Aqua America adquiere la utility de gas natural Peoples. Presentación: http://ir.aquaamerica.com/static-files/c0fc2658-adc5-4022-87ac-0b40ce69978a

Esta empresa ha salido varias veces en otros hilos: en el del sector agua, en el de Lluís, etc…

Creo también que el sector del agua es un sector con mucho futuro, regulado e imprescindible actualmente. Tener “agua” en la cartera es imprescindible. Sé que con Nestle cubres algo por sus muchas marcas de agua embotellada, pero creo que vale la pena incluir también tratamiento de aguas, así que le he echado un ojo:

“Aqua America is the second-largest publicly traded water utility based in the U.S., and serves more than 3 million people in Pennsylvania, Ohio, North Carolina, Illinois, Texas, New Jersey, Indiana and Virginia. Aqua America is listed on the New York Stock Exchange under the ticker symbol WTR.”

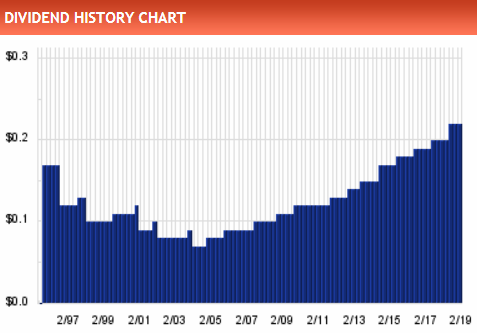

Este es el historial de dividendos.

Segun la lista CCC lleva 26 años incrementando dividendos aunque la RPD es algo baja, sobre un 2.25%. Mirando la gráfica de evolución del dividendo de Dividend Channel parece que lleva muchos menos años, pero esto es debido a que ha hecho muchos splits:

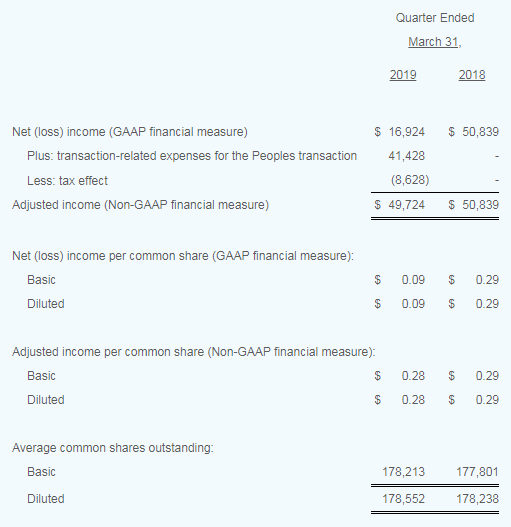

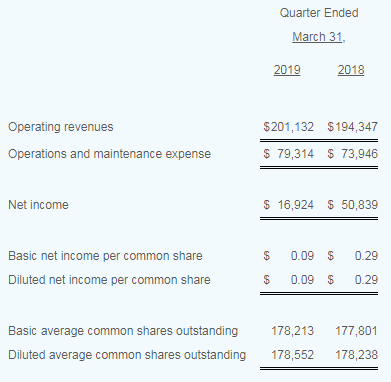

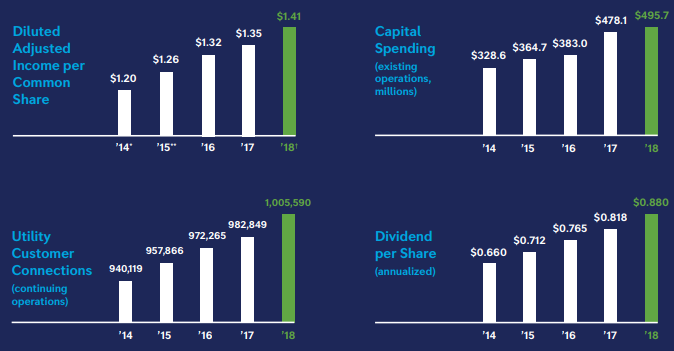

De los resultados de 2018 parece que el dividendo es sostenible:

En unos días publicará resultados.

Una excelente empresa para invertir pero no para mi, ese 2,25% manteniendo el crecimiento se convierte en 10 años en un 5,84%, genial para alguien con un horizonte temporal mas largo, 20 o 30 años, pero a mi se me queda corto.

El sector agua lo tengo cubierto con UU y, si algun dia se pone a tiro, SVT.

Aqua America Declares 7 Percent Dividend Increase (25/07/2019)

The Board of Directors of Aqua America (NYSE: WTR) declared a quarterly cash dividend of $0.2343 per share today, payable Sept. 1, 2019 to all shareholders of record on Aug. 16, 2019.

The September 2019 dividend will represent a $0.0153 increase, or 7.0 percent, compared to the $0.2190 cash dividend the company paid in June of this year. This marks the 29th dividend increase in the past 28 years, and the company has paid a consecutive quarterly cash dividend for more than 74 years. Following the increase, the annualized dividend rate will be $0.9372 per share. The board’s stated long-term targeted dividend payout ratio continues to be in the range of 60 to 70 percent of earnings from operations.

Financial Results for Q2 2019 (06/08/2019)

- Revenues for the quarter were $218.9 million, an increase of 3.3 percent compared to $211.9 million in the second quarter of 2018. Rates and surcharges and new customers from acquisitions and organic growth were the largest contributors to the increase.

- Operations and maintenance expenses increased to $86.4 million for the second quarter of 2019 compared to $73.5 million in the second quarter of 2018. Charges related to the Peoples transaction increased expenses by $12.7 million. Excluding the impact of the Peoples transaction, operations and maintenance expenses would have been in line with the second quarter of 2018.

- Net income for the second quarter 2019 was $54.9 million or $0.25 per share (GAAP). Net income decreased from the second quarter of 2018 net income of $66.6 million or $0.37 per share (GAAP) due primarily to Peoples transaction-related items of $11.9 million, net of tax.

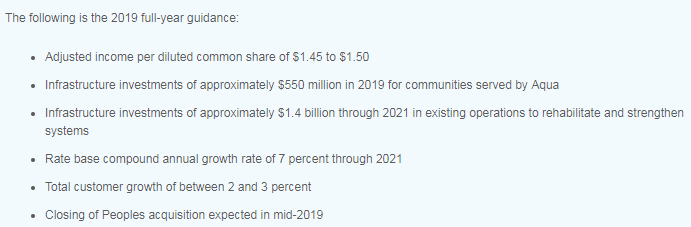

Reaffirms 2019 Aqua standalone guidance highlights

- Adjusted income per diluted common share of $1.45 to $1.50

- Infrastructure investments of approximately $550 million in 2019 for communities served by Aqua

- Infrastructure investments of approximately $1.4 billion through 2021 in existing operations to rehabilitate and strengthen systems

- Rate base compound annual growth rate of 7 percent through 2021

- Total customer growth of between 2 and 3 percent

- Closing of Peoples acquisition expected in fall 2019

Financial Results for Q3 2019 (04/11/2019)

- Revenues for the quarter were $243.6 million, an increase of 7.7 percent compared to $226.1 million in the third quarter of 2018.

- Operations and maintenance expenses increased to $82.0 million for the third quarter of 2019 compared to $68.6 million in the third quarter of 2018.

- Net income for the third quarter 2019 was $88.5 million (GAAP) or $0.38 per share (GAAP), compared to $78.2 million or $0.44 per share for the third quarter 2018, an increase in net income of 13.1 percent from the prior year.

Reaffirms 2019 guidance

- Adjusted income per diluted common share (non-GAAP) of $1.45 to $1.50

- Infrastructure investments of approximately $550 million in 2019 for communities served by Aqua

- Infrastructure investments of approximately $1.4 billion through 2021 in existing operations to rehabilitate and strengthen systems

- Rate base compound annual growth rate of 7 percent through 2021

- Total customer growth of between 2 and 3 percent

- Closing of Peoples acquisition expected to occur in late 2019 or early in 2020

Me estaba volviendo loco con un descuadre en mi cartera, hasta que he visto que la cotización de esta posición estaba a cero.

Han cambiado el nombre y el símbolo.

Ahora es Essential Utilities (WTRG)

Aqua America Announces New Name and Executive Leadership Team Ahead of Peoples Closing

Earnings For 2019 (27/02/2020)

Full-year 2019 operating results

- Total operating revenues of $889.7 million in 2019, an increase of 6.2 percent compared to $838.1 million in the prior year.

- Net income of $224.5 million (GAAP) or $1.04 per share (GAAP), compared to $192.0 million (GAAP) or $1.08 per share (GAAP) in 2018, an increase in net income of 17.0 percent from the prior year.

Fourth quarter 2019 operating results

- Revenues increased to $226.0 million in the fourth quarter compared to $205.7 million in the same period of 2018, an increase of 9.9 percent. Rate and surcharges, volume and customer growth increased revenues.

- Net income of $64.2 million (GAAP) or $0.28 per share (GAAP) compared to the net loss of $3.7 million (GAAP) or $0.02 per share (GAAP) for the fourth quarter of 2018.

2020 Essential guidance highlights

- Adjusted pro-forma income per diluted common share (non-GAAP) of $1.53 to $1.58.

- 3-year earnings growth CAGR 5-7% for 2019 through 2022, such that base is 2019 adjusted income per share (non-GAAP)

- Rate base compound annual growth rate of 6 to 7 percent through 2022 in water; and 8 to 10 percent in gas through 2022

- Total annual water customer growth of between 2 and 3 percent on average, depending upon regulatory approval

Mensajes movidos desde el hilo Proyecto de Miguel Ángel.

En principio, parece que se dica a una actividad que podría ser productiva. Según Investing “La Compañía se dedica a proporcionar servicios de agua o aguas residuales concentrados en Pennsylvania, Ohio, Texas, Illinois, Carolina del Norte, Nueva Jersey, Indiana y Virginia”.

La evolución de su cotización es francamente positiva ya que en los últimos 5 años ha subido sin demasiados sobresaltos (su volatilidad en las 250 últimas sesiones ha sido del 17,1 %) + de un 50 % y su capitalización no es demasiado baja (11.150 mill. $). Además su Beta es de 0,48.

Sin embargo sus ratios financieros no me gustan nada :

- Ratio de solvencia y test ácido son muy bajos.

- En relación al ebitda, tanto su EV como su deúda neta son muy altos.

En cuanto a rentabilidad para el accionista, veo que para conseguir dar un yield del 2,2 % y subirlo cada año un 7,4 % de promedio en los últimos 5 años :

- Tiene que recurrir constantemente a unos pay-out que rondan el 100 %.

- Su FCF tiene una evolución negativa del - 15,4 % de promedio en los últimos 13 años…

Entonces… ![]() …

… ![]() …no entiendo la evolución de su cotización

…no entiendo la evolución de su cotización ![]() …¿ Alguien me podría aclarar algo ?

…¿ Alguien me podría aclarar algo ?

Habría que ver si ese payout del 100% es sin el capex de inversión y lo mismo para el FCF. Vamos, que lo suyo sería mirar con detenimiento las cuentas de la empresa para ver la solvencia que tiene con el desarrollo de su negocio orgánico.

M* no le have seguimiento cualitativo.

ValueLine si le hace seguimiento cualitativo. Donde hablan de una adquisición, de ahí que quizás no sea tan fácil ver su payout de un vistazo.

"Oct 2, 2020 Commentary

Essential Utilities raised its dividend a solid 7% last quarter. The company increased the share payout from $0.2343 to $0.2507. This rate of increase ought to be maintained to mid-decade.Earnings comparisons should be flat in 2020. Even though the second quarter surpassed our expectations, the company will probably be hindered by the costs associated with the large acquisition it made earlier this year. Recall that it (then known as Aqua America), paid $4.3 billion and assumed over $1 billion in debt to purchase Peoples gas utility. All told, Essential’s share net should to be around $1.00, which isn’t bad considering the amount of unusual charges. It also should be noted that both of the company’s two key segments are much less vulnerable to the economic slowdown caused by the corona-virus. With the exception of industrial customers, the demand for water and gas is relatively inelastic.In 2021, we expect the bottom line to get back on track. Management is estimating that the regulated water and

segments will grow 6% to 7.0%, and 8% to 10%, annually through 2022. This, along with some rate relief and cost savings, should enable Essential’s share net to reach $1.20. The construction budget is large. This year, the company plans on spending only $550 million to upgrade its water pipelines and other assets. However, capital expenditures have been projected to total about $2.8 billion through 2022. Thus, spending ought to average over a $1 billion annually in 2021 and 2020. Finances are more than decent. True, debt levels have increased as a result of the Peoples merger. In addition, external funds will be required to fund the massive building program discussed above. Never-theless, the balance sheet is still better than average, and will likely remain so.These shares are ranked 2 (Above Average) for year-ahead performance. So short-term investors looking for well-defined prospects should find the stock of interest. For those looking out to 2023-2025, however, total return potential remains"

Muy esclarecedor, gracias mr-j.

Es una gozada participar en este foro donde siempre hay ideas, datos, informaciones…porque se ha juntado mucha materia gris y muy poco egoísmo.

WTRG | Essential Utilities

04 de marzo - Se anuncia dividendo de US$0,33

Los accionistas recibirán un dividendo de US$0,33.

- Fecha de expiración: 13 de mayo de 2025

- Fecha de pago: 2 de junio de 2025

- El rendimiento del dividendo será del 3,4%, superior al promedio de la industria del 2,6%.

Sostenibilidad y crecimiento

- El dividendo está cubierto por las ganancias (tasa de pago de ganancias del 58%) pero la empresa no tiene flujos de efectivo libres disponibles, lo que indica que puede estar usando reservas de efectivo o deuda para pagar el dividendo.

- El dividendo ha aumentado un promedio de 7,9% anual durante los últimos 10 años y se ha mantenido estable sin reducciones materiales en los pagos, lo que indica un largo historial de crecimiento y estabilidad de dividendos.

- Se espera que las ganancias por acción crezcan un 13% en los próximos 3 años, lo que debería respaldar el dividendo y una cobertura de ganancias adecuada.

Ayer precisamente estaba pensando en ampliar WRTG, que la tengo en pérdidas por cambio dolar y (de memoria, comprobar) superaba el 3% y algo de dividendo.

Como no amplié, hoy alcanzará la cotización de Nvidia… ![]()

American Water and Essential Utilities to Merge as a Leading Regulated U.S. Water and Wastewater Utility https://www.essential.co/news-releases/news-release-details/american-water-and-essential-utilities-merge-leading-regulated

- Market Cap de $AWK: $27.6B

- Market Cap de $WTRG: $11.6B