https://finance.yahoo.com/m/36203bb2-0506-30f6-ad2f-af3ef7cec6fc/vf-lowers-fiscal-year-revenue.html

Otra que puede dar oportunidad ![]()

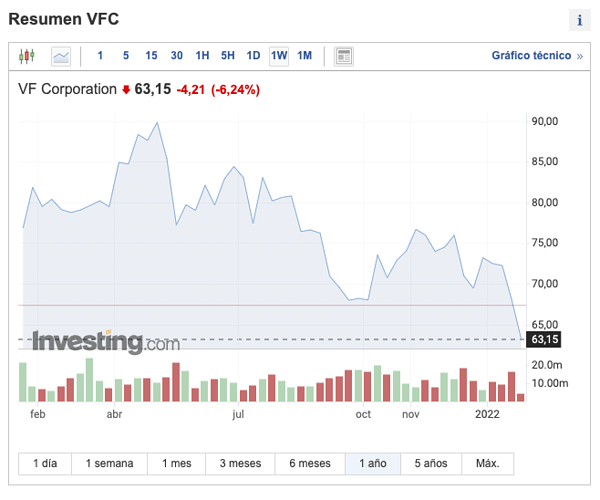

Pues ya la tenemos en 3,6% de RPD ¿Alguien que la tenga en el punto de mira?

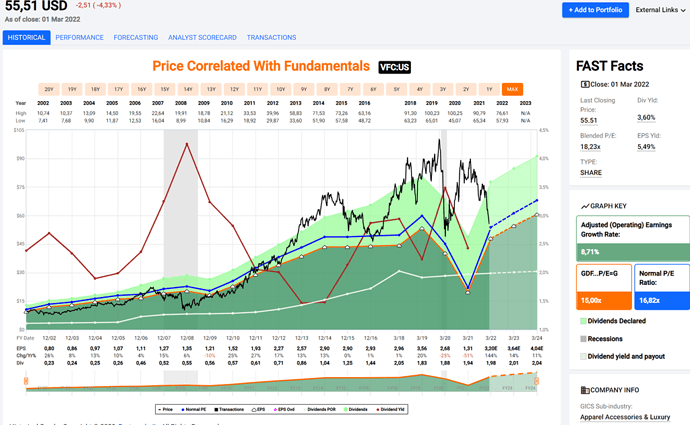

Yo le he estado echando un ojo estos días. Es una empresa centenaria, defensiva, pero cotizaba a unos múltiplos (como tantas) tremendos, de hecho, lleva una caída en picado desde hace 6 meses… De momento está a PER 15, a ver cómo sigue en estas semanas.

En nuestra CQSS figura como consumo cíclico… ![]()

Entre otras cosas fabrica mochilas de las que es líder en USA con un 55 % de participación ![]() .

.

Tiene una deúda-neta/EBITDA bastante alta en comparación con las empresas de su sector. Quizá sea éste el motivo de la fuerte bajada de su cotización. ![]()

En los últimos 5 años venía dedicando a dividendos, en promedio, el 71 % del FCF. No me extrañaría que empiece a recortarlos con el fin de reducir deúda. ![]()

Pienso que nos podría venir bien tener una buena mochila para ir guardando los dividendos ![]()

En minimos de 52 semanas (aunque con el dolar en paridad) y con RPD de casi 5%… Para el que se anime

En contra:

- Lleva castigo continuo desde los 65$ (aunque estabilizó sobre los 45-50$ un tiempo)

- Aunque está calificada como defensiva, yo no estoy del todo de acuerdo Es ropa de “marca”, (no ropa a secas) lo cual puede penalizar recuperación si el consumidor decide que puede excluirla hasta que mejore todo.

Me auto corrijo…que veo que esta como CÍCLICA, lo cual me cuadra mas

.(me parecio leer en el hilo de la empresa que en un momento dado se indicaba que era defensiva)

A mí me parece una gran oportunidad a estos precios esta empresa…

Pues ya tenemos el yield por encima del 7% ![]()

¿Pero las high yield ya no te gustan, no? ![]()

Lo del CEO no creo que haya influido mucho porque el de Vodafone también ha anunciado hoy que se marcha y la acción está plana.

Entiendo que se debe a la rebaja de previsiones por la ralentización del consumo:

VF Corp. (NYSE:VFC) stock slumped in premarket trading on Monday after announcing the retirement of its top executive and trimming its 2023 outlook.

The apparel and footwear manufacturer said it is updating its outlook “to reflect the impact of weaker than anticipated consumer demand across its categories, primarily in North America,” that is causing the company to cut prices and reduce inventories. COVID-19 restrictions in China and weakening consumers in Europe were cited as concerns adding to the outlook cut, though to a lesser extent than North American dynamics.

The company now anticipates revenue for the second half of 2023 “to be modestly lower than previously outlined,” with a slated 3% to 4% expected increase from 2022 down from the 5% to 6% outlined in previous reports. Due to promotions pursued in order to lower inventory levels, the company expects adjusted EPS in the range of $2.00 to $2.20, down from $2.40 to $2.50 in prior forecasts. The analyst consensus stands at $2.41.

Técnicamente tiene pendiente cerrar un pequeño gap algo por debajo de los 30$. La verdad es que es un poco una pena que tenga un yield tan alto…

Un saludo.

¿Estaremos ante el fina 50 años de racha? en simply safe dividends confirmaron hará dos meses seguridad del dividendo:

Softening Apparel Sales Unlikely to Disrupt V.F. Corp’s Dividend

Dividend Yield

6.66%

Safe

Reaffirmed Oct 4, 2022

Dividend Growth

V.F. Corp shares have dropped roughly 60% this year, making the parent company of Vans, the iconic skateboard shoe brand, the highest-yielding Dividend Aristocrat with an attractive payout above 6%.

Elevated inventories and an abrupt change in consumer spending habits spurred by persistent inflation have weighed heavily on the stock.

Like many clothing companies, V.F. Corp’s inventory troubles came from accelerated production efforts after being caught short on supply during the pandemic-boosted spike in consumer spending.

But persistent inflation has blunted apparel sales, and now V.F. Corp is burdened with inventory levels 40% higher than pre-pandemic levels.

As such, the company will need to increase promotional activity in the coming quarters to work down excessive inventory and avoid getting stuck with clothing that can quickly lose value as seasons change and fashion trends evolve.

Discounting products will result in compressed margins and the firm’s payout ratio sitting above the firm’s 50% target for a while.

.png)

Source: Simply Safe Dividends

That said, management believes V.F. Corp will “grow into” a 50% payout ratio and has reiterated a commitment to the dividend as the company works through a challenging environment.

V.F. Corp has grown its dividend for 50 straight years, an impressive feat, especially for an apparel company that perpetually needs to adapt to ever-evolving fashion trends.

Besides stretched dividend coverage over the next year or two, lower profitability will push the company’s leverage ratio higher.

Without a quick recovery appearing likely, we would not be surprised to see V.F. Corp’s A- credit rating downgraded by a notch or two, though we expect the firm to retain its investment-grade status.

Despite these near-term challenges, V.F. Corp’s long-term outlook appears stable. Inventory levels will normalize. Pandemic-driven supply disruptions will fade. And casual, outdoor, and active apparel categories seem likely to grow over time.

Coupled with V.F. Corp’s overall financial strength, stabilizing cash flow, and commitment to maintaining its dividend, we are reaffirming the firm’s Safe Dividend Safety Score.

Furthermore, we expect the company to declare a low single-digit dividend raise in the coming weeks, extending its annual growth streak to 51 years.

Even so, the overall environment for apparel may remain strained until the economy stabilizes and consumer appetite for discretionary goods returns.

And despite eleven of V.F. Corp’s twelve brands having met or exceeded expectations as of late, the company’s largest brand Vans (35% of revenue) has stalled recently and needs to show sales growth before the stock begins to recover some of this year’s losses.

.png)

Source: V.F. Corp Investor Presentation, September 2022

Vans has recorded healthy revenue growth since V.F. Corp acquired the brand in 2004 (see below). But management recently lowered guidance for this fiscal year, expecting a mid-single-digit decline in Vans’ sales due partly to a weak back-to-school season.

.png)

Source: V.F. Corp Investor Presentation, September 2022

We are giving management the benefit of the doubt in restoring Vans’ growth trajectory given the brand’s long-term track record under V.F. Corp’s watch, new leadership in place, and the amount of noisy external factors that have impacted the industry recently due to Covid.

But we will continue monitoring Vans’ trajectory as V.F. Corp wants to be valued as a growth story rather than a stodgy income play. This business needs to show it should remain part of the portfolio given its material contribution to the firm’s cash flow.

If all goes well, management believes V.F. Corp could deliver low double-digit EPS growth over the next five years, giving the stock an unusual combination of high income and fast growth potential.

Overall, we believe V.F. Corp’s solid brands that cater to the growing active lifestyle, outdoors, and work segments will support solid cash flow and modest dividend growth in the years ahead.

We will continue to monitor V.F. Corp and provide updates as needed. The biggest issues to watch are trends at Vans and how much worse the current promotional environment gets for apparel.

A casi todos los entrenadores los confirman poco antes de destituirlos ![]()

![]()

![]()

Un saludo.