0.1156

0.6900

1

2

A

5

25

30

100

81.00

72.20

0.85

68

5%

11%

17%

14%

15%

0P00012BBI

XNAS:GOOG

Alphabet Inc

Communication Services

Internet Content & Information

USD

2,280.78

—

—

Wide

Wide

0.9993

Exemplary

High

Very High

0.4845

0.7653

1

1

A++

3

75

100

95

3,600.00

2,949.09

0.70

3150

38%

17%

23%

20%

60%

0P0000033M

XNAS:KLAC

KLA Corp

Information Technology

Semiconductor Equipment & Materials

USD

364.85

1.15%

Quarterly

Wide

Wide

0.9981

Exemplary

Medium

High

0.1681

0.5832

3

2

B++

3

85

80

45

396.00

386.58

0.93

423

16%

10%

21%

16%

15%

0P000002L4

XNAS:MNST

Monster Beverage Corp

Consumer Staples

Beverages - Non-Alcoholic

USD

89.12

—

—

Narrow

Wide

0.9933

Standard

Medium

Medium

0.1038

0.7726

1

2

A+

5

100

75

90

82.00

84.59

1.07

100

12%

10%

16%

13%

20%

0P00000459

XNAS:PCAR

PACCAR Inc

Industrials

Farm & Heavy Construction Machinery

USD

86.84

1.57%

Quarterly

Narrow

Narrow

0.9781

Exemplary

Medium

Medium

0.1124

0.6616

2

3

A

3

60

50

85

103.00

92.62

0.89

97

12%

11%

19%

15%

15%

0P000004J4

XNAS:QCOM

Qualcomm Inc

Information Technology

Semiconductors

USD

143.22

1.90%

Quarterly

Narrow

Wide

0.9951

Standard

High

High

0.1645

0.5875

3

1

A+

3

60

35

50

163.00

158.13

0.89

200

40%

14%

25%

20%

35%

0P00000546

XNAS:SBUX

Starbucks Corp

Consumer Discretionary

Restaurants

USD

78.50

2.45%

Quarterly

Wide

Wide

0.9993

Exemplary

Medium

High

0.1634

0.5977

1

2

A++

4

45

70

85

100.00

96.39

0.80

89

13%

19%

24%

22%

35%

0P000004ZF

XNAS:SWKS

Skyworks Solutions Inc

Information Technology

Semiconductors

USD

108.87

2.06%

Quarterly

Narrow

Narrow

0.9759

Exemplary

High

High

0.1999

0.6169

3

3

A

4

70

65

55

180.00

161.90

0.64

150

38%

18%

30%

24%

45%

0P0000059E

XNAS:TROW

T. Rowe Price Group Inc

Financials

Asset Management

USD

127.09

3.49%

Quarterly

Wide

Wide

0.9968

Exemplary

Medium

High

0.2619

0.7451

1

3

A+

4

90

45

85

155.00

172.26

0.78

144

13%

18%

23%

21%

45%

0P0000005S

XNYS:AAP

Advance Auto Parts Inc

Consumer Discretionary

Specialty Retail

USD

189.86

2.37%

Quarterly

Narrow

Narrow

0.9686

Exemplary

Medium

Medium

0.1167

0.5945

3

4

A

3

75

50

50

233.00

211.08

0.86

230

21%

10%

21%

16%

35%

0P00000016

XNYS:ABB

ABB Ltd

Industrials

Electrical Equipment & Parts

USD

30.97

2.83%

Annually

Wide

Wide

0.9983

Standard

Medium

Medium

0.1210

0.6931

2

3

B++

3

65

30

90

38.00

33.34

0.87

39.33

27%

10%

18%

14%

25%

0P0000004C

XNYS:ACN

Accenture PLC

Information Technology

Information Technology Services

USD

298.46

1.27%

Quarterly

Wide

Wide

0.9996

Exemplary

Medium

High

0.1818

0.7381

1

3

A++

2

100

95

100

258.00

298.96

1.07

385

29%

10%

15%

13%

30%

0P00000075

XNYS:AMG

Affiliated Managers Group Inc

Financials

Asset Management

USD

133.62

0.03%

Quarterly

Narrow

Narrow

0.9458

Exemplary

High

High

0.1541

0.5096

3

3

B++

4

10

15

45

175.00

172.20

0.77

152

14%

17%

30%

24%

25%

0P0000007L

XNYS:APD

Air Products & Chemicals Inc

Materials

Specialty Chemicals

USD

246.16

2.49%

Quarterly

Narrow

Wide

0.9911

Exemplary

Medium

High

0.1838

0.7111

1

3

A++

4

100

70

95

317.00

272.76

0.83

290

18%

11%

16%

14%

20%

0P000000QB

XNYS:BAX

Baxter International Inc

Health Care

Medical Instruments & Supplies

USD

76.05

1.47%

Quarterly

Narrow

Narrow

0.9822

Exemplary

Medium

Medium

0.1179

0.6447

1

3

A+

4

60

70

100

90.00

81.76

0.89

90

18%

13%

19%

16%

35%

0P000002AB

XNYS:BEN

Franklin Resources Inc

Financials

Asset Management

USD

27.08

4.21%

Quarterly

Narrow

Narrow

0.8676

Exemplary

High

High

0.1569

0.5598

3

4

B++

5

55

5

60

29.00

33.17

0.87

27

0%

21%

30%

26%

35%

0P0000011H

XNYS:CNI

Canadian National Railway Co

Industrials

Railroads

USD

113.78

1.80%

Quarterly

Wide

Wide

0.9994

Standard

Medium

Medium

0.1262

0.6719

1

4

A

2

95

80

100

107.00

113.69

1.03

134.42

18%

10%

15%

13%

35%

0P0000943F

XNYS:DFS

Discover Financial Services

Financials

Credit Services

USD

113.49

1.85%

Quarterly

Narrow

None

0.6500

Exemplary

High

High

0.3436

0.8597

3

4

A

3

40

75

35

138.00

133.89

0.83

139

22%

14%

25%

20%

30%

0P000001R9

XNYS:DPZ

Domino’s Pizza Inc

Consumer Discretionary

Restaurants

USD

363.17

1.08%

Quarterly

Wide

Wide

0.9973

Exemplary

Medium

High

0.1580

0.5876

2

3

A

4

95

95

75

400.00

409.12

0.90

400

10%

17%

25%

21%

50%

0P00000232

XNYS:FICO

Fair Isaac Corp

Information Technology

Software - Application

USD

409.55

—

Quarterly

—

Wide

0.9905

—

—

High

0.3030

0.5779

3

2

B++

4

95

90

60

—

421.67

0.97

538

31%

10%

22%

16%

35%

0P000002DN

XNYS:GD

General Dynamics Corp

Industrials

Aerospace & Defense

USD

224.91

2.15%

Quarterly

Wide

Wide

0.9978

Standard

Medium

Low

0.0929

0.7030

1

2

A++

1

100

50

85

215.00

212.33

1.05

275

22%

10%

15%

13%

10%

0P000002YM

XNYS:IFF

International Flavors & Fragrances Inc

Materials

Specialty Chemicals

USD

132.17

2.38%

Quarterly

Wide

Wide

0.9963

Standard

Medium

Medium

0.1403

0.6056

2

2

A+

4

100

50

75

150.00

152.06

0.88

159.5

21%

10%

18%

14%

15%

0P000002TG

XNYS:ITW

Illinois Tool Works Inc

Industrials

Specialty Industrial Machinery

USD

208.07

2.31%

Quarterly

Narrow

Wide

0.9951

Exemplary

Medium

Medium

0.1007

0.7199

1

3

A++

5

90

95

90

205.00

198.04

1.03

222

7%

11%

16%

14%

15%

0P00000357

XNYS:KMB

Kimberly-Clark Corp

Consumer Staples

Household & Personal Products

USD

133.02

3.44%

Quarterly

Narrow

Wide

0.9947

Exemplary

Medium

Low

0.0780

0.6882

1

4

A

5

60

40

100

126.00

125.14

1.06

132

-1%

10%

16%

13%

10%

0P000003JU

XNYS:MDT

Medtronic PLC

Health Care

Medical Devices

USD

100.15

2.52%

Quarterly

Wide

Wide

0.9989

Standard

Medium

High

0.1617

0.7021

1

3

A++

4

75

80

95

129.00

112.07

0.83

116

16%

10%

14%

12%

40%

0P0000000I

XNYS:MMM

3M Co

Industrials

Conglomerates

USD

149.29

3.98%

Quarterly

Wide

Wide

0.9996

Standard

Medium

Medium

0.1450

0.6995

1

4

A++

4

95

45

95

186.00

167.82

0.84

157

5%

14%

19%

17%

15%

0P0000043L

XNYS:ORCL

Oracle Corp

Information Technology

Software - Infrastructure

USD

71.92

1.78%

Quarterly

Narrow

Wide

0.9936

Poor

Medium

High

0.2620

0.5957

1

3

A++

3

100

85

95

63.00

76.61

1.03

89

24%

11%

16%

14%

25%

0P000004EA

XNYS:PII

Polaris Inc

Consumer Discretionary

Recreational Vehicles

USD

106.55

2.38%

Quarterly

Wide

Wide

0.9959

Exemplary

High

Very High

0.4198

0.5259

3

5

A

4

55

15

40

184.00

137.20

0.66

125

17%

13%

25%

19%

30%

0P0001KOSE

XNYS:PLTR

Palantir Technologies Inc

Information Technology

Software - Infrastructure

USD

8.68

—

—

Narrow

Narrow

0.9204

Exemplary

High

Extreme

1.0418

0.5939

3

–

B++

–

–

–

–

27.00

20.55

0.37

11.5

32%

26%

39%

33%

180%

0P000005NO

XNYS:RTX

Raytheon Technologies Corp

Industrials

Aerospace & Defense

USD

95.12

2.19%

Quarterly

Wide

Wide

0.9980

Standard

High

Medium

0.1102

0.6803

1

–

A++

–

50

55

95

94.00

91.74

1.02

117.5

24%

11%

17%

14%

10%

0P000000UD

XNYS:SAM

Boston Beer Co Inc

Consumer Staples

Beverages - Brewers

USD

355.30

—

—

Narrow

Narrow

0.9876

Exemplary

Medium

Very High

0.4195

0.6453

3

4

A+

4

25

55

40

740.00

664.55

0.51

382

8%

14%

26%

20%

35%

0P000004R4

XNYS:SAP

SAP SE

Information Technology

Software - Application

USD

99.84

2.08%

Annually

Narrow

Wide

0.9945

Poor

Medium

High

0.1845

0.7118

2

3

A

4

85

60

80

141.00

120.67

0.76

142.73

43%

13%

22%

18%

30%

0P000003IL

XNYS:SPGI

S&P Global Inc

Financials

Financial Data & Stock Exchanges

USD

349.48

0.90%

Quarterly

Wide

Wide

0.9988

Exemplary

Medium

Medium

0.1319

0.7009

2

1

A

3

100

95

95

410.00

407.07

0.86

445.5

27%

13%

22%

18%

50%

0P0000054E

XNYS:STT

State Street Corporation

Financials

Asset Management

USD

72.49

3.08%

Quarterly

Wide

None

0.2321

Standard

High

Very High

0.4671

0.8717

3

3

A

3

85

35

60

92.00

107.45

0.73

91.5

26%

14%

25%

20%

50%

0P000005AR

XNYS:TSM

Taiwan Semiconductor Manufacturing Co Ltd

Information Technology

Semiconductors

USD

95.30

2.02%

Quarterly

Wide

Wide

0.9995

Exemplary

Medium

Very High

0.5164

0.7922

1

3

A++

4

80

95

75

171.00

128.93

0.64

150

57%

10%

18%

14%

30%

0P000002VU

XNYS:TT

Trane Technologies PLC

Industrials

Specialty Industrial Machinery

USD

138.06

1.77%

Quarterly

Narrow

Wide

0.9922

Standard

High

High

0.2266

0.6816

3

–

A

–

–

–

55

126.00

148.35

1.01

162

17%

13%

25%

19%

40%

0P000005NC

XNYS:UPS

United Parcel Service Inc

Industrials

Integrated Freight & Logistics

USD

182.25

2.79%

Quarterly

Wide

Wide

0.9995

Standard

Medium

Medium

0.1134

0.6652

1

3

A+

3

90

50

80

186.00

185.31

0.98

223

22%

15%

20%

18%

35%

0P000005KW

XNYS:USB

U.S. Bancorp

Financials

Banks - Regional

USD

53.07

3.39%

Quarterly

Wide

Narrow

0.9099

Exemplary

Medium

High

0.2714

0.9092

2

3

A

3

70

45

80

60.00

61.32

0.87

58.75

11%

11%

19%

15%

20%

0P000005P1

XNYS:VFC

VF Corp

Consumer Discretionary

Apparel Manufacturing

USD

50.46

3.92%

Quarterly

Narrow

Narrow

0.9758

Exemplary

Medium

High

0.1762

0.5900

3

5

A

3

50

50

55

68.00

68.16

0.74

57

13%

10%

21%

16%

65%

0P000005V9

XNYS:WAT

Waters Corp

Health Care

Diagnostics & Research

USD

327.95

—

Annually

Wide

Wide

0.9979

Exemplary

Medium

High

0.1635

0.6805

2

4

A

4

95

90

90

263.00

289.74

1.19

350

7%

15%

24%

20%

10%

0P00018WBW

XNYS:YUMC

Yum China Holdings Inc

Consumer Discretionary

Restaurants

USD

45.46

1.06%

Quarterly

Wide

Wide

0.9961

Standard

Medium

High

0.3285

0.6618

3

–

B++

–

65

90

60

86.00

68.79

0.59

55.6

22%

22%

34%

28%

40%

0P00006899

XTSE:TD

The Toronto-Dominion Bank

Financials

Banks - Diversified

CAD

96.66

3.48%

Quarterly

Wide

Narrow

0.9895

Exemplary

Medium

Very High

0.4213

0.9488

1

4

A

2

80

80

100

97.00

113.39

0.92

103

7%

10%

15%

13%

15%

0P00006896

XTSE:TRI

Thomson Reuters Corp

Industrials

Specialty Business Services

CAD

125.19

1.74%

Quarterly

Narrow

Wide

0.9914

Standard

Medium

Medium

0.1038

0.7337

2

3

B++

2

50

50

100

134.00

129.97

0.95

150.01

20%

11%

20%

16%

20%

4 Me gusta

Hoy se cumplen dos años desde que empecé mi cartera. Si mi cartera fuera un fondo estaría algo peor que el MSCI World . Todo según la herramienta de seguimiento del Financial Times, con la opción de cobrar los dividendos (también da la opción de reinvertirlos). La rentabilidad anual sería del 10,83% anual. En realidad sería algo menor ya que tiene en cuenta los dividendos brutos. Si los dividendos netos (sin tener en cuenta la recuperación de la doble imposición) suponen el 4% anual de rendimiento, nos dejaría una rentabilidad neta anualizada del 9,8% aprox .

Ese sería mi desempeño como gestor del fondo Torcal. Pero claro, cada vez que compro meto capital, luego el rendimiento del capital es diferente. En mi caso teniendo en cuenta dividendos netos, el capital está rindiendo al 7,40% .

La mejor posición es British American Tobacco con un total return anual del 23,05%, y la peor Gilead con un -2,69%.

En general estoy bastante contento con el rendimiento obtenido. Siempre compro esperando obtener un total return de al menos el 10% y es a eso a lo que aspiro.

Aunque los numeritos siempre están bien para saber qué tal vas, lo importante para mi es el flujo de dividendos y no la cotización. Con una rentabilidad por dividendos neta del 4% estoy más que satisfecho, incluso con Gilead. Ninguna de las empresas que llevo parece que vaya a recortar el dividendo en los próximos años y al final, si el dividendo crece y es sostenible, se tiene que ver reflejado en la cotización. Ya veremos.

El próximo año veremos más. De momento Indexación 1 - Marcos 0

12 Me gusta

Donde hay que firmar? Enhorabuena Marcos.

1 me gusta

No.

Lo contrario que tú vamos.

18 Me gusta